What is Dental Insurance?

Dental insurance is designed to help manage the costs associated with maintaining oral health. For many seniors, dental care becomes increasingly important as they age, with issues like gum disease and tooth loss becoming more common.

Dental plans typically cover preventive services such as cleanings, exams, and x-rays. Understanding the nuances of these plans is crucial, particularly as many do not fall under traditional Medicare, requiring seniors to explore other insurance or supplemental dental coverage options.

There are various types of dental insurance available, each with its own benefits, costs, and limitations. Two common types are Dental Health Maintenance Organizations (DHMOs) and Preferred Provider Organizations (PPOs).

DHMOs usually have a network of dentists who provide services at a reduced rate, but require seeing a primary care dentist for all needs. PPOs offer more flexibility with a larger network of providers and the option to see specialists without referrals.

Evaluate each plan based on what’s covered, the deductible, and any applicable copayments to choose what aligns best with individual dental needs.

It’s essential to also consider additional costs outside of routine care. For example, dental coverage for procedures like fillings, crowns, dentures, and implants may vary significantly.

Seniors should check whether their insurance covers these services under basic or major services, or if they’re only partially included. Understanding the network and the out-of-pocket costs before any work begins can prevent unexpected bills.

For comprehensive peace of mind, seniors should explore both standalone dental plans available on the market and those offered through combined dental and vision insurance packages.

Being an informed consumer can help ensure that the chosen dental insurance adequately meets your healthcare needs, balancing cost with the quality of care.

