What is Dental Insurance?

Dental insurance is a type of health insurance designed to cover a portion of the costs associated with dental care. It provides benefits for a range of dental services, including preventive care, fillings, crowns, and even dentures.

Many dental plans focus on coverage for preventive services, which often include routine checkups and cleanings, helping you maintain good oral health and avoid more complex procedures down the line.

It’s important to note that while dental insurance can significantly offset the costs of dental care, it usually comes with coverage limits and specific terms that vary by insurance company. These plans are tailored to ensure seniors have access to the necessary care while managing out-of-pocket expenses.

Different dental insurance plans offer varied coverages for treatments. For instance, some plans might cover the total cost of preventive care visits, while others might split the cost of more expensive treatments like crowns or bridges between the insurance company and the policyholder.

Understanding these details can help seniors choose the right dental plans that offer the best dental coverage for their needs. Dental insurance differs from health insurance primarily in coverage scope and the specific services it targets.

Many insurance companies offer a variety of dental plans to accommodate different levels of coverage needs. Some might focus on providing comprehensive coverage, including major procedures, while others may emphasize preventive care.

As a senior looking into dental insurance, understanding the different plan structures will guide you in selecting the coverage that best matches your health needs. Always consider how a plan’s premiums, deductibles, and annual maximums align with your financial situation.

By doing thorough research and asking the right questions, you can ensure that your dental insurance will serve you well in maintaining your dental health without overwhelming your budget.

How Vision Insurance Differs from Dental Insurance

Vision insurance differs substantially from dental insurance, though both are complementary to overall health care. Vision insurance typically focuses on services related to eye health and eyesight correction.

This includes coverage for routine eye exams, prescription eyewear, and sometimes discounts on corrective surgeries. Unlike dental insurance, vision insurance generally emphasizes offering savings on the comprehensive eye care seniors need, like checking for glaucoma or cataracts, common concerns as we age.

Vision plans often come with network restrictions, where using in-network providers maximizes your benefits.

The structure of vision insurance is such that it complements your health insurance plan by filling in the gaps regarding eye care. Coverage under vision insurance usually requires separate purchasing from your main health insurance.

This kind of insurance is distinct from dental coverage; while you may find vision and dental plans bundled together by some insurance companies, ensure they both meet your needs independently. It’s crucial to compare the specifics, like the frequency of covered exams or cost-sharing details.

A notable difference between dental and vision coverage is how insurance companies approach services like eyewear versus dental procedures. For example, vision insurance might contribute a fixed amount toward eyeglasses or contact lenses, whereas dental insurance may cover a percentage of major dental work.

This distinction means that while both insurances offer benefits that aid in maintaining health, they operate differently, impacting how seniors budget and plan for these expenses.

When selecting vision insurance, it’s advantageous to consider how it integrates with your current health insurance and dental insurance. Understanding these interactions can help in crafting a holistic approach to your healthcare needs.

Just like with dental plans, investigating the specifics of what each vision insurance plan offers in terms of coverage, network availability, and out-of-pocket costs will ensure it fulfills your eye care needs effectively. Get a clear picture of what suits your lifestyle and health requirements by exploring multiple options, ensuring you are comprehensively covered.

