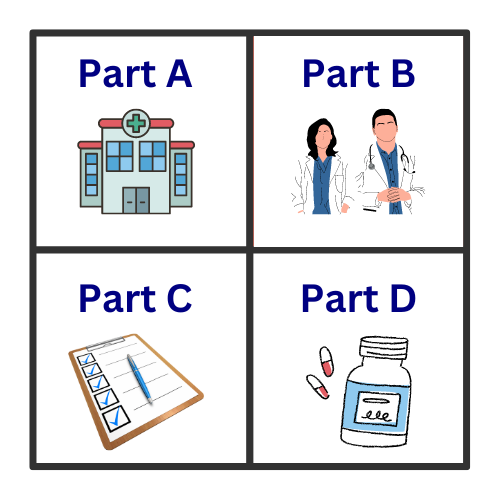

What is a Medicare Supplement Plan?

Medicare Supplement Plans, also known as Medigap, help fill gaps in Original Medicare coverage. They cover out-of-pocket costs like copayments and deductibles that Medicare Parts A and B don’t cover.

Having a Medicare Supplement means you can see any doctor who accepts Medicare, providing flexibility in care choices. These plans are offered by private insurance companies and designed to work alongside Original Medicare to minimize unexpected medical expenses. Knowing the role and benefits of Medicare Supplements can significantly ease worries about health costs.

Role of Medicare Supplement Insurance

Medicare Supplement Insurance, commonly referred to as Medigap, plays a crucial role in bridging the financial gaps left by Original Medicare. While Medicare Parts A and B cover a broad range of healthcare services, they don’t pay for everything, leaving beneficiaries responsible for significant copayments, coinsurance, and other out-of-pocket costs. This is where a Medicare Supplement plan shines by covering these additional expenses, offering peace of mind and predictable healthcare costs.

For instance, when you visit a doctor or a specialist, Medicare Part B might cover only 80% of the Medicare-approved amount. The remaining 20% is left to you, which can become quite costly, especially if you have frequent doctor visits or require specialized care. A Medigap plan helps cover that 20% coinsurance, ensuring you don’t have to worry about financial strain when accessing necessary medical care.

Moreover, a Medigap policy can cover other costs, such as the Part A deductible, which can be substantial if you face a hospital stay. By paying this deductible, your Medigap plan alleviates concerns about unplanned expenses during hospitalization. For seniors managing chronic conditions or planning for the unexpected, this layer of financial support proves invaluable.

Medigap plans also offer standardization. This means that regardless of which insurance company sells the policy, the benefits of each plan type remain the same. For example, Plan G provides identical benefits across different insurers, making it easier to compare costs and select a policy that fits your healthcare needs without confusion.

It’s important to note that while Medigap plans offer substantial coverage for out-of-pocket expenses, they do not typically cover long-term care, vision, dental, hearing aids, or private-duty nursing.

Understanding what each plan covers and does not cover is essential for making well-informed decisions about your healthcare coverage. Resources like MedicarePlansResource.org help simplify this information, offering seniors and caregivers a clear view of Medigap benefits and helping them navigate these choices confidently.

Explaining Medigap in Simple Terms

Medigap can sound complicated, but breaking it down makes it easier to understand.

At its core, Medigap, or Medicare Supplement Insurance, helps you manage costs that Original Medicare leaves behind. Think of it as a safety net. When Medicare pays its share for covered services, Medigap picks up the differences, reducing the out-of-pocket expenses you’d normally face.

Medicare doesn’t pay for everything. For instance, there are costs like deductibles, amounts you need to pay before Medicare starts covering payments. Medigap plans can help with these deductibles.

There’s also coinsurance, where you’re responsible for a percentage of the costs for a service. Again, Medigap steps in to cover those costs.

Medigap plans are labeled with letters – like A, B, C, D, F, G, K, L, M, and N. Each one offers a different level of coverage, but the benefits of any letter are the same no matter which company sells it.

So, a Plan F sold by one company provides the same basic benefits as a Plan F from another. This standardization makes comparing Medigap plans simpler since you’re essentially comparing price and customer service offerings, not different sets of benefits.

Here’s a simple example: if you have a Plan G, your Medigap plan will handle most of your excess charges after Original Medicare. This means you won’t pay separately for copays at the doctor’s office beyond your Medigap premiums. Many seniors find this predictability comforting as it transforms unpredictable health costs into a manageable monthly expense.

Understanding Medigap includes knowing what it doesn’t cover. Long-term care, vision, and dental care are not part of Medigap benefits, so plans for these services need to be considered separately. Fortunately, resources are available to guide you in exploring options that provide fuller health coverage.

Ultimately, Medigap is about removing the stress of unexpected health bills, letting you focus on what matters most, staying healthy and enjoying life. Consider exploring more detailed guides and tools available at MedicarePlansResource.org. They can clarify Medigap options further, ensuring you choose confidently and wisely.