Best Medicare Advantage Plans North Dakota 2025

Medicare Advantage plans in North Dakota for 2025 are offered by several top insurance companies. Rest assured, it’s easier than it might be to find a plan that fits your needs. With the right guidance from our website and help from our licensed insurance agents, if you’d like, you can find the ideal plan tailored to your needs.

In this comprehensive guide, we’ll explore the best Medicare Advantage plans in North Dakota, discuss eligibility and enrollment, and provide valuable resources to help you make an informed decision.

Let’s dive into the world of North Dakota Medicare Advantage plans and discover the options that are right for you!

Key Takeaways

- Understanding Medicare Advantage Plans in North Dakota requires utilizing resources like Medicare.gov and the CMS website.

- Various types of plans are available, offering unique features & benefits tailored to the needs of different individuals.

- Financial assistance programs such as Medicaid and Extra Help may be available for eligible beneficiaries to help cover costs associated with coverage selection

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plans in North Dakota

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare. These plans are offered by Medicare-approved private insurance companies and provide medical insurance to eligible individuals.

Approximately 18% of North Dakota’s population is enrolled in Medicare. Conversely, 21% of the state’s over 130,000 Medicare beneficiaries had enrolled in Medicare Advantage plans in 2024.

The North Dakota Insurance Department oversees the private insurance companies that offer Part C coverage in the state and provides information regarding Original Medicare, Medicare Advantage plans, and Part D prescription drug coverage.

You can gain a deeper understanding of your options by utilizing resources like Medicare.gov and the Centers for Medicare & Medicaid Services (CMS) website. They provide extensive information on Medicare coverage components.

Our website, Comparemedicareadvantageplans.org, is also a great resource. Our plan finder tool on this website is useful for identifying plans within your locality and comparing diverse options.

Types of Medicare Advantage Plans in North Dakota

In North Dakota, Medicare Advantage plans serve as an alternative to Medicare Supplement Plans (Medigap). There are different types of plans available, including:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-For-Service (PFFS)

- Special Needs Plans (SNP)

- Medicare cost plans

All these plans have various features that meet different needs. Each plan type has unique features and benefits tailored to suit the needs of different individuals.

The Centers for Medicare and Medicaid Services (CMS) has developed a star rating system to aid in your decision-making process. It evaluates Medicare Advantage and Part D prescription drug plans on a scale of one to five stars, enabling you to gauge the quality and performance of different plans, thereby helping you select the most suitable plan for your needs.

Coverage Offered by Medicare Advantage Plans

Medicare Advantage plans provide all of the benefits of Original Medicare Parts A and B, excluding hospice care. They may also include additional benefits such as vision, dental care, and prescription drugs.

For instance, Medicare Part D is a program that offers drug coverage to Medicare beneficiaries who lack another source of coverage for prescription costs.

As of late 2022, more than 74% of North Dakota’s Medicare beneficiaries had Part D coverage, either through stand-alone Medicare Part D plans or integrated with a Medicare Advantage plan.

These plans provide supplemental health care benefits, including prescription drug coverage, routine hearing, vision, and dental exams, as well as fitness club memberships.

Choosing a Medicare Advantage plan grants you comprehensive Medicare benefits, customized to meet your needs, and guarantees the receipt of needed care and services.

Eligibility and Enrollment for Medicare Advantage in North Dakota

To enroll in a Medicare Advantage plan in North Dakota, you must meet certain eligibility requirements and adhere to specific enrollment periods. Individuals aged 65 and above, as well as those with a qualifying disability, are eligible for Medicare Advantage plans.

Gaining knowledge about the eligibility requirements and enrollment periods is key to accessing a Medicare Advantage plan that aligns with your needs. Subsequent sections will outline these requirements and periods, equipping you with the information required for making well-considered decisions about your Medicare coverage.

Eligibility Requirements

To enroll in a Medicare Advantage plan in North Dakota, you must possess Medicare Parts A and B, not be enrolled in Medigap, and fulfill specific criteria for certain plan types.

Original Medicare in North Dakota consists of Medicare Parts A and B, with Part A covering inpatient hospital expenses and Part B covering outpatient costs such as doctor’s visits.

It is important not to be enrolled in Medigap when enrolling in a Medicare Advantage plan, as Medigap and Medicare Advantage are two distinct forms of coverage that cannot be combined. Grasping these eligibility requirements aids in selecting a Medicare Advantage plan that is most harmonious with your healthcare needs.

