Medicare Advantage Plans Michigan 2026

Looking into the potential Medicare Advantage Plans in Michigan for 2026? This article covers the available plan options, potential benefits, and important enrollment details for the year 2026.

Key Takeaways

- Some Medicare Advantage Plans in Michigan may provide additional coverage, including medical, dental, and vision benefits.

- There are various types of Medicare Advantage Plans available in Michigan, including HMO, PPO, and Special Needs Plans, each offering distinct features and benefits that could cater to different healthcare needs.

- Enrollment in Medicare Advantage Plans is confined to specific periods, such as the Annual Open Enrollment Period from October 15 to December 7, and plans often have no deductibles or low premiums, enhancing accessibility for beneficiaries.

Compare Plans in One Step!

Enter Zip Code

Understanding Michigan Medicare Advantage Plans

Medicare Advantage Plans in Michigan will likely provide comprehensive coverage, including all the services covered by Original Medicare. These plans are administered by private insurance companies and regulated by the Centers for Medicare and Medicaid Services (CMS), ensuring that they meet specific standards and could provide reliable coverage.

Some Medicare Advantage Plans may offer additional benefits. Unlike Original Medicare, certain plans might include dental, vision, and hearing coverage, which could significantly enhance the quality of care for beneficiaries. However, the potential costs and coverage may vary widely between different plans, so beneficiaries should carefully evaluate their options.

Enrollment in Medicare Advantage Plans is limited to specific periods, such as the Annual Open Enrollment Period from October 15 to December 7. During this time, beneficiaries can switch plans or enroll in a new one, ensuring they have the coverage that best meets their needs.

Types of Michigan Medicare Advantage Plans Available

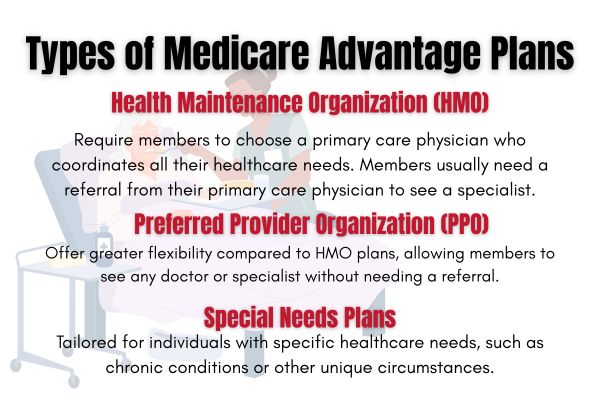

Michigan will likely offer a variety of Medicare Advantage Plans that could cater to diverse healthcare needs, possibly ensuring that beneficiaries can find a plan that suits their specific requirements. The primary types of plans available are Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNPs).

Each type of plan has its own set of features and benefits, designed to meet different healthcare needs and preferences. Next, this article explore the specifics of HMO, PPO, and SNP plans to help you make an informed choice.

HMO Plans

HMO plans in Michigan require members to choose a primary care physician who coordinates all their healthcare needs. This means that to see a specialist, members usually need a referral from their primary care physician. This system helps streamline care management and likely ensures that all aspects of a member’s health are monitored closely.

These plans may have lower monthly premiums compared to other Medicare Advantage options, possibly making them an attractive option for beneficiaries looking for comprehensive care.

HMO plans typically restrict members to a network of doctors and hospitals for non-emergency care. This means that if you seek care outside of this network, you may have to pay the full cost of the services. Ensure that your preferred healthcare providers are within the plan’s network before enrolling.

PPO Plans

PPO plans offer greater flexibility compared to HMO plans, allowing members to see any doctor or specialist without needing a referral. This could be particularly beneficial for those who want the freedom to choose their healthcare providers. Some PPO plans might not have residency restrictions within the U.S., possibly providing even more flexibility for members.

Preventive care services will likely be provided at lower out-of-pocket cost under these plans, and copays for office visits generally remain consistent. This predictability could make managing healthcare expenses easier for beneficiaries.

