Understanding Prescription Drug Coverage

Prescription drug coverage is a critical aspect of selecting the right Medicare prescription drug plan. Medicare plans must provide a formulary listing covered drugs, helping beneficiaries understand their prescriptions benefits. The Annual Notice of Change letter often includes a summary of the formulary, helping beneficiaries stay informed about their covered drugs.

In 2026, the new out-of-pocket cap for prescription drugs under Medicare Part D will be $2,100, providing significant financial protection for beneficiaries. Additionally, the expected average total premium for standalone Part D prescription drug plans is projected to fall to $34.50 in 2026, offering some cost relief.

Medicare plans have a timeframe of 72 hours to make a decision if a drug is not on their formulary, with 24 hours for expedited reviews. This ensures timely decisions regarding prescription drug coverage, maintaining access to necessary medications.

Special Enrollment Periods

Special enrollment period allows beneficiaries to alter their Medicare plans due to significant life events. Certain people, such as those who qualify for special enrollment, can change their plans outside of the annual enrollment period. Beneficiaries can switch to a five-star plan at any time during the year, providing flexibility in choosing higher-rated coverage.

The enrollment period for five-star plans starts on December 8, allowing beneficiaries to switch if desired. Additionally, if a beneficiary was incarcerated and continued to pay for Medicare coverage, they can enroll in a plan within two months post-release.

Keep in mind that beneficiaries can switch to a five-star plan only once during the plan year.

Steps to Enroll or Switch Plans

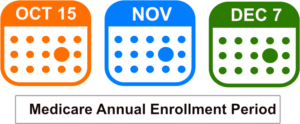

The Annual Enrollment Period is critical as it allows beneficiaries to switch between traditional Medicare and Medicare Advantage plans or adjust their Part D prescription drug coverage. If a Medicare plan’s contract with Medicare ends, beneficiaries can switch to a different plan up to two months prior to and one month after the contract termination.

Those who qualify for both Medicare and Medicaid can change their Medicare drug plan monthly. Individuals who move or lose existing coverage have specific timeframes to make changes to their Medicare plans. Beneficiaries are allowed to join a Medicare drug plan within two months after losing other creditable drug coverage.

You can join a plan online, by calling, or by mailing a paper form. Check if your doctors and pharmacies are in the plan’s network before enrolling.