Comparing Medigap, Medicare Advantage, and Supplement Plans

Navigating the world of Medigap, Medicare Advantage, and other supplement plans can feel overwhelming due to the variety of coverage options, insurance terms, and cost structures involved. Understanding the differences between these plans, as well as how to evaluate their premiums and benefits, is the key to making well-informed choices about your healthcare protection and out-of-pocket expenses.

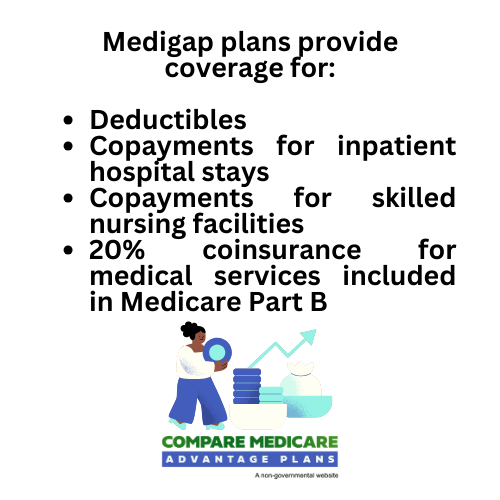

These insurance options are designed to fill different roles. Medigap plans help with expenses not covered by Original Medicare, while Medicare Advantage plans offer comprehensive, bundled alternatives.

By exploring plan costs, premiums, and supplemental coverage side-by-side, you’ll be able to identify the solution that best matches your medical needs, budget, and lifestyle goals. Our website offers robust tools to assist you in this crucial comparison process, whether you’re examining average Medigap plan costs, shopping for the best supplement policy, or vetting Medicare Advantage options in your area.

Using Our Website to Explore Plan Premiums and Benefits in Your Area

When you’re considering different types of Medicare coverage, whether it’s Medigap, a Medicare Advantage plan, or another type of supplement plan, having a clear and direct comparison of the policies available in your area is essential to finding the right fit.

CompareMedicareAdvantagePlans.org is specifically designed to put all the details you need at your fingertips. You can seamlessly browse Medigap plans and their monthly premiums, compare the full range of supplement plans, and evaluate which solutions offer the blend of insurance coverage and plan cost that matches your budget.

To begin, simply enter your ZIP code on our website to access up-to-date rates and coverage information tailored to your location. Local rates can significantly impact the monthly premiums you’ll pay, and since insurance companies base Medigap costs and supplement plan pricing on geographic factors, this real-time, area-specific information is crucial.

Our site shows you not only the range of average costs for Medigap insurance in your region but also the specific monthly premium amounts from leading insurance providers. This gives you the ability to directly compare plan premiums, view deductible details, and see both high-coverage and budget-friendly supplement plan options side by side.

Our online tools break down each Medigap plan by type, Plan G, Plan N, high-deductible options, and more, so you can assess exactly what each policy covers and how much it will cost monthly. You’ll find clear details about the coverage included under each plan, such as copayment and coinsurance coverage, deductible limits, and any extra benefits. This helps you determine whether paying a slightly higher premium for a more comprehensive supplement plan makes sense for your needs, or if a lower-cost plan with higher deductibles might be better suited to your expected healthcare usage.

Each policy is presented with its unique plan cost, monthly premium, deductible, and total expected out-of-pocket costs within a standardized comparison chart. This makes it easy for you to compare the benefits of various Medigap plans and other supplement policies quickly, without missing out on crucial differences that might impact your budget or coverage down the road. Plus, by using our cost-calculator tools, you can estimate your total annual premiums based on your specifics, age, gender, tobacco use, and desired coverage tier, giving you a highly personalized view of what your insurance might cost.

You’re never limited to just Medigap plans. Our platform also lets you see how Medicare Advantage plans compare, factoring in premiums, deductibles, and extra perks like drug coverage or dental and vision.

Understanding these differences is vital, since Medicare Advantage plans commonly bundle various benefits, often with different plan premiums or cost-sharing structures, while Medigap policies help specifically with the gaps in Original Medicare coverage.

Use the comparison features to weigh supplement plans against one another, ensuring you know exactly how each plan stacks up in terms of coverage, insurance reliability, policy costs, and plan premiums.

If you ever get stuck or have in-depth questions about plan cost, benefits, or Medigap policy choices, our network of licensed insurance agents is available to assist. You can reach out through the platform for expert, unbiased advice at no extra cost. Agents can help you interpret monthly premiums, uncover hidden costs, weigh deductible differences, and pick the supplement plan that fits your needs and budget.

There’s no obligation to enroll just by browsing; you’re in full control of your decision every step of the way.

Ultimately, using CompareMedicareAdvantagePlans.org empowers you to make truly informed decisions about Medicare supplement coverage.

Our website takes the guesswork out of comparing plan premiums, calculating average cost, and understanding what each supplement or Medigap policy will provide in return for your monthly investment. Whether you need a quick quote, a deep dive into coverage and policy benefits, or you’re ready to enroll online, our resources seamlessly guide you from shopping to selection with confidence and clarity.

Start your search for supplement plans today and take advantage of real-time insights and expert support, all focused on helping you manage your Medicare coverage, insurance costs, and healthcare security for the future.

