Medicare Advantage Enrollment Trends

Over the past few years, Medicare Advantage enrollment has surged dramatically. Back in 2007, only 19% of eligible beneficiaries were enrolled in these plans. Fast forward to 2024, and that number has skyrocketed to 54%, with around 32.8 million individuals opting for Medicare Advantage plans. This trend indicates a growing preference for the additional benefits and flexibility that these plans offer compared to traditional Medicare.

Enrollment patterns vary significantly by state, influenced by factors such as urbanization and historical market presence. Some states boast enrollment rates exceeding 60%, reflecting the diverse needs and preferences of beneficiaries across the country. Additionally, special needs plans (SNPs) have seen substantial growth, with over 6.6 million MA enrollees participating as of 2024.

The Medicare Advantage market is highly concentrated, with UnitedHealthcare and Humana accounting for nearly 47% of all enrollees. Other companies, such as Wellcare, also have a small portion of marketshare. The Congressional Budget Office predicts that the percentage of Medicare beneficiaries in these plans could rise to 64% by 2034, underscoring the growing reliance on these plans for comprehensive healthcare coverage.

Impact of the Inflation Reduction Act on Medicare Advantage Plans

The Inflation Reduction Act (IRA) brings significant changes to reduce costs and enhance benefits for Medicare beneficiaries. One impactful provision caps member spending on covered insulin medications at $35 per month, for both in-network and out-of-network pharmacies. This offers substantial relief for those managing diabetes, ensuring affordability and accessibility.

In addition to the insulin cap, the IRA mandates zero cost-sharing for adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP), starting in 2023. This means beneficiaries can receive crucial vaccines without incurring out-of-pocket expenses, promoting better public health outcomes.

The IRA includes a Medicare Drug Price Negotiation Program aimed at lowering prescription drug costs at a negotiated price, offering substantial financial relief to beneficiaries.

The IRA also emphasizes health equity, with CMS implementing new major provisions to ensure equitable access to healthcare within Medicare Advantage plans and IRA-related provisions. These changes, along with adjustments to formulary designs, aim to create a more balanced and fair system for all beneficiaries, supported by an annual health equity analysis.

Financial Outlook with CMS’s 2026 Rate Notice

The Final Rate Announcement for Medicare Advantage plans in 2026 brings a positive shift in the financial outlook, providing greater flexibility and opportunities for growth. The National Per Capita MA Growth Percentage for 2026 is set at 10.72%, which will significantly impact capitation rates and the overall financial strategies of Medicare Advantage plans.

Additionally, the Fee-for-Service Growth Percentage for 2026 is estimated at 8.81%, further influencing financial planning and decision-making for these plans. These growth percentages highlight the robust financial health and potential for expansion within the Medicare Advantage program. The estimated average revenue increase of 7.16% for Medicare Advantage plans in 2026 underscores the financial viability and attractiveness of these plans for both providers and beneficiaries.

This new rate announcement creates opportunities for Medicare Advantage plans to focus on growth, develop strong plan offerings, and invest in initiatives that improve care quality and member satisfaction. As the financial landscape evolves, beneficiaries must stay informed about these changes with advance notice to maximize their Medicare benefits.

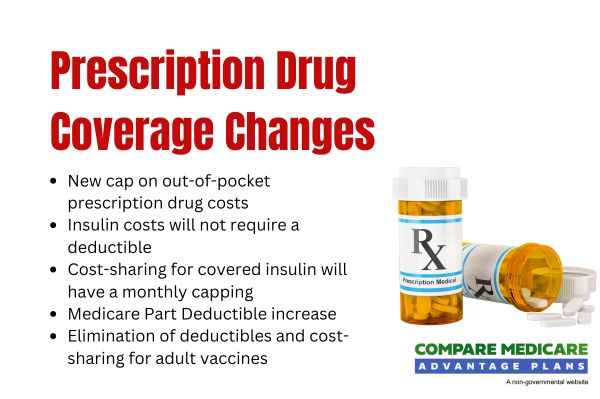

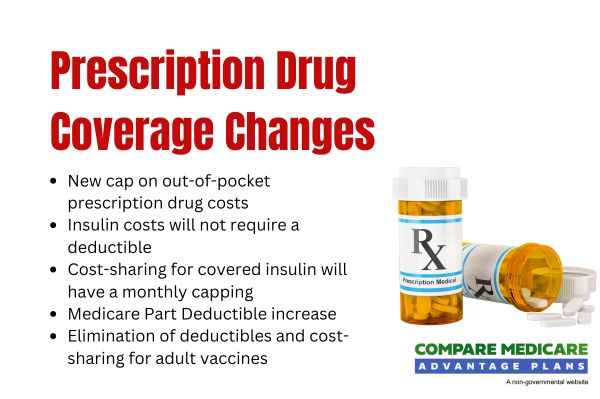

Changes in Prescription Drug Coverage

Significant changes are on the horizon for prescription drug coverage under Medicare Advantage plans. Beginning in 2026, out-of-pocket expenses for Part D prescription drugs will be capped at $2,100, offering significant financial relief for those needing high-cost medications. This cap ensures that beneficiaries can better manage their healthcare expenses without the burden of high actual OOP costs.

Introduced in 2025, the Medicare Prescription Payment Plan allows enrollees to manage out-of-pocket prescription costs through monthly payments. In 2026, the plan will feature automatic renewal of participation, ensuring continuity and ease of access.

Additionally, new subsidies for high-cost drugs during the initial coverage phase will help alleviate financial burdens, making essential medications more affordable. These changes underscore a commitment to making prescription drugs more affordable and accessible, ensuring beneficiaries get the medications they need without financial strain.

Utilization Management Policies

Utilization management policies play a crucial role in ensuring appropriate utilization of healthcare services, improving care quality, and managing costs within Medicare Advantage plans. In 2026, Medicare and Medicaid Services CMS will finalize updates to submit risk adjustment data submissions to align with ICD terminology, improving data reporting accuracy and clarity. These updates will allow for more precise risk adjustments and better resource allocation.

Normalization methodologies for risk scoring will account for variations in healthcare utilization post-COVID-19, providing a more accurate reflection of beneficiaries’ health needs. Additionally, updated methodologies for the Medical Loss Ratio will alter how costs are tracked across Medicare Advantage plans, potentially affecting financial assessments and plan methodologies.

Shifting towards stricter utilization management, prior authorizations will be implemented in six states to ensure services are used appropriately and efficiently. These policies are designed to protect beneficiaries while maintaining the financial stability of the Medicare Advantage program.

Enhancements to Benefits and Services

Medicare Advantage plans are continually evolving to offer enhanced benefits and services aimed at improving health outcomes for beneficiaries. One notable enhancement is the mandate for zero cost-sharing for adult vaccines, ensuring that beneficiaries can access essential immunizations without incurring out-of-pocket expenses. Plans must also reimburse beneficiaries for out-of-network adult vaccine expenses, streamlining the claims process and ensuring broader access.

Supplemental benefits are also being enhanced, particularly for those with chronic conditions, to improve overall health and quality of life. The 2026 Rate Announcement introduces structural reforms intended to enhance efficiency and affordability within Medicare Advantage plans, providing extra benefits. These reforms aim to create a more sustainable and effective healthcare system for all beneficiaries.

New guidelines will restrict alterations to authorized inpatient admissions to instances of clear errors or fraud, preventing unnecessary disruptions in care. These enhancements reflect a commitment to providing comprehensive and equitable healthcare services to all Medicare Advantage enrollees, including minor modifications.