PPO plans often come with higher costs for out-of-network services. While you have the freedom to choose providers outside of the plan’s network, it’s important to be aware that doing so may result in higher out-of-pocket expenses.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific healthcare needs, such as chronic conditions or other unique circumstances. These plans provide personalized care and benefits designed to meet the specific needs of their members, possibly ensuring that they receive the focused care they require.

Overview of Michigan Medicare Advantage Plans

Certain Medicare Advantage Plans in Michigan may provide comprehensive coverage that might include various supplemental and prescription drug benefits. Some plans may offer lower monthly premiums, possibly making healthcare accessible and affordable for beneficiaries. This comprehensive approach could potentially ensure that members have access to a wide range of services without the need for multiple plans.

The network of providers for Medicare Advantage Plans in Michigan likely includes over 80,000 local doctors and more than 1.7 million nationwide. This extensive network ensures that beneficiaries have access to quality care wherever they are. Some plans may also include additional benefits like coverage for dental, vision, and hearing services, possibly enhancing the overall value.

Financial protection will likely be another vital feature of Medicare Advantage Plans in Michigan, such as out-of-pocket maximums. This potential cap could mean that beneficiaries may have a limit on how much they have to pay out of pocket for covered services each year, possibly providing peace of mind and financial security.

Potential Services and Benefits

Some Medicare Advantage plans in Michigan may feature lower costs for specific services, likely making it easier for members to access the care they need without worrying about upfront costs.

Certain plans may cover hearing aids, likely providing essential support for hearing-impaired members. Vision care may also include one comprehensive eye exam per year, with limits on dilation and eyeglasses, supporting overall eye health.

Dental coverage might encompass procedures such as crowns and extractions, possibly ensuring that members have access to essential dental care. These additional benefits could potentially enhance overall healthcare accessibility and support members’ health.

Enrollment Process for Michigan Medicare Advantage Plans

Current members in Medicare Advantage plans can switch to another plan until March 31, providing flexibility for members to find the best fit for their needs. Eligible individuals can enroll in Medicare Advantage plans during their Initial Enrollment Period (IEP), which spans three months before, the month of, and three months after they turn 65. This initial period is crucial for new beneficiaries to secure their healthcare coverage.

Knowing the various enrollment periods is key to making informed decisions. The following subsections will detail when to enroll and the different enrollment periods.

When to Enroll

Enrollment opportunities may vary based on a beneficiary’s specific situation, such as turning 65 or losing other coverage. If not enrolled during the Initial Enrollment Period (IEP), individuals may sign up during the General Enrollment Period from January 1 to March 31. This period allows those who missed their IEP to still gain coverage.

The Medicare Open Enrollment Period occurs annually from October 15 to December 7, allowing beneficiaries to make changes to their health plans. During this time, participants can switch from Original Medicare to a Medicare Advantage plan or vice versa. Changes made during the Medicare Open Enrollment take effect starting January 1 of the following year.

In the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31, participants can switch between Medicare Advantage plans or revert to Original Medicare. This period provides an additional opportunity for those already enrolled in a Medicare Advantage plan to make adjustments.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Different Enrollment Periods

There are several enrollment periods, including Initial Enrollment, Annual Election Period (AEP), and Open Enrollment Period (OEP). Special Enrollment Periods are available for those who experience qualifying life events, allowing them to enroll outside standard periods.

Medicare Advantage plans have specific enrollment periods, including the Initial Enrollment Period for new beneficiaries, the Annual Enrollment Period (AEP) typically from October 15 to December 7 each year, and Special Enrollment Periods (SEPs) triggered by qualifying life events. During the Annual Enrollment Period, beneficiaries can switch between Medicare Advantage plans or return to Original Medicare with or without a standalone prescription drug plan.

Special Enrollment Periods allow for changes to Medicare Advantage plans under certain circumstances, such as moving out of the plan’s service area or losing other health coverage. These periods ensure that beneficiaries can maintain appropriate coverage throughout the year.

