NYC Medicare Advantage Plus Plan

Navigating the complex world of healthcare may be challenging, especially for retirees in New York City. With the potential introduction of the NYC Medicare Advantage Plus Plan, it’s crucial to understand the possible ins and outs of this new offering, as it could have significant implications for New York retirees.

This article will guide you through the potential details of the plan, its Aetna contract, and how it compares to Original Medicare. By the end, you’ll be well-equipped to make informed decisions about your healthcare options.

Key Takeaways

- Some of the NYC Medicare Advantage Plus Plans may offer comprehensive coverage and additional benefits to New York retirees.

- Support from public service retirees has resulted in a Manhattan Supreme Court ruling requiring more information on the plan.

- Seniors should evaluate their potential healthcare plans, consider costs, seek expert advice, and explore senior care alternatives when navigating their healthcare choices.

Compare Plans in One Step!

Enter Zip Code

The NYC Medicare Advantage Plus Plan Explained

From January 1, 2022, the NYC Medicare Advantage Plus Plan, which may be tailored for New York retirees, may replace both traditional Medicare and a Medicare Advantage Plan.

This unified program will likely be managed by Medicare-approved administrators like Empire BlueCross BlueShield, and may aim to provide:

- Benefits that could last for a full calendar year

- Reduced cost-sharing

- Possible Rewards

The NYC Medicare Advantage Plus Plan, a part of the Medicare Advantage Program, could provide its enrollees with access to services from both in-network and out-of-network providers, possibly bringing flexibility and convenience to the healthcare experience.

Retirees need to understand the plan’s potential features and eligibility requirements.

Potential Features

Some of the NYC Medicare Advantage Plus Plans may aim to provide comprehensive coverage for retirees and their dependents. A summary of benefits will likely be available in the enrollment guide provided by the City of New York, which could detail the services that may be covered by this plan.

The plan’s provider network could ensure that retirees can have access to a wide range of healthcare services, both in-network and out-of-network.

Beyond the standard Medicare benefits, the NYC Medicare Advantage Plus Plan may offer additional benefits that might not be provided through Original Medicare. These could include:

- An annual routine physical exam

- Hearing exams

- Dental and vision coverage

These additional benefits will likely aim to enhance the overall healthcare experience for New York retirees.

Eligibility Requirements

Retirees must meet specific criteria to qualify for the NYC Medicare Advantage Plus Plan. These include age, residency, and current Medicare status. To qualify, retirees must be residents of New York and enrolled in both Medicare Parts A and B.

Fortunately, there are no health conditions or disabilities that would affect eligibility for the NYC Medicare Advantage Plus Plan.

This could ensure that a wide range of retirees may have access to the potential benefits that could be offered by this comprehensive healthcare plan.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Controversial Aetna Contract

The Aetna contract, negotiated by the Adams administration with the support of the Municipal Labor Committee, has been a topic of controversy.

While Mayor Bill de Blasio has been vocal in his support, public service retirees have expressed significant opposition, fearing that the contract will restrict their access to healthcare providers and services.

Protests, legal action, and communication with city officials are some of the methods used by public service retirees to voice their concerns about the Aetna contract.

Despite this opposition, the Manhattan Supreme Court ruling upheld the contract, allowing the city to proceed with the plan.

Mayor Bill de Blasio’s Support

Mayor de Blasio’s endorsement of the Aetna contract was motivated by the potential annual savings of $600 million and associated economic benefits for New York City.

He believes that the Aetna contract will lead to lower deductibles, capped out-of-pocket maximums, and new benefits for the city’s retirees.

Publicly expressing his support for the Aetna contract, Mayor de Blasio has been a driving force behind the push for the NYC Medicare Advantage Plus Plan.

His belief in the plan’s potential benefits for both the city and its retirees has been a key factor in its continued progression.

Opposition from Public Service Retirees

Public service retirees have voiced their concerns about the NYC Medicare Advantage Plus Plan, citing the following fears:

- Restricted access to medical providers

- Potential increases in out-of-pocket costs

- Concerns about prior authorizations

- Potential loss of pre-existing benefits

These apprehensions have prompted various groups and organizations to issue statements and position papers on the current plans.

