Does Humana Medicare Cover Incontinence Supplies?

When dealing with incontinence, managing the potential cost of supplies may be a concern for many. If you’re on Humana Medicare, you might wonder if Humana Medicare covers these costs or incontinence supplies.

This article explores the potential coverage for incontinence supplies, offering you a clear understanding of what to expect from different Humana Medicare plans.

Key Takeaways

- Some of the Humana Medicare Advantage plans may offer coverage for incontinence supplies, unlike Original Medicare; the extent of coverage will likely depend on the specific plan details and medical necessity.

- While Humana Medicare may have limited coverage for incontinence supplies, it could potentially cover a variety of incontinence treatments, such as certain devices and biofeedback-assisted pelvic muscle exercise training, if prescribed by a healthcare professional.

- Some possible alternatives to Medicare for incontinence supplies might include Medicaid, local non-profits, community organizations, and the National Diaper Bank Network, which could provide varying levels of support based on eligibility and medical necessity.

Compare Plans in One Step!

Enter Zip Code

Humana Medicare and Incontinence Supplies

As a prominent provider in the healthcare industry, Humana Medicare will likely provide a range of plans that could cater to various health needs, including incontinence supplies.

The extent of coverage for these supplies, however, is not guaranteed and will likely hinge on the specifics of your Medicare plan. Consequently, gaining a comprehensive understanding of your plan could be beneficial.

For instance, some of the Medicare Advantage plans, like those that could be offered by Humana, may have the potential to cover a variety of over-the-counter incontinence supplies.

These could include men’s guards, protective pads, and other supplies that could be aimed at managing incontinence.

Original Medicare vs. Humana Medicare Advantage

When it comes to incontinence supplies, Original Medicare might not provide coverage. This means items like adult diapers, which could be essential for those dealing with incontinence, will likely not be covered. However, Humana could offer a solution in the form of Humana Medicare Advantage.

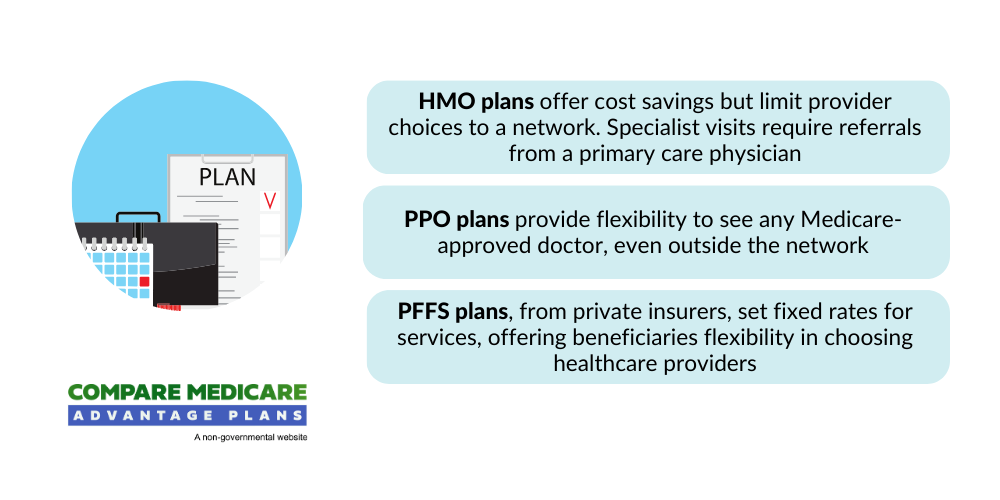

Some of the Humana Medicare Advantage plans might go beyond the coverage of Original Medicare. It will likely encompass HMO, PPO, and PFFS plans, and may also provide supplementary services that could include potential coverage for incontinence supplies.

This is a stark contrast to Original Medicare, which does not cover such items. Therefore, if you need coverage for incontinence supplies, Humana Medicare Advantage might be a suitable choice.

Potential Factors Affecting Coverage

Coverage for incontinence supplies might not be automatic. Several potential factors might come into play, including:

- plan type

- prescriptions

- and medical necessity

For instance, despite the broad coverage Humana Medicare might offer, it may not extend to incontinence supplies due to a lack of medical necessity. This could leave the patient responsible for these costs.

Moreover, there may be potential limitations to the coverage provided by Humana Medicare. For example, although incontinence supplies may not be included in the coverage of Original Medicare, certain Medicare Advantage plans might offer coverage for such supplies. Nonetheless, the particulars of the plan and involved prescriptions will likely determine this.

Incontinence Treatments Covered by Humana Medicare

While Humana Medicare’s coverage for incontinence supplies may be limited, it could cover a variety of incontinence treatments.