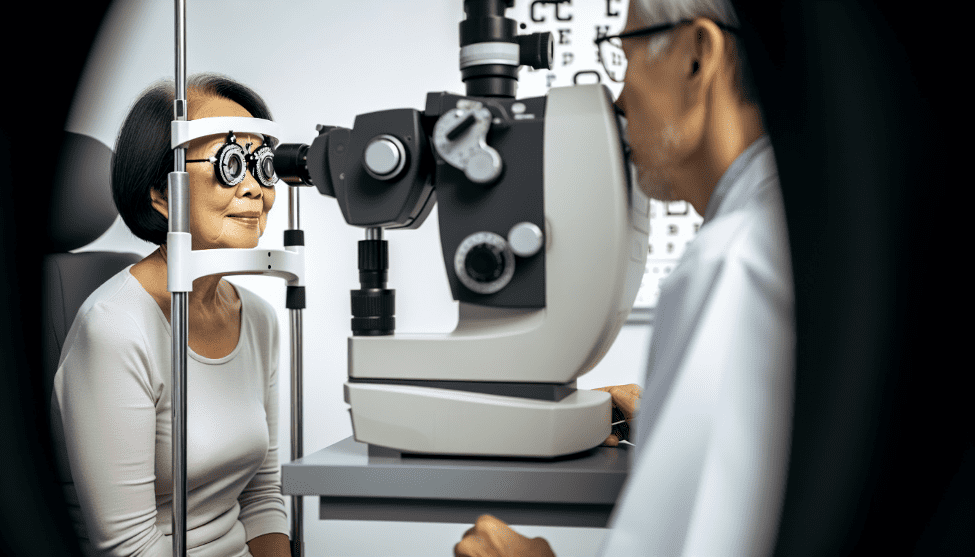

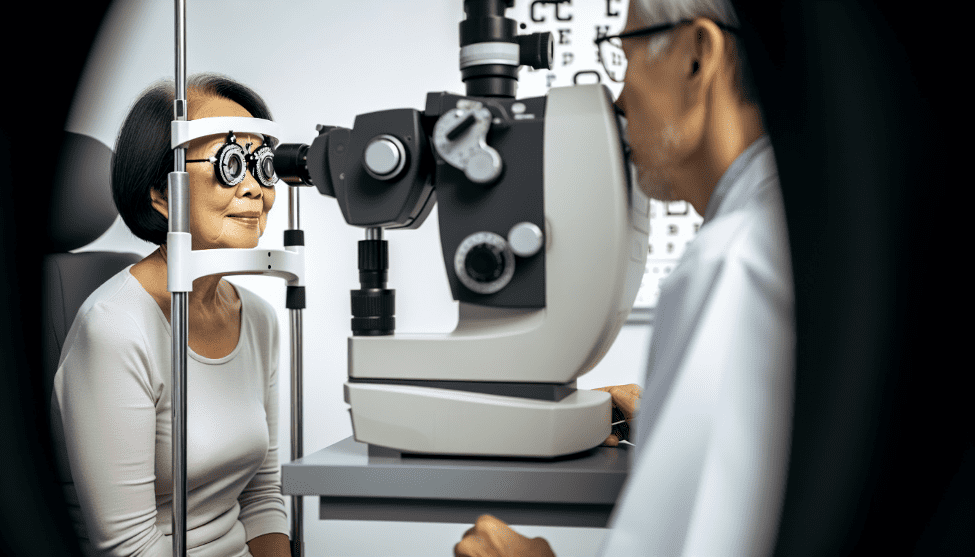

Exploring Vision Coverage Options

Vision insurance plays a key role in maintaining overall health for seniors, as vision can naturally decline with age, necessitating regular eye exams and corrective lenses. This type of insurance typically covers annual exams, prescription glasses, contact lenses, and sometimes discounts on procedures like LASIK.

Seniors plans frequently include vision as a supplementary part of health or retirement benefits, helping to mitigate costs associated with maintaining vision health.

Vision plans usually follow a structure similar to dental insurance, with network providers offering services at reduced costs. It’s important to examine what the vision insurance policy covers because coverage can vary.

Basic plans might cover routine exams and corrective lenses, but more comprehensive options can include allowances for frames and lenses every one to two years, or even coverage for bifocals and trifocals. Understanding what each plan entails can lead to significant savings on necessary eye care.

Another factor to consider is whether the vision insurance is included as part of a Medicare Advantage Plan. While traditional Medicare may not offer vision coverage, many Medicare Advantage Plans include benefits for vision care.

These plans might cover routine eye examinations and pay for a portion of eyeglass costs, making them an attractive option for seniors. It’s wise to compare these with standalone vision insurance policies to assess which offers the best value based on individual needs.

As you explore different vision coverage options, think about your current and future health needs. Regular eye care is important not just for vision clarity but also for overall health, as many eye exams can reveal other systemic health issues.

By reviewing plan options meticulously and thinking ahead, seniors can maintain eye health effectively while controlling costs.

In summary, understanding dental and vision insurance is a vital part of managing healthcare during retirement. Seniors should feel empowered to explore these options, comparing both standalone and combined plans.

For those interested in seeing what plans are available, entering your ZIP code on our website can provide a tailored list of dental and vision insurance options specific to your area, considering local insurance companies and networks.

The Importance of Dental Care in Retirement

As we transition into retirement, our health needs evolve, making dental care a crucial aspect of maintaining overall well-being. Despite its importance, many seniors overlook dental insurance, which plays a vital role in preserving oral health.

Common issues such as gum disease, tooth loss, and complications related to diabetes require consistent dental attention. Understanding the benefits of dental coverage ensures that seniors can access necessary treatments without bearing prohibitive costs.

Moreover, combining dental and vision plans often provides comprehensive healthcare solutions, bridging gaps left by Medicare and other insurance options.

Common Dental Issues for Seniors

During retirement, seniors frequently encounter dental issues that require vigilant care and maintenance. Gum disease is one of the most prevalent concerns, characterized by inflamed, bleeding gums that, if untreated, can lead to more severe complications like tooth loss.

Tooth decay remains a persistent issue as well, with older adults often experiencing cavities despite their diligent oral hygiene routines. Other common concerns include tooth sensitivity, which can make eating and drinking uncomfortable, and dry mouth, which often results from medications that many seniors take.

These issues highlight the need for routine dental visits, where a dentist can provide preventive care and recommend appropriate treatments. Dental insurance is critical in managing these common dental problems by offsetting the costs of regular check-ups, cleanings, and necessary dental procedures.

Since Medicare doesn’t typically cover dental care, having dental insurance allows seniors to pursue essential healthcare without the financial burden. Moreover, seniors are encouraged to select dental plans that cover not just preventive care, but also treatments like fillings, crowns, or even dentures.

By addressing these needs, seniors maintain their health while safeguarding their retirements savings from unexpected dental expenses. Addressing dental issues promptly can enhance one’s quality of life in retirement, reducing discomfort and preventing further health problems.