Enrollment Periods

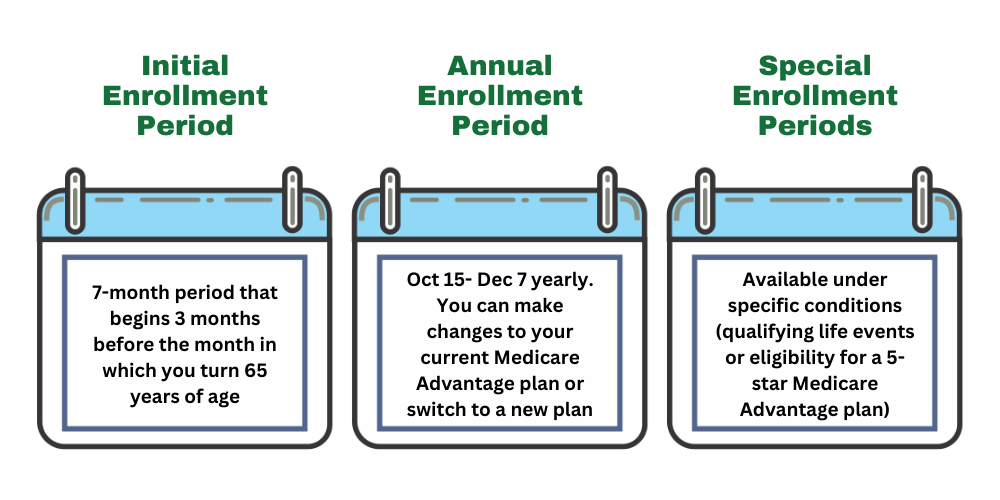

There are three main enrollment periods for Medicare Advantage plans in North Dakota: the Initial Enrollment Period, the Annual Election Period, and the Special Enrollment Period.

The Initial Enrollment Period is a seven-month period that starts three months before the month in which an individual turns 65, includes the month of their 65th birthday, and concludes three months after the month in which they turn 65.

The Annual Election Period, which takes place from October 15 to December 7 each year, allows Medicare Advantage plan participants to change their plan or revert to Original Medicare.

Special Enrollment Periods are occasions outside of the Initial Enrollment Period and Annual Election Period when you can change your plan or revert to Original Medicare due to certain qualifying circumstances, such as relocating to a new state.

Getting a grasp on these enrollment periods is key to securing a Medicare Advantage plan that aligns most closely with your needs.

Comparing Medicare Advantage Plans in North Dakota

Comparing Medicare Advantage plans is a critical step in finding the plan that best meets your needs. By comparing plans, you can ensure that you are obtaining:

- Coverage

- Network

- Costs

- Extra benefits

- Prescription drug coverage

- Quality ratings

that most suit your needs. In this section, we will discuss the factors to consider when comparing Medicare Advantage plans in North Dakota and provide resources to help you in your search.

By investing time in comparing plans and assessing your options, you can make well-considered decisions about your healthcare coverage, guaranteeing access to necessary care and services.

Factors to Consider

When selecting a Medicare Advantage plan in North Dakota, it is important to consider the following factors:

When selecting a Medicare Advantage plan in North Dakota, it is important to consider the following factors:

- Coverage

- Network

- Costs

- Prescription drug coverage

- Extra benefits

- Quality ratings

The type of Medicare Advantage plan can affect coverage and costs, with all plans offering the same coverage as Original Medicare but additional benefits potentially increasing premiums.

The provider network is another crucial factor, as it determines the doctors, hospitals, and healthcare providers from which you can receive services. Medicare Advantage plans have networks of authorized providers, and adhering to the network can assist in reducing out-of-pocket expenses.

For a well-considered decision about your healthcare coverage, it’s imperative to select a plan whose provider network encompasses healthcare providers that you prefer or need for your medical care.

Top Providers of Medicare Advantage Plans in North Dakota

In this section, we will highlight the top providers of Medicare Advantage plans in North Dakota, including NextBlue of North Dakota and other prominent providers. These providers offer a range of plans and benefits to suit the needs of North Dakota residents, ensuring that you can find the plan that is right for you.

Whether you’re interested in comprehensive coverage, low premiums, or additional benefits, these top providers have something to offer for every Medicare beneficiary in North Dakota.

NextBlue of North Dakota

NextBlue of North Dakota offers a variety of Medicare Advantage plans, including Classic PPO, Premium PPO, and Freedom PPO plans.

These plans provide comprehensive care for members with diabetes, including benefits such as a $0 copay for annual wellness exams, hemoglobin A1C lab testing, and a $0 copay for certain services.

In addition to these specialized plans, NextBlue of North Dakota also offers all-in-one coverage for Medicare Parts A, B, and D, along with dental, vision, hearing, and a fitness plan.

NextBlue’s Medicare Advantage plans in North Dakota have a customer satisfaction rating of 4.5 stars, making them a top choice for Medicare beneficiaries in the state. By examining NextBlue’s plan offerings and benefits, you can decide if their plans are in harmony with your healthcare needs and preferences.

Other Prominent Providers

In addition to NextBlue of North Dakota, there are several other prominent providers offering Medicare Advantage plans in the state, such as:

- Aetna Medicare

- HealthPartners

- Humana

- Lasso Healthcare

- Medica

- Blue Cross Blue Shield of North Dakota

- Sanford

Each of these providers offers a range of plans and benefits, ensuring that Medicare beneficiaries in North Dakota have access to the coverage and services they need.

When considering these providers, it is essential to compare their plans and benefits to determine which option best suits your individual needs.

By investigating the offerings of these prominent providers, you can identify the Medicare Advantage plan that offers the optimal balance of coverage, costs, and extra benefits for your healthcare needs.