This might include devices like Elitone, which could offer external pelvic stimulation to help women alleviate symptoms of incontinence. Coverage may be available if such devices have been recommended by a healthcare professional.

Humana Medicare may also cover biofeedback-assisted pelvic muscle exercise training, given that a beneficiary has previously tried pelvic floor muscle training without success. This treatment must be prescribed by a physician to qualify for coverage.

Additionally, Humana Medicare may also provide reimbursement for at least 200 catheters per month, as these could be considered essential supplies for incontinence treatment.

Prescriptions and Recommendations

A doctor’s prescription will likely play a crucial role in the coverage of incontinence treatments. For instance, Humana Medicare may cover incontinence supplies as part of its potential plan benefits if a physician prescribes them. The potential impact of a doctor’s prescription could be seen through specific Medicare Advantage plans.

Doctors may also suggest a range of incontinence treatments, including:

- Medications

- Surgery

- Pelvic floor physiotherapy

- Anti-incontinence devices

The potential coverage for these treatments for patients with medical conditions and certain Humana Medicare Advantage plans may be contingent upon the details of their specific Medicare Advantage plan.

Medicare Part B and D Coverage

Medicare Part B and D could also play a role in managing incontinence. Although Medicare Part B might not cover incontinence treatments or supplies, Medicare Part D could potentially help with the costs of prescription drugs for incontinence.

However, this may require the purchase of a separate Medicare Part D prescription drug plan.

It’s worth noting that Medicare Part D might not cover all prescription drugs associated with incontinence. The extent of coverage will likely depend on the specific plan chosen.

Therefore, a detailed review of your plan to comprehend the extent of coverage for incontinence treatments and supplies may be advised.

Medicaid and Dual Eligible Special Needs Plans

Exploring other avenues for coverage, Medicaid and Dual Eligible Special Needs Plans (D-SNPs) could also play a role in covering incontinence supplies.

Medicaid coverage for certain supplies may vary depending on the state and specific Medicaid plan. Coverage may be available if it’s determined to be medically necessary, and individuals who are dual-eligible may receive full coverage.

D-SNPs, on the other hand, will likely be tailored to cater to the requirements of individuals who qualify for both Medicare and Medicaid.

Some of these plans could aim to potentially integrate benefits from both programs for eligible recipients.

State-Specific Coverage

Medicaid coverage for incontinence supplies will likely be state-specific.

- In California, for example, Medicaid might offer coverage for incontinence supplies to individuals enrolled in a Medicaid plan in the state, although there may be age-related limitations on coverage.

- In Texas, Medicaid might provide coverage for these supplies when prescribed by a physician for the treatment of urinary or fecal incontinence.

In New York, Medicaid may cover a variety of incontinence supplies, such as:

- disposable and reusable diapers

- liners

- underpads

- briefs

- bladder control pads

- protective underwear

These supplies may only be provided if they are medically necessary. Similarly, Florida Medicaid could provide coverage for these supplies when they are prescribed and considered medically necessary by a healthcare provider.

Combining Medicare and Potential Medicaid Benefits

Combining the possible Medicare and Medicaid benefits could provide full coverage for incontinence supplies. This dual eligibility might allow individuals to utilize the advantages of both programs to potentially reduce healthcare expenses and ensure access to essential incontinence products.

However, challenges may arise from this combination, such as inadequate coordination between the two programs, which could lead to increased expenses and adverse outcomes for individuals eligible for both.

Furthermore, those who may have limited dual eligibility might not have access to complete Medicaid benefits, which could affect their support for certain Medicare premiums.

Alternative Options for Incontinence Supplies

If Medicare coverage is not sufficient or not available, there may be alternative plans for obtaining incontinence supplies. For example, you might want to consider the following options:

- Local non-profits and community organizations may have programs in place to supply free or low-cost incontinence supplies to those who require them.

- Some manufacturers and retailers could offer assistance programs or discounts for individuals in need.

- Online marketplaces and websites may offer discounted prices or bulk purchasing options.

These initiatives could potentially provide valuable support to individuals in need.

Certain local non-profit organizations, like adult diaper banks and organizations supported by state-level programs like Medicaid, may also provide incontinence supplies.

You might also find assistance through initiatives like the National Diaper Bank Network, which may offer complimentary diapers to families, or by contacting local charities and organizations for support.

Local Non-Profit and Community Organizations

Local non-profit organizations could be a lifeline for those in need of incontinence supplies. These organizations, which might include:

- local senior health centers

- diaper banks

- local chapters of the Salvation Army

- agencies that assist to families in need

These could offer a variety of incontinence products covered, such as diapers, adult briefs, bladder control pads, adult diapers, and other products for urinary incontinence, possibly catering to the needs of individuals.

