Choosing the right Medicare supplement, also known as a Medigap policy, can significantly impact your experience with original Medicare by either reducing your financial risks or introducing potential drawbacks based on your needs and lifestyle. Medigap insurance works alongside original Medicare, offering supplemental coverage for costs like deductibles, coinsurance, and copayments that aren’t fully covered by your primary plan. However, understanding both the advantages and limitations of Medigap plans is crucial, as factors such as premiums, benefit consistency, flexibility, and coverage exclusions can influence your overall satisfaction. Knowing who benefits most from Medicare supplement insurance and being aware of possible drawbacks can empower you to make choices that best align with your long-term health, coverage needs, and financial outlook.

Who Might Benefit Most From a Medicare Supplement

Medicare supplement insurance, commonly referred to as a Medigap policy or Medicare supplemental plan, is specifically designed to fill the gaps left by original Medicare. For many seniors, this additional coverage can greatly reduce anxiety about budgeting for healthcare expenses, particularly when it comes to unforeseen hospitalizations, ongoing specialist visits, or extended care requirements.

Individuals who benefit the most from a Medigap policy are those who want steady, reliable coverage and minimal financial uncertainty. Because Medigap plans standardize their benefits, meaning each lettered plan (such as Plan G or Plan N) provides the same coverage regardless of the insurer, seniors can confidently choose a Medigap plan based on their unique financial expectations and personal health requirements, without worrying about coverage inconsistencies. The greatest beneficiaries of Medicare supplement insurance tend to be those with significant or unpredictable health needs.

If you see doctors frequently, require specialist care, or have chronic illnesses, the out-of-pocket costs with original Medicare alone can quickly add up. Medigap policyholders enjoy the benefits of robust supplemental coverage, which absorbs hospital coinsurance, outpatient coinsurance, and even some excess charges not covered by original Medicare. For instance, suppose you need multiple procedures or hospital stays in a given year; your Medicare supplement will provide peace of mind by picking up where original Medicare leaves off, reimbursing or even directly covering permissible gaps. This makes the plan especially valuable to those who want to manage their annual healthcare costs with greater precision and predictability.

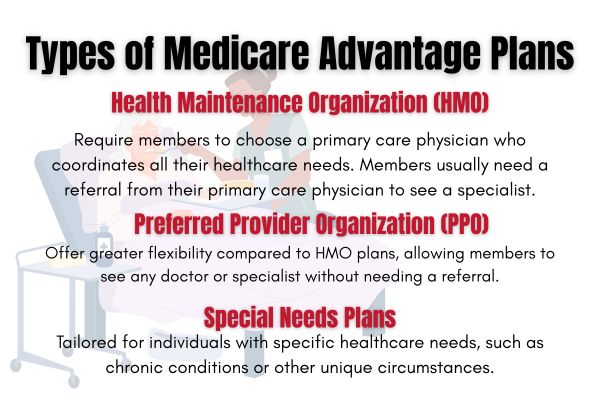

Another key group that may benefit most from a Medigap policy are those who appreciate flexibility in choosing healthcare providers. Unlike many Medicare Advantage plans, which typically require network compliance and referrals, most Medigap policies allow you to visit any doctor or hospital nationwide that accepts Medicare. This is an often-overlooked benefit for retirees who travel seasonally or live in multiple states during the year. The guarantee of provider choice can be especially important if you have trusted specialists or need access to renowned medical institutions outside your primary state of residence. This nationwide portability of benefits is a hallmark of Medigap coverage and a prime reason why certain individuals prefer it over Medicare Advantage alternatives.

Financially, those who value long-term cost stability are ideal candidates for Medigap insurance. While these plans require a monthly premium on top of the original Medicare Part B premium, the assurance that additional hospital costs, coinsurance, and certain deductibles are handled can help avoid budget surprises. Seniors with greater financial means, or those who value predictable, fixed costs over the risk of large, variable expenses, may see a Medigap policy as a worthy investment in their peace of mind.

The absence of high annual out-of-pocket responsibilities commonly associated with some Medicare Advantage plans is a deciding factor for many. It’s also important to recognize the non-financial benefits that Medigap policies provide. Many insured individuals find value in the straightforward nature of these plans. You don’t need to file as many claims or deal with complex, tiered copayment systems. Coverage typically starts automatically after original Medicare pays its share, streamlining reimbursement and reducing paperwork. For seniors who desire a simple, reliable plan, these benefits can spare much of the usual administrative hassle associated with health insurance management.

However, not everyone will benefit equally from a Medigap plan. Those with limited financial resources, or who rarely need healthcare outside of preventive care, might prioritize lower up-front costs and consider Medicare Advantage for its additional benefits and integrated drug coverage instead. Still, if you’re concerned about hospital and doctor bills, especially for ongoing or unpredictable conditions, the right Medigap policy can be an indispensable safety net. Ultimately, the most significant advantage of having supplemental coverage through a Medigap plan is the ability to safeguard your retirement savings and maintain continued access to high-quality healthcare without unexpected bills undermining your financial stability.