OEP, AEP, Special Enrollment

The AEP allows beneficiaries to change their Medicare Advantage plans annually from October 15 to December 7. This period is crucial for making adjustments to coverage for the upcoming year.

The Open Enrollment Period (OEP) for Medicare runs from January 1 to March 31 each year, allowing beneficiaries to switch plans or return to Original Medicare. This period provides an additional opportunity for those already enrolled in a Medicare Advantage plan to make changes.

Special Enrollment Periods (SEPs) allow beneficiaries to enroll or make changes to their Medicare plans outside of OEP and AEP due to qualifying life events, such as moving or losing other coverage. These periods ensure that beneficiaries can maintain appropriate coverage throughout the year, regardless of changes in their circumstances.

Possible Costs Associated with Michigan Medicare Advantage Plans

Certain Medicare Advantage plans in Michigan may offer lower premiums, which could potentially reduce the financial burden on beneficiaries. These low-cost options might make it easier for individuals to access the healthcare coverage they need without worrying about high monthly premiums.

Knowing the potential costs associated with certain Medicare Advantage Plans could crucial. Next, the following subsections will explore the potential premiums, co-pays, and out-of-pocket maximums to help you make an informed decision.

Premiums and Co-Pays

Some Medicare Advantage plans in Michigan may offer reduced premium options, possibly allowing beneficiaries to choose affordable plans. This could be particularly beneficial for those on a fixed income. Some Medicare Advantage plans may also have lower copayments for services, likely making costs predictable for members.

Out-of-Pocket Maximums

Out-of-pocket maximums for Medicare Advantage plans in Michigan might vary significantly, likely providing cost protection for members against high healthcare expenses. Unlike Original Medicare, certain Medicare Advantage plans might offer an out-of-pocket maximum, which could cap the total amount members pay for covered services in a year. This potential feature will likely provide financial security and peace of mind for beneficiaries.

Potential Services and Benefits

Some Medicare Advantage plans in Michigan may include additional coverage for vision, hearing, dental, and prescription drugs. For instance, dental coverage might encompass services like crowns, fillings, and extractions.

How to Qualify for Michigan Medicare Advantage Plans

Eligibility for Michigan Medicare Advantage Plans generally requires individuals to meet the following criteria:

- Be enrolled in Medicare Parts A and B.

- Reside in the service area of the plan they wish to enroll in.

- Not have other health coverage that conflicts with the plan.

Additionally, individuals must not have end-stage renal disease (ESRD) at the time of enrollment to qualify for most Medicare Advantage Plans. Some Medicare Advantage Plans may have specific health qualifications or underwriting standards that applicants must meet. Enrollment in Medicare Advantage Plans typically requires individuals to fill out an application and may involve additional verification of eligibility.

Contracted Network and Access to Care

HMO plans typically require members to use a specific network of healthcare providers to receive benefits, except in emergency situations. PPO plans provide more flexibility by allowing members to receive care from outside their network, albeit at a higher cost. Some HMO plans may not require referrals for accessing specialty care, streamlining the process for members.

Health Maintenance Organizations (HMOs) often focus on providing coordinated care through a limited network of local physicians and hospitals. Medicare Advantage plans are required to establish a network of providers that sufficiently meets the healthcare needs of their enrollees.

Certain types of Medicare Advantage plans, such as regional preferred provider organizations (RPPOs), may offer care outside of their network under specific conditions. Plans like private fee-for-service (PFFS) must operate in areas where multiple network plans are available to ensure competitive access to care.

Comparing Michigan Medicare Advantage Plans to Original Medicare

Medicare Advantage plans must cover at least the same services as Original Medicare but some might provide additional benefits such as dental, vision, and hearing care. Knowing the differences between Medicare Advantage Plans and Original Medicare will likely be crucial. These next subsections will explore coverage differences and cost comparisons to help you choose the best option.

Possible Coverage Differences

Original Medicare has limited coverage for dental, vision, and hearing services, while certain Medicare Advantage plans may include these services. Some Medicare Advantage plans may incorporate prescription drug coverage, which is not a standard feature of Original Medicare. This extra coverage could potentially make Medicare Advantage plans more comprehensive and beneficial.