Tips for Reducing Medigap Expenses and Getting the Best Value

Finding practical ways to reduce your Medigap expenses while still securing robust supplemental insurance coverage can make a real difference in your overall healthcare budget. Reviewing plan costs, comparing policy options, and evaluating monthly premiums are only the first steps, but the path to true savings often involves a blend of expert advice, strategic enrollment, and careful timing.

Savvy consumers take advantage of every cost-saving opportunity, from household discounts to leveraging comprehensive comparison tools. Learn how to minimize premiums, maximize deductible efficiency, and combine available resources for the best value, all while maintaining the high-quality coverage you deserve.

Expert Advice on Supplemental Insurance and Enrollment Assistance

Securing the most value from your Medigap, also known as Medicare Supplement insurance, begins with understanding not only plan costs but the underlying factors that influence monthly premiums, deductibles, and overall policy expenses.

As an insurance expert with CompareMedicareAdvantagePlans.org, I’ve seen firsthand how effective strategies and expert guidance can lead to substantial savings. The process typically begins with a holistic analysis of your unique medical needs and anticipated healthcare usage, medical history, recurring prescriptions, upcoming procedures, or the frequency of doctor’s visits ,all play a pivotal role in selecting the right supplement plan. Unlike a one-size-fits-all approach, customizing your coverage means you’re less likely to pay for benefits you won’t use, keeping unnecessary expenses in check.

The timing of your Medigap enrollment is one of the most overlooked aspects of reducing plan costs and premiums. For most people, the best time to enroll in a Medigap policy is during your six-month Medigap Open Enrollment Period, which starts the month you turn 65 and enroll in Medicare Part B. In this window, you enjoy guaranteed issue rights, insurers can’t deny coverage, impose waiting periods for pre-existing conditions, or charge higher plan premiums due to health status.

Missing this enrollment window could result in higher premiums, stricter underwriting, or even declined applications. This timing advantage alone can yield long-term savings, so monitoring your eligibility and acting proactively is vital to minimizing both short-term and lifetime Medigap expenses.

Expert advice from licensed insurance agents can illuminate supplemental insurance options that you may otherwise overlook. For example, some companies offer premium discounts for non-smokers, multiple policies in a single household, or setting up automatic bank payments.

Others may reduce monthly premiums if you pay annually, rather than monthly. These are nuanced details that an expert understands and can calculate, likely going unnoticed if you’re comparing supplement plans on your own. Our website, CompareMedicareAdvantagePlans.org, enables you to view up-to-date premiums in your area, compare deductible limits, and see which plans offer the most robust coverage for your budget.

Comparing multiple supplement policies is central to finding the best value. Plan costs fluctuate not just with plan type, such as Plan G versus Plan N, but based on your state, zip code, gender, age, and, for some providers, current health.

With our online tools, you can enter specific details and immediately see which Medigap policies offer the lowest monthly premiums for the coverage you need. This transparency helps you avoid overpaying, especially as different insurers can charge vastly different rates for identical coverage.

Some plans have higher deductible amounts with lower premiums, which could appeal to healthier individuals who expect fewer claims; others may cost more per month but save you money during a year with unforeseen medical needs.

Assessing your total costs means considering more than just the advertised “premium.” Factor in expected deductible outlays, copayments, coinsurance responsibility, and any potential rate increases based on the insurer’s pricing structure, community-rated, issue-age, or attained-age.

Comparing Medigap, supplement plans, and even Medicare Advantage on a single dashboard clarifies which policy delivers the best premium-to-coverage ratio and helps you avoid underinsurance or unnecessary premium payments.

Don’t forget that your needs may change, so periodic re-evaluation with the help of licensed experts can lead to additional savings down the line by switching to more cost-effective policies or taking advantage of new plan discounts that become available in your area.

Enrollment assistance is especially valuable for those who may not feel comfortable navigating plan cost comparisons or confusing Medicare Supplement insurance details on their own. At CompareMedicareAdvantagePlans.org, you can connect with knowledgeable, unbiased agents who analyze your unique situation and recommend options that balance premium costs and comprehensive coverage.

Our goal is always to help you find an affordable Medigap plan without sacrificing the benefits you need. We also walk you through online enrollment, answer questions about deductibles or premiums, and ensure all paperwork is accurate, so you avoid missing deadlines or facing unexpected policy changes.

Ultimately, the key to reducing Medigap expenses and securing the best supplement plan value is combining technology-driven comparison tools, insightful expert advice, and proactive enrollment strategies. Start your journey to optimal savings at CompareMedicareAdvantagePlans.org by comparing plan premiums, deductible levels, and supplemental coverage options.

Use expert insights, available free of charge, to understand every cost factor, minimize unnecessary expenses, and lock in a Medigap policy that aligns with both your health priorities and your budget for the years ahead.

Understanding the average costs of Medigap insurance is the first step toward making an informed decision about your healthcare coverage. By comparing options in your area, you can find a plan that fits both your needs and your budget.

Use our free comparison tool to review Medigap plans, benefits, and prices easily. If you have questions or need assistance, our licensed insurance agents are ready to help you navigate your choices and make the best selection for your situation. Secure your healthcare future today by exploring personalized Medigap insurance rates.