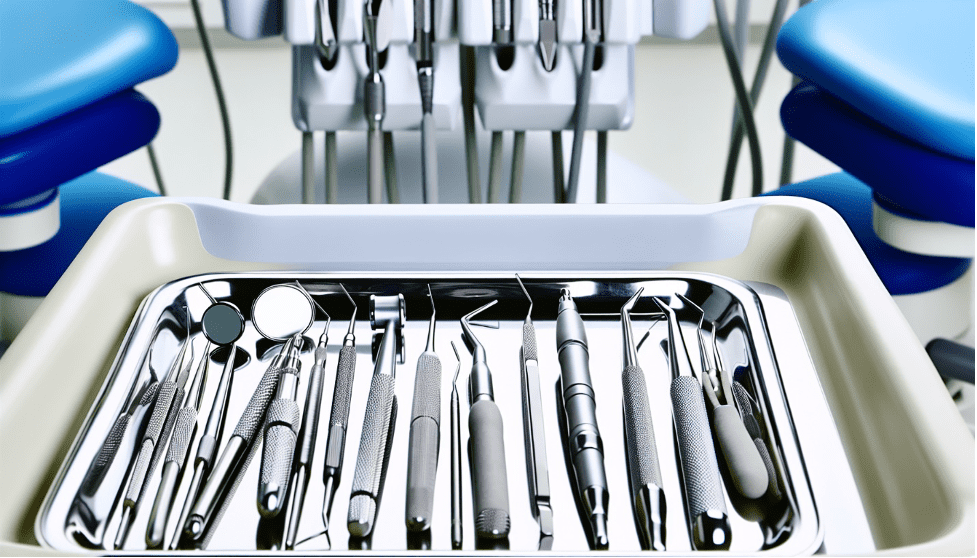

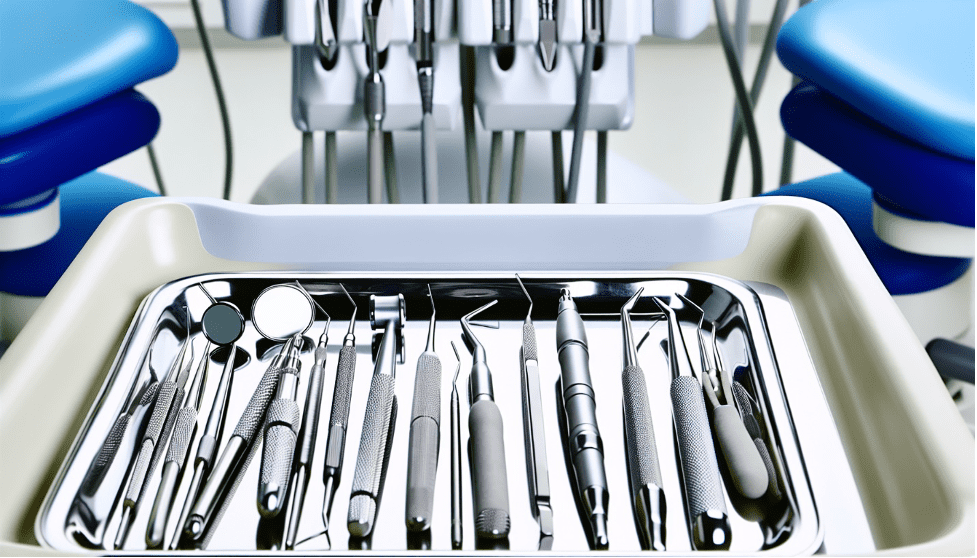

Common Dental Services Covered

Diving into the realm of dental insurance for seniors, understanding which dental services are typically covered can really help in making informed choices about coverage. Most dental plans aim to cover essential dental care services, ensuring that seniors maintain their oral health without facing overwhelming costs.

Coverage can range from preventive care to more extensive dental procedures, reflecting the specific needs of seniors. While every plan is different, there are common services that most dental insurance options aim to include.

Knowing these can guide you in picking the right plan that balances benefits and costs effectively.

Overview of Preventive Care Services

Preventive care is a cornerstone of most dental insurance plans, especially those designed with seniors in mind. These services generally include routine check-ups, cleanings, and x-rays.

By focusing on prevention, dental insurance helps seniors avoid more serious dental issues that could lead to complex and costly procedures. Preventive care not only helps maintain oral hygiene but also detects early signs of potential problems, allowing for timely interventions.

Coverage for these services is typically comprehensive, often with minimal or no out-of-pocket cost, making it an accessible aspect of dental care for seniors.

A strong emphasis on preventive services is seen across various dental plans, including those by renowned providers like Delta Dental. These services might also extend to fluoride treatments and sealants, especially for those with specific dental needs or vulnerabilities.