The Manhattan Supreme Court ruling, while upholding the Aetna contract, stipulated that the city must provide retirees with additional information about the plan and its potential consequences.

This ruling has served as a reminder that any changes to retiree healthcare plans must be handled with caution and respect for the promised benefits.

Manhattan Supreme Court Ruling

The Manhattan Supreme Court has made a ruling that will prevent New York City from transferring retired employees and their elderly or disabled dependents to an Advantage plan managed by Aetna. This ruling is permanent.

The court determined that the city could not remove retirees from their current plan of traditional Medicare with supplemental coverage, as the new plan contravened administrative law and did not allow for a suitable transition for retirees.

This decision has been well-received by retiree groups, as it ruled in favor of the NYC Organization of Public Service Retirees, a grassroots organization representing retired EMTs, firefighters, and other municipal retirees.

The ruling serves as a reminder that any future changes to retiree healthcare plans must be handled with caution and respect for the promised benefits.

Implications for Retirees

The Manhattan Supreme Court ruling has significant implications for NYC retirees, as it effectively blocked the city from implementing the switch to the Medicare Advantage plan.

This ruling preserved their current healthcare coverage, ensuring that they continue to receive the benefits they were promised.

While the ruling did not directly impact healthcare services available to retirees, it did uphold their healthcare plans and prevent any changes to their out-of-pocket healthcare costs.

This decision has granted retirees peace of mind, knowing that their healthcare coverage will remain consistent.

The Municipal Labor Committee’s Role

The Municipal Labor Committee played a key role in the lawsuit, having worked in conjunction with New York City in submitting the plan to transition retired employees and their eligible dependents to the NYC Medicare Advantage Plus Plan.

They provided arguments and evidence that supported their stance, ultimately influencing the Manhattan Supreme Court’s decision.

Despite their disapproval of the NYC Medicare Advantage Plus Plan, the Municipal Labor Committee voted in favor of a public-private partnership administered by Aetna to realize the projected cost savings during the controversy over the Aetna contract.

Their involvement in the lawsuit highlights the importance of safeguarding the interests of public service retirees during such disputes.

Comparing Medicare Advantage and Original Medicare

Considering the complexity of healthcare options, understanding the differences between Medicare Advantage and Original Medicare is fundamental.

Both options could provide coverage for a broad range of services and supplies, such as hospital stays, doctor visits, preventive services, and some medical equipment.

However, certain Medicare Advantage plans may include additional benefits, such as prescription drug coverage, and dental, vision, and hearing services.

Considering the potential cost aspect, Medicare Advantage might be cheaper than Original Medicare due to the reduced cost that may come with providing benefits in certain Medicare Advantage plans.

However, comparing the potential costs and coverage of different plans may be necessary to make a choice that best suits your individual needs.

Coverage Differences

In terms of coverage, Medicare Advantage plans encompass all the benefits of Original Medicare and may extend further to include dental, vision, and fitness benefits. Some Medicare Advantage plans may also provide prescription drug coverage through Medicare Part D.

This could be an important consideration when weighing the coverage differences between the two options.

Potential Cost Considerations

When juxtaposing the possible costs of Medicare Advantage and Original Medicare, one must consider the potential:

- Premiums

- Deductibles

- Co-payments

- Out-of-pocket maximums

Additionally, the cost of prescription drugs may differ between the two plans.

The deductible for certain Medicare Advantage plans will likely differ from those of Original Medicare. Likewise, some of the co-payment costs for certain Medicare Advantage plans may vary depending on the plan and services received, while Original Medicare could have fixed copayment costs for different services.

By assessing these potential factors, one can make a well-informed decision about which healthcare plan is most suitable.

Senior Care Alternatives in New York City

Aside from the NYC Medicare Advantage Plus Plan, there could be various senior care alternatives available in New York City.

These options may provide different levels of care and support, possibly ensuring that seniors can find a suitable healthcare solution that meets their unique needs.

Among the highest-rated senior care providers in NYC may be:

- LeanOnWe

- Alvita Care

- Touching Hearts At Home

- Home Instead

- Renaissance

These providers could offer a range of services and support that could cater to the diverse needs of seniors in the city.

