Extra Benefits in Medicare Advantage

Medicare Advantage plans often include wellness services like gym memberships, fitness programs, and transportation to medical appointments. These additional benefits promote healthier lifestyles and ensure access to essential services.

Many Medicare Advantage plans also cover:

- Dental services

- Vision services

- Hearing services

These are services that Plan G does not cover. This comprehensive coverage makes Medicare Advantage a compelling choice for those seeking extensive healthcare benefits.

Standard Coverage in Plan G

Medicare Plan G covers essential medical costs, including:

- Medicare Part A coinsurance

- Hospital costs

- The first three pints of blood

- Skilled nursing facility coinsurance

- Hospice care coinsurance

- The Part A deductible

This coverage fills coverage gaps in basic coverage, original medicare coverage.

While Plan G provides comprehensive coverage for many medical services, it lacks additional benefits like dental, vision, and hearing coverage. Recognizing these limitations is crucial for making an informed decision about your health insurance coverage.

Suitability Based on Health Needs

Choosing the right Medicare plan depends on your unique health needs. Chronic conditions, frequency of medical care, and overall health status are crucial factors in determining whether Medicare Advantage or Plan G is the best fit. Evaluating these factors will help you make an informed decision aligned with your healthcare needs and lifestyle.

Chronic Conditions and Special Needs

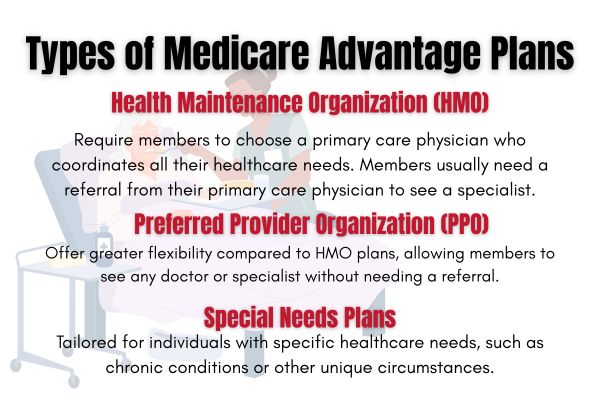

Medicare Advantage Special Needs Plans (SNPs) provide tailored care for individuals with specific chronic conditions or low incomes, offering comprehensive care coordination and additional services to meet their unique needs.

SNPs can include extended hospital stays and other targeted benefits, ensuring individuals with severe or chronic health issues receive appropriate care and support.

Frequent Medical Care

For individuals requiring frequent medical services, Medicare Plan G may be more advantageous due to its comprehensive cost coverage. It minimizes out-of-pocket expenses, making it a reliable option for those with ongoing healthcare needs.

The predictable financial structure of Plan G helps beneficiaries manage their healthcare costs effectively, making it a superior choice for those needing regular medical care.

Lifestyle Considerations

Lifestyle factors, such as travel habits and living location, significantly influence the choice between Medicare Plan G and Medicare Advantage. Recognizing how these factors affect your healthcare coverage is essential for making an informed decision.

Evaluating these lifestyle considerations will help you choose the plan that best aligns with your needs.

Travel and Out-of-State Coverage

For frequent travelers, Medicare Plan G offers nationwide provider access, ensuring healthcare services anywhere in the country. This flexibility benefits those who split their time between states or travel regularly for work or leisure.

Medicare Advantage plans may have the following limitations and alternatives:

- May limit out-of-state coverage.

- Some plans may not cover services outside your home state, which can be a significant drawback for frequent travelers.

- In such cases, a Medigap plan like Plan G ensures you receive necessary care without coverage gaps.

Urban vs. Rural Living

The availability and suitability of Medicare plans can vary significantly based on whether you live in an urban or rural area. In rural counties, the average Medicare beneficiary has access to around 27 Medicare Advantage plans, showing substantial growth in availability. However, this number is still lower compared to urban areas, where more options are typically available.

Rural residents may find fewer healthcare providers participating in Medicare Advantage networks, which can limit their access to care. In contrast, urban dwellers often have more choices and easier access to a broader range of providers. Understanding these geographic differences is crucial for selecting a plan that meets your healthcare needs.

Can You Switch Between Plans?

Switching between Medicare Advantage and Plan G is possible, but must be done during specific enrollment periods. The annual open enrollment period from October 15 to December 7 is the primary time when you can make these changes. It’s essential to understand the rules and potential challenges associated with switching plans to ensure a smooth transition.

Medical underwriting can be a significant barrier when switching from Medicare Advantage to Plan G, especially if you have pre-existing conditions. Conversely, moving from Plan G to Medicare Advantage requires ensuring eligibility and understanding coverage limitations.

Switching from Medicare Advantage to Plan G

One of the main reasons individuals switch from Medicare Advantage to Plan G is the desire for more provider choice and less hassle with preauthorization requirements. However, switching may involve challenges due to medical underwriting rules. It’s essential to be aware of these potential obstacles and plan accordingly.

When you switch from a Medicare Advantage plan to Original Medicare, you will need to sign up for Medicare Part D for prescription drug coverage. It’s important to do this at the same time. This ensures continuous coverage and avoids any gaps in your healthcare benefits.

Switching from Plan G to Medicare Advantage

To move from Plan G to a Medicare Advantage plan, you need to ensure you are eligible and reside in the plan’s service area. Additionally, be aware that Medicare Advantage plans may not cover certain deductibles or copayments from your previous Medigap policy.

Understanding these factors is crucial for a smooth transition and avoiding unexpected costs.

Consulting an Expert

Navigating the complexities of Medicare can be challenging, and consulting a licensed Medicare agent can help you make informed decisions. A knowledgeable advisor can provide insights into the various Medicare options and help you avoid costly mistakes.

Finding the right insurance company advisor involves considering their experience with Medicare plans and their ability to provide ongoing support. Recommendations from friends or family can lead you to trustworthy professionals who can guide you through the Medicare landscape.

Finding the Right Insurance Advisor

A reputable insurance advisor should be knowledgeable about the various Medicare options and have a good track record of helping clients find the best plan for their needs. Consulting a licensed insurance agent is crucial to navigate the choices between Medicare Plan G and Medicare Advantage.

When choosing an advisor, ask about their experience with Medicare plans, any certifications they hold, and the types of plans they recommend most often. This will ensure that you receive expert advice tailored to your specific healthcare needs.

Questions to Ask Your Advisor

When consulting an insurance advisor, it’s essential to ask the right questions to ensure they are well-suited to help you with your Medicare decisions. Inquire about their experience with Medicare plans similar to your needs and their fee structure, as different advisors may have varying compensation models.

Additionally, ask what services beyond enrollments the advisor provides, as ongoing support can enhance your understanding of coverage options. Transparency and impartiality are crucial qualities to look for in an advisor, as their guidance can significantly influence your Medicare plan choices.