With guidance from CompareMedicareAdvantagePlans.org, you can compare available Medigap plans, evaluate their specific benefits, review policies from leading insurance companies, and confidently decide if a Medigap policy aligns with your health outlook and lifestyle. Whether you’re most concerned about hospital bills, flexibility in provider choice, or ensuring steady benefits as healthcare needs change, a Medicare supplement plan’s coverage can be tailored to provide lasting protection for years to come.

Supplemental Coverage: Filling the Gaps in Original Medicare

Navigating the world of Medicare can be overwhelming, especially when trying to bridge the coverage gaps left by original Medicare. While original Medicare (Part A and Part B) provides foundational health benefits, many people are surprised by the out-of-pocket costs that remain, such as copayments, deductibles, and coinsurance. That’s why supplemental coverage, in the form of Medigap or Medicare supplemental insurance, has become an essential consideration for those wanting greater financial security. This segment explores key distinctions between Medigap plans and Medicare supplemental policies, clarifying how they fit within the broader Medicare landscape and how to choose the best fit for your personal needs.

The Differences Between Medigap Plans and Medicare Supplemental Policies

When discussing supplemental coverage within the Medicare system, two terms often surface interchangeably: Medigap plans and Medicare supplemental policies. It’s essential to recognize that Medigap, Medicare supplement, and Medicare supplemental insurance all refer to the same type of insurance product. These plans work in tandem with original Medicare to help fill remaining gaps in coverage, such as deductibles, coinsurance responsibilities, and copayments that are not fully covered by standard Medicare parts A and B. By addressing these out-of-pocket costs, Medigap aims to provide beneficiaries with a smooth, predictable health insurance experience.

Medigap policies are standardized insurance offerings sold by private companies and regulated by both federal and state agencies. These plans are designed to complement your original Medicare coverage, not replace it. Each Medigap policy, regardless of the insurance company, follows the same set of standardized benefits defined by the government for that specific plan letter (such as Plan G or Plan N). These benefits can include coverage for hospital coinsurance, skilled nursing facility coinsurance, and sometimes excess charges for medical services. The real benefit is the peace of mind that comes from knowing your hospital stays, doctor visits, and even some emergency care won’t result in substantial surprise bills.

The insurance expert perspective emphasizes how these policies work seamlessly with original Medicare, ensuring no interruption of your basic health coverage while efficiently handling leftovers like coinsurance and deductibles. Unlike Medicare Advantage plans, which are broader, stand-alone health insurance plans that replace original Medicare and often introduce their own networks, coverage rules, and additional benefits, Medigap plans are only available to beneficiaries already enrolled in both Medicare Part A and Part B. With Medigap, your insurance coverage is secondary: original Medicare pays its approved portion first, and then your policy picks up eligible leftover costs according to the policy’s defined benefits.

Since the benefits are standardized, it’s easy to compare plans: Plan G from one insurance company offers the same Medigap coverage and benefits as Plan G from another, though premiums may differ. Medicare supplement or supplemental coverage doesn’t typically include dental, vision, hearing, or prescription drug coverage. For those extras, separate plans or standalone Part D drug coverage are required. This is an important distinction, as Medicare Advantage plans may combine such additional benefits with your basic health insurance. The focus of Medigap coverage remains squarely on filling gaps in original Medicare, not on bundling “extras.”

The advantage here is flexibility: your Medigap plan works nationwide with any provider that accepts Medicare, meaning your coverage and benefits are not tied to a specific network or area. Another core distinction for supplemental coverage relates to costs. Medigap plans involve a monthly premium paid in addition to your Medicare Part B premium. The policy premium varies based on factors like age, location, tobacco use, and the insurance company’s pricing structure. However, after paying your premium, your share of healthcare costs for covered services is often minimal, since the policy typically absorbs most coinsurance and deductible requirements. This is especially valuable for those who prioritize predictable health expenses and a straightforward plan design.

Medigap insurance is also guaranteed renewable as long as the premium is paid, providing long-term security. Policyholders don’t face coverage cancellation due to worsened health conditions, a significant benefit when compared with other types of private health insurance. This guarantee, combined with standardized benefits and free provider choice, distinguishes Medigap as a strong supplemental coverage solution.

In summary, Medigap plans and Medicare supplemental policies are essentially synonymous, focusing on plugging the gaps left by original Medicare coverage by providing predictable benefits, standardized policy choices, and national flexibility. Individuals considering supplemental coverage should weigh their personal health, financial stability, and preferences for provider choice and predictability before selecting a policy. With resources like CompareMedicareAdvantagePlans.org, you can easily compare Medigap plans, benefits, costs, and even enroll online or seek advice from licensed insurance experts , putting you in full control of your health coverage path as Medicare evolves.