Original Medicare does not cover long-term care, but some Medicare Advantage plans might include hearing, vision and dental care. Medicare Advantage plans typically have a defined network of doctors and hospitals, unlike Original Medicare, which allows you to see any provider who accepts Medicare. This network requirement will likely streamline care but may also limit provider choice.

Medicare Advantage plans may vary greatly in coverage options and costs, unlike the standard benefits of Original Medicare. This variability likely lets beneficiaries choose a plan that fits their needs and preferences, offering tailored healthcare solutions.

Potential Cost Comparisons

Unlike Original Medicare, some Medicare Advantage plans might set a limit on out-of-pocket expenses for covered services. This potential cap could offer financial protection and peace of mind.

Original Medicare generally requires up to a 20% coinsurance for services, whereas Medicare Advantage plans might offer fixed copays for similar services. This predictability could make it easier for beneficiaries to manage their healthcare expenses.

Emergencies and Referrals

In a medical emergency, individuals should always seek care at the closest emergency room, as Medicare Advantage plans are mandated to cover emergency services at in-network rates. This ensures that members receive the necessary care without worrying about network restrictions. Medicare Advantage plans must cover emergency room services anywhere in the United States, providing peace of mind for beneficiaries.

No referral is needed to access emergency care through a Medicare Advantage Plan, simplifying the process for members in urgent situations. Medically necessary follow-up care related to an emergency must be covered by your Medicare Advantage Plan to avoid health risks.

Federal law ensures your right to receive emergency medical care, regardless of your insurance status or ability to pay. While Medicare Advantage plans may offer a broader range of services, they might necessitate referrals for specialist visits, which could add complexity to accessing care.

Summary

Michigan Medicare Advantage Plans for 2026 will likely offer a comprehensive and flexible approach to healthcare, possibly providing significant benefits over Original Medicare. Some plans may feature additional services such as dental, vision, and hearing coverage, as well as prescription drug coverage. The variety of plans available, including HMO, PPO, and SNP options, likely ensures that beneficiaries can find a plan that meets their specific needs.

Enrollment periods and the possible costs for these plans will likely be crucial factors to consider. With the potential premiums, fixed copayments, and capped out-of-pocket expenses, some Medicare Advantage Plans could potentially provide financial protection and predictability. The extensive network of providers will likely enhance the overall value of these plans, possibly making them an attractive option for Michigan residents.

Choosing the right Medicare Advantage Plan could significantly impact your healthcare experience and financial well-being. By understanding the various options, potential benefits, and costs, you can make an informed decision that best suits your needs. Take action today to explore your options and ensure you have the best coverage for 2026.

Frequently Asked Questions

→ What are the differences between Medicare Advantage Plans and Original Medicare?

Some Medicare Advantage Plans may include additional benefits like dental, vision, and hearing coverage, which Original Medicare lacks. Furthermore, certain Medicare Advantage Plans may offer out-of-pocket maximums and may sometimes prescription drug coverage, possibly providing greater financial protection.

→ When can I enroll in a Medicare Advantage Plan in Michigan?

You can enroll in a Medicare Advantage Plan in Michigan during your Initial Enrollment Period (IEP) when you turn 65, the Annual Enrollment Period (AEP) from October 15 to December 7, or the Open Enrollment Period (OEP) from January 1 to March 31 if you are already enrolled. It’s important to mark these dates to ensure you don’t miss your opportunity for enrollment.

→ What types of Medicare Advantage Plans are available in Michigan?

Michigan provides several types of Medicare Advantage Plans, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs), each designed to meet different healthcare requirements. Choose the plan that best fits your specific health needs for optimal coverage.

→ Do Medicare Advantage Plans cover emergency services?

Medicare Advantage Plans will likely cover emergency services at in-network rates throughout the United States, and no referral is necessary for access. Additionally, these plans may provide coverage for medically necessary follow-up care related to the emergency.

ZRN Health & Financial Services, LLC, a Texas limited liability company