Financial Assistance for Medicare Beneficiaries in North Dakota

For some Medicare beneficiaries in North Dakota, financial assistance programs are available to help with the costs of Medicare coverage.

In this section, we will discuss the various programs available, including Medicaid programs and other financial assistance programs. By exploring these options, you may be able to receive additional support in covering the costs of your Medicare Advantage plan.

Gaining knowledge about the financial assistance programs available in North Dakota, including those supported by the federal government, can help you maximize your Medicare coverage and assure that you receive necessary care and services without straining your finances.

Medicaid Programs

Medicaid programs in North Dakota provide assistance with premiums and long-term care for eligible Medicare beneficiaries. To be eligible for Medicaid assistance, you must meet certain income requirements, which vary depending on the program.

In addition to income requirements, there may be specific eligibility criteria for certain age groups, such as individuals under age 21 or those age 65 and over in the state hospital.

Medicaid in North Dakota provides coverage for Medicare Part B premiums and other cost-sharing for eligible Medicare beneficiaries.

If you meet the eligibility requirements for Medicaid assistance, you can receive support in covering the costs of your Medicare Advantage plan, ensuring that you have access to the care and services you need.

Other Financial Assistance Programs

In addition to Medicaid programs, other financial assistance programs are available to help Medicare beneficiaries in North Dakota with the costs of their coverage. These programs include Extra Help, Medicare Savings Programs, and State Pharmaceutical Assistance Programs.

Extra Help is a program that offers support in covering the expenses of Medicare drug coverage, such as premiums, deductibles, and cost-sharing. Medicare Savings Programs offer benefits such as coverage of Medicare Part B premiums, Medicare Part A and B cost-sharing, and in certain circumstances, Part A premiums.

Investigating these financial assistance programs can help you find the support you need to manage the costs of your Medicare Advantage plan and assure access to necessary care and services.

Helpful Resources for Medicare Advantage Plans in North Dakota

In this section, we will introduce helpful resources for exploring Medicare Advantage plans in North Dakota. These resources include:

- State Health Insurance Counseling (SHIC) program

- North Dakota Department of Insurance

- Medicare Rights Center

- Health insurance brokers

By utilizing these resources, you can gain valuable information and insight into the Medicare Advantage plans available in North Dakota, helping you make an informed decision about your healthcare coverage.

Leveraging these resources, you can confidently navigate Medicare Advantage plans in North Dakota and find a plan that suits you best.

State Health Insurance Counseling (SHIC)

The State Health Insurance Counseling (SHIC) program provides free, unbiased advice and assistance for Medicare beneficiaries in North Dakota.

This program can help you with various aspects of Medicare Advantage plans, including understanding eligibility, enrollment, and appeals.

To contact or make an appointment with the North Dakota State Health Insurance Counseling (SHIC) program, you may call 1-888-575-6611 or visit their website at https://www.insurance.nd.gov/shic-medicare.

Consulting with SHIC allows you to receive personalized guidance and advice based on your individual needs and preferences.

This can assist you in making a well-considered decision about your Medicare Advantage plan and assure the receipt of necessary care and services.

Other Helpful Resources

In addition to the State Health Insurance Counseling (SHIC) program, other helpful resources are available to assist you in exploring Medicare Advantage plans in North Dakota.

The North Dakota Department of Insurance can provide enrollment guidance, help you compare and change Medicare Advantage plans, and clarify state regulations.

The Medicare Rights Center offers counseling and advocacy services, ensuring that you have access to affordable healthcare and assistance with all Medicare issues, including Medicare Advantage plans.

Health insurance brokers, such as Louise Norris, are also available to provide insight into health insurance and health reform, assisting you in finding the best Medicare Advantage plan for your needs through a private insurance company.

With the help of these resources, you can make an informed decision about your healthcare coverage and ensure that you have access to the care and services you require.

Summary

In conclusion, understanding your options and making informed decisions are crucial when it comes to selecting the best Medicare Advantage plan in North Dakota.

By considering the types of plans available, coverage offered, eligibility requirements, enrollment periods, and top providers, you can find the plan that aligns with your healthcare needs and preferences.

Utilize the helpful resources mentioned in this guide, such as the State Health Insurance Counseling (SHIC) program, to make the most of your Medicare coverage and ensure that you receive the care and services you need.

Frequently Asked Questions

→ Does North Dakota have Medicare Advantage plans?

Yes, North Dakota offers Medicare Advantage plans through NextBlue of North Dakota as well as many other insurance companies.

→ How do you qualify to get $144 back from Medicare?

To qualify for the Medicare Giveback Benefit, you must be enrolled in Original Medicare (Parts A and B), pay your Medicare Part B premium, and live in a service area of a plan that offers the benefit.

→ Is Medicare Advantage cheaper?

Medicare Advantage plans are slightly less expensive, on average, than traditional Medicare, but this cost savings is concentrated in a few counties.

→ What is the main difference between Original Medicare and Medicare Advantage plans?

Original Medicare is a federal program administered by the government, while Medicare Advantage plans are offered by private insurance companies and often provide additional benefits beyond medical coverage.

Compare Medicare Advantage Plans by Company

ZRN Health & Financial Services, LLC, a Texas limited liability company