By regularly visiting a dentist, seniors can take proactive steps in managing their overall health. Ensuring that preventive services are fully covered can significantly lower long-term dental costs.

Moreover, many plans waive waiting periods for these services, allowing immediate access upon enrollment.

Supplemental insurance can play a critical role here, bridging gaps not covered by standard health plans or Medicare Advantage. This combination ensures that seniors don’t only react to dental issues but actively prevent them.

Integrating preventive care with comprehensive dental insurance results in a balanced approach to dental health, emphasizing early intervention.

Seniors finding themselves evaluating dental plans should check for generous preventive care coverage, as it is a substantial benefit, reducing the risk of developing more severe and costly dental issues.

Major Dental Procedures and Their Coverage

As seniors assess their dental insurance options, understanding coverage for major dental procedures becomes crucial. Major procedures typically involve significant care needs such as root canals, crowns, bridges, and even dentures.

These services are pivotal for addressing substantial dental issues that can arise due to age-related wear or previously neglected care. Dental coverage for such procedures is often more complex, with many plans covering a percentage of the procedure costs rather than the full amount.

This co-insurance model helps manage costs but requires careful planning.

Dental plans, including those from providers like Cigna Dental and Humana Extend, differ in how they handle these major procedures. Most require a waiting period before coverage kicks in, often ranging from six to twelve months.

Understanding these waiting periods and how they fit into a plan’s comprehensive strategy is vital for seniors making long-term care decisions. Costs associated with major procedures are usually higher, making insurance a valuable asset in reducing out-of-pocket expenses.

Comparing different plans’ coverage details can reveal significant differences in how major dental procedures are handled. Some plans may offer better coverage for specific procedures, so seniors should consider their unique dental history and current needs when evaluating options.

Inclusion of such procedures in their coverage can cushion financial impacts and provide peace of mind. Ultimately, having a plan that covers these extensive services adequately ensures that seniors can receive necessary treatments without financial strain, promoting long-term oral health and overall well-being.

Comparing Dental and Vision Plans

Choosing the right dental and vision plans is essential for seniors aiming to maintain their health and manage expenses effectively. Dental coverage and vision insurance each offer specific benefits tailored to seniors’ needs, including preventive care and critical procedures.

As you explore these plans, it’s vital to consider various factors such as costs, coverage scope, and the insurance company’s reputation. Understanding these elements helps in making informed decisions, ensuring that your health needs are met without surprises.

Let’s delve into the key factors to consider for dental coverage and understanding vision insurance benefits.

Key Factors to Consider for Dental Coverage

When evaluating dental plans, it’s crucial to focus on several key factors to ensure you choose the best fit for your needs. First, consider the extent of coverage each plan offers.

Dental insurance typically includes various levels of dental care, ranging from preventive services, like cleanings and exams, to major procedures such as root canals, crowns, and dentures. It’s important to understand how these are covered, many plans might offer near-full coverage for preventive care but a lower percentage for costly procedures.

The costs associated with each service can vary significantly depending on the insurance company, so checking the specifics of coverage percentages and annual limits is essential.

Waiting periods can also impact your decision. Many dental plans impose waiting periods for extensive procedures, meaning you might need to wait several months before such coverage begins. If you anticipate needing major dental work soon, consider how these waiting periods align with your immediate needs. Another factor is the dentist network associated with your chosen insurance company.

Plans often require you to use network dentists to receive full benefits, though they might allow out-of-network visits at a higher cost. Ensuring your preferred dentist is within a network can prevent unexpected expenses and facilitate smooth, long-term care.

Don’t forget to review the benefits package of each insurance plan thoroughly. This includes examining treatments covered, the services frequency limits, and any additional perks like discounts on cosmetic procedures or alternative treatments.

Understanding how these benefits align with your dental health goals can ensure that the plan you select supports your well-being comprehensively. It’s wise to compare quotes and check any supplemental insurance options that complement your existing Medicare Advantage plan, providing a more robust shield against dental expenses.