Enrollment Process for Cigna Medicare Advantage Plans

Enrolling in a Cigna Medicare Advantage plan involves a few key steps and eligibility criteria. Individuals must first be eligible for Medicare and have both Part A and Part B coverage.

The enrollment process typically occurs during the Annual Enrollment Period, which runs from October 15 to December 7 each year.

When to Enroll

Enrollment for Cigna Medicare Advantage plans can begin three months prior to an individual’s 65th birthday or during the Annual Enrollment Period from October 15 to December 7 each year. Changes made during this period will take effect on January 1 of the following year.

A Medicare Advantage Open Enrollment Period from January 1 to March 31 allows for one plan change.

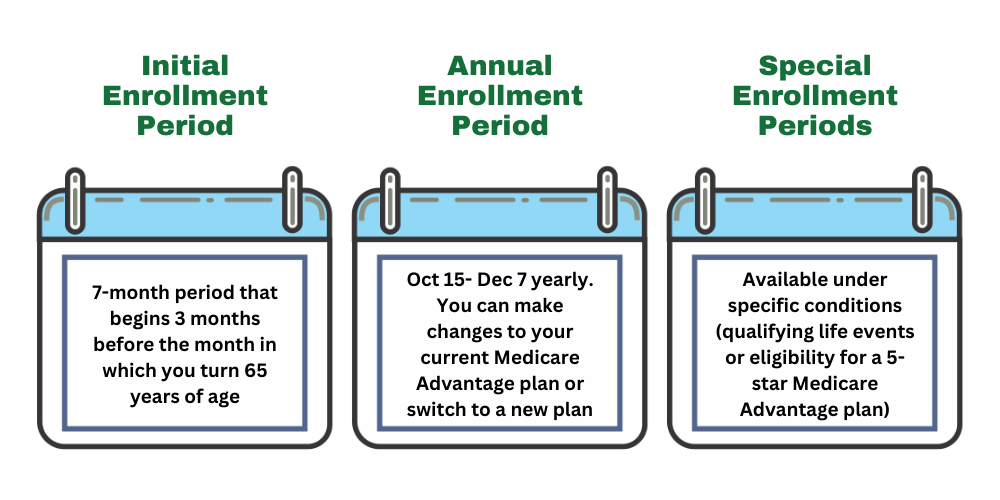

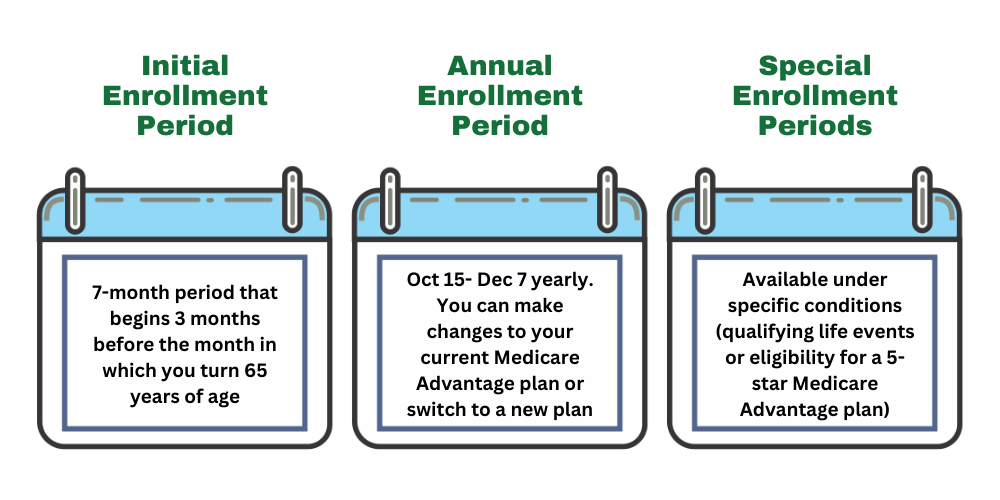

Different enrollment periods

There are several key enrollment periods, including the Initial Enrollment Period, Annual Enrollment Period, and Special Enrollment Periods. The Annual Enrollment Period (AEP) runs from October 15 to December 7 each year and allows beneficiaries to make changes to their plans.