Provider Networks

Seniors in NYC will likely have access to various provider networks. These networks may offer a wide range of healthcare services, such as medical specialists, mental health specialists, home care services, rehabilitation services, and social services.

In addition to these provider networks, seniors in NYC may also access healthcare services through NYC Care and the geriatric services provided by NYC Health + Hospitals.

These clinics and hospitals could offer comprehensive care that may be tailored to the needs of seniors.

Possible Financial Assistance Programs

Financial assistance programs may help seniors cover some of their healthcare costs in New York City. Programs such as Medicaid and Supplemental Security Income (SSI) may provide support for eligible seniors in need of assistance.

To secure financial aid for senior care in New York City, reviewing the requirements and determining eligibility for programs such as Medicaid, Senior Citizen Rent Increase Exemption (SCRIE), and Elderly Pharmaceutical Insurance Coverage (EPIC) is necessary.

These programs could help reduce healthcare costs for seniors living at or below a certain income level.

Navigating Your Healthcare Choices

Navigating the multiple healthcare choices for seniors in NYC could be complex. To make confident decisions about your healthcare options, evaluating the potential benefits and costs of different plans and seeking advice from healthcare professionals, insurance brokers, or government agencies may be necessary.

Evaluating Possible Benefits and Costs

For an effective evaluation of the potential benefits and costs of different healthcare plans, you may want to consider factors like:

- Affordability

- Coverage

- Appeals process

- Claims history

- Deductibles

- Network details

- Premiums

- Medicine coverage

- Co-pay or co-insurance

- Additional benefits

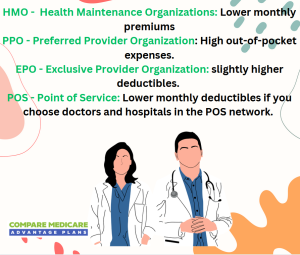

By comparing the types of health insurance plans available, such as:

HMO

HMO

- PPO

- EPO

- POS

Seeking Expert Advice

Seeking professional advice when choosing a healthcare plan could be vital, given the complexity and potential confusion of healthcare plans.

Insurance agents or healthcare advisors will likely have the necessary knowledge and expertise to assist in comprehending the various options available and guiding you toward a plan that is suited to your requirements.

Certified application counselors (CACs) in the Federally facilitated Marketplaces (FFMs) could guide members in comprehending and utilizing healthcare plans.

By seeking the help of these professionals, you can navigate the enrollment process and ensure that your healthcare needs are met. Call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Summary

Understanding the potential NYC Medicare Advantage Plus Plans and their possible implications for New York retirees is crucial. With the controversial Aetna contract, the Manhattan Supreme Court ruling, and the comparison between Medicare Advantage and Original Medicare, it’s essential to stay informed about your healthcare options.

By evaluating the potential benefits and costs of different plans and seeking expert advice, you can make the best decision for your healthcare needs. Remember, staying informed and proactive is the key to ensuring a healthy and secure future.

Frequently Asked Questions

→ What is the difference between Medicare and Medicare Advantage Plus?

Medicare will likely provide hospital and doctor visits, while some of the Medicare Advantage Plus plans may provide those services and might include additional benefits such as routine dental, vision, and hearing care, and prescription drug coverage.

→ What is happening with the NYC retiree’s health plan?

Judge Frank has permanently enjoined NYC from removing Medicare-eligible retirees and their dependents from their current health plans and from requiring them to enroll in Aetna Medicare Advantage.

As a result, all current health plans remain in effect and no retiree will be moved into the new plan.

→ What was the court decision on Medicare Advantage in NYC?

The Manhattan Supreme Court judge issued a ruling that permanently prohibited New York City from switching retired employees and their elderly or disabled dependents to the Medicare Advantage plan managed by Aetna.

→ How do I opt out of Medicare Advantage Plus NYC?

To opt out of the NYC Medicare Advantage Plus Plan, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

→ What are some of the senior care alternatives available in New York City?

Some of the senior care alternatives in New York City may include provider networks, clinics, hospitals, and financial assistance programs that could be designed to meet seniors’ needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.

HMO

HMO