Using This Website to Compare Plans, Benefits, and Costs in Your Area

When it comes to selecting the right Medicare coverage, whether it’s a Medigap policy or a Medicare Advantage plan, having clear, accurate tools for comparison is crucial. At CompareMedicareAdvantagePlans.org, you’ll find comprehensive resources to evaluate both benefits and costs, as well as access up-to-date coverage options tailored for your location. Our platform empowers you to compare insurance policies, assess their unique coverage details, explore diverse plan benefits, and gauge true annual expenses for every Medicare solution, including the robust offerings of Humana Medicare Advantage plans for 2026. By using our online tools, you can confidently identify the right plan, initiate enrollment online, and get expert support as needed, ensuring every Medicare part and policy fits your health and budget priorities.

Online Tools for Evaluating and Enrolling in the Right Plan

Digital platforms have revolutionized how Americans explore their Medicare insurance options, making it easier than ever to compare plans, benefits, coverage, and costs, all from the comfort of home. CompareMedicareAdvantagePlans.org leads with an intuitive suite of online tools specifically crafted to address the complexity of evaluating Medigap, Medicare Advantage, and Part D prescription drug plans. By utilizing these online resources, you gain real-time insights into the insurance landscape, ensuring you select the right plan that truly fits your healthcare needs and financial situation.

Our comparison tools begin by letting you enter basic details, such as your zip code, age, and Medicare eligibility, so you instantly access plans available in your area. This location-specific approach means you’ll see both Medigap and Medicare Advantage options, complete with precise costs, policy features, and coverage maps, reflecting what’s relevant to your home region or any place you might travel. Visitors can immediately compare the benefits provided by Medigap insurance versus the bundled services found in Advantage plans, such as prescription drug coverage, dental benefits, vision, and even wellness extras. These interactive features encourage side-by-side assessments, allowing you to appreciate the nuanced differences in coverage and benefits that would otherwise require hours of manual research.

When evaluating Medigap plans, our online platform highlights key aspects like guaranteed renewability, standardized plan benefits, and premium ranges from various top-rated insurance companies. You can sort policies by cost, policyholder ratings, or specific coverage needs, such as wanting a plan that covers most of your coinsurance and deductibles or one with a lower monthly premium. The transparency in pricing and the breakdown of what each Medigap plan covers (and does not cover) give you the confidence to select supplemental insurance that matches your expectations, eliminating the guesswork around ongoing or unexpected medical costs.

For those considering Medicare Advantage, our evaluation tools clarify which plans include prescription drug coverage (Part D), which offer extra perks like transportation and telehealth, and the provider networks you’ll be required to use. A simple comparison grid visually contrasts monthly premiums, annual out-of-pocket maximums, benefits for each plan part, and even enrollment incentives from major insurers, including Humana and others. If prescription medication is a priority, you can search for plans by coverage of specific drugs or overall pharmacy benefits, ensuring the advantage policy aligns with your prescription needs and cost expectations.

Understanding the costs of your selected coverage is vital. Our cost calculator combines plan premiums, expected out-of-pocket expenses, and Part D estimates, providing you with a true total annual cost projection for either a Medigap or Medicare Advantage choice. This empowers visitors to go beyond promotional prices and scrutinize every potential cost factor, from specialist copays to hospital stay deductibles, letting you budget each year confidently. Plans are ranked not just by cost, but by depth of benefits, coverage of risky gaps, and real user reviews, a comprehensive view crucial to making a smart policy decision.

Enrolling in the right plan has never been simpler thanks to our seamless online enrollment feature. Once you’ve compared your options, you can begin the application process directly from our site, no paperwork, no unnecessary delays. Submit your enrollment securely online, choose your preferred start date, and receive instant confirmation that your coverage is on track. Should you have questions during evaluation or enrollment, licensed insurance agents are one click or call away. These experts help clarify any confusion regarding plan parts, coinsurance responsibilities, or coverage limitations, and their guidance ensures you won’t accidentally miss any key coverage or cost concern.

Ultimately, CompareMedicareAdvantagePlans.org is more than a policy search engine; it’s a robust support system for seniors, caregivers, and anyone navigating Medicare decisions. By integrating advanced online tools, clear cost projections, and personalized insurance advice, we ensure you aren’t left to navigate the maze of benefits, coverage options, and policy costs alone. Instead, you’re empowered to compare, evaluate, and finally enroll in the plan that secures your health and your wallet, well into the future. Every Medicare part, plan, policy, and benefit is explained and compared transparently, letting you choose with confidence and clarity.

Choosing between Medigap and Medicare Advantage ultimately depends on your healthcare needs, budget, and personal preferences. By understanding the key differences and benefits of each option, you can make a more informed decision for your future. If you’d like assistance, CompareMedicareAdvantagePlans.org offers easy-to-use comparison tools and access to licensed agents who can answer your questions and help guide you through the enrollment process. Make the most of your Medicare coverage by exploring your options thoroughly and selecting the plan that aligns with your priorities and provides the peace of mind you deserve.