It is essential for seniors to have dental insurance that fits their specific needs, ensuring access to a network of qualified dentists. This not only helps manage existing dental problems but also aids in the early detection of potential issues, leading to better health outcomes in the long term.

Choosing the right coverage involves evaluating different insurance companies and understanding the specifics of what each plan offers, including any limitations or waiting periods that may affect immediate access to care.

How Dental and Vision Plans Can Help

Dental and vision plans offer a holistic approach to healthcare, providing a safety net that ensures seniors receive essential services without financial strain. Dental plans often include preventive services like cleanings and exams, but for comprehensive coverage, seniors need plans that go beyond basics.

This means looking for services that cover a portion of costs for more involved procedures like fillings, extractions, or even restorative work like crowns and dentures. Knowing what each plan offers helps in comparing options, considering both the cost and the network of available providers.

Moreover, many seniors benefit from dental and vision insurance combined, as these plans often offer greater flexibility and ease of management. Transitioning into retirement often means adjusting to changes in Medicare and understanding how supplemental insurance fits the picture.

While traditional Medicare does not offer dental coverage and only limited vision options, many Medicare Advantage Plans incorporate these elements. These plans can be more cost-effective and provide expanded benefits, such as discounts on vision services or eyewear, alongside dental care.

Insurance companies offer varied plans, each with different levels of coverage, costs, and networks. It becomes essential for seniors to evaluate these options carefully to find a plan that best suits their unique needs.

They’ll need to consider not only the out-of-pocket expenses but also any waiting periods or service limitations that might impact their care. For many, hearing, dental, and vision care form the triad of essential services needed to maintain health during retirement, making integrated plans a beneficial choice.

Exploring dental and vision insurance options is a step towards securing peace of mind in retirement.

By choosing plans that align with their health requirements and financial capabilities, seniors can ensure they receive the care they need without unnecessary financial hardship. This careful evaluation enables seniors to focus on enjoying their retirement years with confidence, knowing their health care needs are adequately addressed.

If you’re looking to explore plans available in your area, enter your ZIP code on our website to find tailored options that fit your health care needs and financial situation.

Comparing Different Dental Insurance Plans

When evaluating dental insurance options, understanding the differences between plans is key to making an informed choice. Seniors face unique health needs, making it crucial to compare various dental plans, considering costs, dental coverage, and network flexibility.

Many seniors weigh their choices between Dental Health Maintenance Organizations (DHMOs) and Preferred Provider Organizations (PPOs), both offering distinct benefits and limitations.

Additionally, many insurance companies provide supplemental dental coverage, an important factor for those already covered by Medicare. This variety helps ensure seniors can find the dental care solutions that suit their individual health and financial situations.

Factors to Consider When Choosing Plans

Choosing the right dental insurance plan involves a thorough consideration of several factors that affect both coverage and cost.

First and foremost, consider the type of dental care you require. For seniors, this often includes preventive care like regular check-ups and cleanings, but it also extends to more involved procedures such as fillings, crowns, dentures, and even implants.

Knowing your specific needs allows you to select a dental plan that offers not only preventive services but also covers a portion of major procedures. Many plans vary in the scope of dental coverage they provide, which can heavily influence your choice.

It is also important to be aware of any out-of-pocket expenses. This includes understanding deductibles, copayments, and any caps on coverage.

When evaluating dental plans, check the details about what each covers and the associated costs for the services you expect to use. Some dental insurance options will have higher premiums but lower copayments for major work, which might be beneficial if you anticipate needing more dental care.

Network considerations are another crucial aspect. Some plans may limit you to a network of preferred dentists, while others provide more freedom.

If you have a favored dentist or specialist, ensure they are part of the plan’s network. Additionally, networks can influence costs, as services from out-of-network providers are typically more expensive.

Finally, don’t discount the importance of insurer reputation and customer service. Each insurance company offers varying levels of support and may handle claims differently.

Reading reviews from other seniors and consulting with trusted healthcare advisors can offer insight into an insurer’s reliability and service quality. Taking time to weigh these factors will enable seniors to select a plan that best aligns with their healthcare needs, providing peace of mind in accessing necessary dental care.