The Open Enrollment Period (OEP) occurs from January 1 to March 31, providing another opportunity to switch plans or return to Original Medicare.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) for Medicare Advantage runs from January 1 to March 31 each year, allowing beneficiaries to switch plans or disenroll from their current plan. The Annual Enrollment Period (AEP) occurs from October 15 to December 7, enabling individuals to enroll in new plans or make changes to their existing plans.

Special Enrollment Periods (SEPs) are available for those who experience qualifying events, such as moving out of the service area or changes in Medicaid eligibility, allowing them to adjust their plans outside the standard enrollment times.

Possible Costs Associated with Cigna Medicare Advantage Plans

Cigna Medicare Advantage plans will likely come with various costs, which may include premiums, co-pays, and out-of-pocket expenses that may vary by plan and geographic location. Understanding these costs is crucial for healthcare Medicare Advantage customers to make informed decisions about their coverage options.

Out-of-Pocket Maximums

Some Cigna Medicare Advantage plans may feature an out-of-pocket maximum that could cap annual spending, possibly protecting members from high healthcare costs in a given year. This cap likely ensures that once the maximum is reached, further costs are covered by the plan, providing financial protection for beneficiaries.

How to Qualify for Cigna Medicare Advantage Plans

Individuals must be enrolled in both Medicare Part A and Part B to qualify for Cigna Medicare Advantage plans. Applicants must also reside within the service area of the specific plan they wish to join. Enrollment typically occurs during the Annual Enrollment Period from October 15 to December 7 each year.

There are also options to change Medicare Advantage plans during the Medicare Advantage Open Enrollment Period from January 1 to March 31. Special Enrollment Periods may be available for individuals who experience qualifying events, allowing them to adjust their plans outside the standard enrollment times.

Enrollment can be completed through this website or by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Contracted Network and Access to Care

Cigna provides tools to help members easily locate in-network healthcare providers and pharmacies, including provider network contacts.

The network of providers in Cigna Medicare Advantage plans will likely include both hospitals and healthcare providers, possibly ensuring comprehensive care for members. Access to care may vary based on geographical location and available providers, but Cigna emphasizes the importance of a connected healthcare team, including pharmacists and case managers, to coordinate care effectively.

Comparing Cigna Medicare Advantage Plans to Original Medicare

Cigna Medicare Advantage plans could provide additional benefits not covered by Original Medicare, such as vision, dental, and hearing coverage, Comparing these plans to Original Medicare could help beneficiaries understand the added value and make informed decisions about their healthcare coverage.

Coverage Differences

Unlike Original Medicare, some Cigna Medicare Advantage plans may include preventive services at no extra cost. Plans will likely bundle Medicare Parts A, B, and sometimes D, possibly offering comprehensive coverage in a single plan. Additional benefits such as vision, dental, and hearing care may also be included, possibly making these plans a more holistic option compared to Original Medicare.

Cost Comparisons

Cigna Medicare Advantage plans may have lower out-of-pocket costs compared to Original Medicare due to their bundled services and additional benefits.

Some Cigna Medicare Advantage plans may provide lower copayments for primary care visits, which could help beneficiaries budget their healthcare expenses more effectively. Additionally, in certain regions, certain plans may integrate prescription drug coverage, which could potentially lower certain drug costs compared to the standard Medicare plans, possibly further enhancing their value.

Emergencies and Referrals

For emergency services, patients typically do not require a referral, likely allowing immediate access to care regardless of network restrictions. This could ensure that members can receive the necessary medical attention promptly in urgent situations.

Referrals from a primary care provider (PCP) may be necessary for non-emergency situations to ensure coverage at optimal benefit levels. In certain plans like HMO, referrals to specialists must come from the PCP to maintain coverage benefits. Using in-network providers for referrals could potentially minimize out-of-pocket costs for patients, making it a crucial aspect of managing healthcare expenses.

Summary

Cigna Medicare Advantage plans for 2026 will likely offer a wide range of benefits and services designed to meet the diverse needs of healthcare Medicare Advantage customers. From comprehensive coverage that includes Parts A, B, and sometimes D, as well as additional benefits such as dental, vision, and hearing services, these plans could provide a holistic approach to healthcare.

Understanding the different types of plans available, the enrollment process, and the associated costs will likely be crucial for making informed decisions about your healthcare coverage. By considering the potential benefits and services offered by Cigna, you can choose a plan that best fits your healthcare needs and ensures your well-being in the years to come.