To access these free or low-cost supplies, individuals may:

- Reach out to diaper banks in their vicinity and demonstrate their need based on a low-income or Medicaid eligibility

- Explore support from established non-profit organizations like the Salvation Army or local food banks

- Research state-level resources and programs for potential Medicaid coverage.

National Diaper Bank Network

The National Diaper Bank Network could be another valuable resource for those in need of incontinence supplies.

This nonprofit organization will likely collaborate with several community-based diaper banks across the United States to supply diapers to families facing financial constraints and to promote awareness about diaper needs.

Individuals may access services from the National Diaper Bank Network by visiting their website to connect with community-based diaper banks listed in their directory. These banks collect, store, and distribute free diapers.

The Network may also provide incontinence pads and liners and will likely not have specific income restrictions for eligibility, although it primarily supports low-income families.

Navigating Humana Medicare Plans

To potentially maximize your coverage for incontinence supplies, it may be vital to comprehend your Humana Medicare plan. This will likely involve comparing Humana Medicare Advantage HMO and PPO plans, which may differ in their network, cost, and coverage.

HMO plans require the selection of a primary care physician (PCP) and referrals for specialist visits within the network, while PPO plans allow access to any doctor or specialist, both in and out of the network, without requiring a referral.

In terms of cost, HMO plans generally feature lower monthly premiums and out-of-pocket expenses compared to PPO plans, which typically have higher premiums but offer more flexibility in selecting healthcare providers.

Furthermore, both HMO and PPO plans include all the benefits provided by Original Medicare, but PPO plans may also encompass additional benefits and services not covered by Original Medicare.

Comparing Humana Medicare Advantage HMO and PPO Plans

When comparing Medicare Advantage HMO PPO plans, it’s important to consider their advantages and disadvantages. HMO plans generally offer reduced premiums and out-of-pocket expenses, require the selection of a PCP, and mandate referrals for specialist consultations.

On the other hand, PPO plans entail higher costs but provide greater flexibility and the option to consult any physician without referrals.

While the specifics of incontinence supplies coverage may differ by plan, Humana Medicare Advantage HMO plans may offer coverage for incontinence supplies or provide an over-the-counter (OTC) allowance for such health products. PPO plans may offer similar provisions, although the specifics can differ by plan.

Lower Cost Preferred Pharmacies

Preferred pharmacies could be a cost-effective way to obtain incontinence supplies. Humana’s preferred pharmacy network, for instance, might allow Medicare members to acquire prescriptions at a reduced cost compared to standard in-network pharmacies. These preferred pharmacies may include:

- CenterWell Pharmacy

- Albertsons Companies pharmacies

- Kroger Health and its family of pharmacies

- Costco

- Publix

- HEB

Some of these pharmacies could offer cost savings on incontinence supplies and other healthcare products.

Potential savings may be significant, with Humana Medicare beneficiaries potentially obtaining prescriptions at a lower cost at preferred pharmacies compared to standard in-network cost-share pharmacies.

The exact savings may vary depending on the plan, so it’s advised to scrutinize your plan details or contact Humana directly for more information.

Summary

While incontinence could pose challenges, understanding your coverage options might help manage these challenges effectively. Humana Medicare may cover incontinence supplies depending on the plan type and specific coverage details. Original Medicare does not cover incontinence supplies, but some Humana Medicare Advantage plans may offer coverage.

Remember that coverage will likely depend on factors such as plan type, prescriptions, and medical necessity. While Humana Medicare may cover specific incontinence treatments, alternative options, such as local non-profits or the National Diaper Bank Network, could be a lifeline.

Combining the potential Medicare and Medicaid benefits or understanding your Humana Medicare plan specifics could also help maximize your coverage.

Frequently Asked Questions

→ Does Medicare pay for incontinence supplies?

No, Medicare might not cover incontinence supplies or adult diapers, but some Medicare Advantage plans may provide coverage for these products in specific service areas. It’s best to check with your plan for details.

→ How to get free incontinence pads?

You could potentially get free incontinence pads from local senior health centers, Medicaid, free diaper coupons, and loyalty programs. Some of these resources may also offer to provide a bulk supply of free pads for those in need.

→ What incontinence treatments may be covered by Humana Medicare?

Humana Medicare will likely cover a variety of incontinence treatments, which may include devices like Elitone and biofeedback-assisted pelvic muscle exercise training if recommended or prescribed by a healthcare professional.

→ What are some alternative options for obtaining incontinence supplies?

You might want to consider reaching out to local non-profits or community organizations and explore the National Diaper Bank Network for alternative options to obtain incontinence supplies. These options could assist in accessing the necessary supplies.

ZRN Health & Financial Services, LLC, a Texas limited liability company