Medicare Savings Program vs Medicaid

If you’re trying to discern the difference between the Medicare Savings Program and Medicaid, you’re not alone. These two programs may often intertwine, yet cater to distinct healthcare financial needs. The Medicare Savings Program will likely assist with costs that may be specifically tied to Medicare, while Medicaid could offer a full range of healthcare support.

This guide compares these crucial programs, emphasizing the eligibility criteria and scope of coverage that could help you understand which you may qualify for.

Key Takeaways

- Some of the Medicare Savings Programs (MSPs) may assist with certain Medicare costs for low-income individuals, potentially covering premiums and cost-sharing, while Medicaid may offer broader healthcare coverage and support, particularly to those over 65 or with limited financial resources.

- Eligibility for MSPs and Medicaid is income and asset-based with state-specific criteria, and it’s crucial to understand these to determine qualification for program assistance, with income that may be benchmarked to the Federal Poverty Level.

- MSPs and Medicaid could work in concert to potentially provide extensive healthcare coverage, where MSPs may focus on Medicare-related expenses such as premiums and copays, and Medicaid could cover a wider range of health services, which may include long-term care.

Compare Plans in One Step!

Enter Zip Code

Demystifying Medicare Savings Programs and Medicaid

Medicare Savings Programs (MSPs) could be benefit initiatives that may be designed to alleviate some of the Medicare costs for individuals who may have limited financial resources. They could provide assistance with certain Medicare premiums and in some instances, cost sharing, aimed at boosting enrollment and easing financial strain on beneficiaries.

On the other hand, Medicaid will likely offer a wider array of healthcare services and support. It may work in tandem with some of the Medicare Savings Programs MSPs to provide comprehensive coverage, especially when individuals turn 65 and become Medicare eligible.

Eligibility for these programs will likely hinge on a few factors. For certain MSPs, full or partial Medicaid beneficiaries with restricted incomes may qualify. A good grasp of these programs may be beneficial, as they could potentially notably lessen healthcare costs for qualifying individuals.

Navigating Eligibility Criteria: MSP vs. Medicaid

Eligibility for MSPs and Medicaid will likely be determined by income and financial resources. Each state could establish its own income and asset limits, leading to eligibility variations across different states. Comprehending these criteria might be key to determining eligibility for the most suitable program.

Income Considerations for Eligibility

Income eligibility for MSPs and Medicaid is based on Federal Poverty Guidelines, and these limits may vary from state to state. For instance, MSPs may be designed to cover certain Medicare premiums and some out-of-pocket costs for eligible individuals with income below the federal poverty level.

Some of the income limits for these programs will likely be released in January or February, with an effective date of January 1. Hence, individuals should assess their state’s unique criteria to ascertain their eligibility for these programs.

Resource and Asset Evaluations

To determine eligibility for MSP, states may assess members’ savings and investments. Certain items like the individual’s primary residence, a vehicle, burial plots, and life insurance with a cash value are not considered. MSPs could also help cover certain hospital insurance (Medicare Part A) and medical insurance (Medicare Part B) premiums for eligible individuals.

The resource threshold for Medicare Savings Programs may vary by state, taking into account state-specific income and asset limits.

For Medicaid eligibility, assets and resources will likely be evaluated through the Asset Verification System, with certain assets could be excluded from the calculation.

For Medicaid eligibility, assets and resources will likely be evaluated through the Asset Verification System, with certain assets could be excluded from the calculation.

Coverage Scope: What MSPs and Medicaid Could Pay For

The MSPs will likely be designed to provide relief by covering some of the Medicare premiums and Medicare cost-sharing expenses for beneficiaries who meet the eligibility criteria. This may include coverage for:

- Medicare Part A and Part B premiums

- Deductibles

- Coinsurance

- Copayments

Fundamentally, MSPs could serve a significant function in handling personal Medicare expenses.

On the other hand, Medicaid could provide a wider range of healthcare services, which may include:

- inpatient and outpatient hospital services

- physician services

- home health services

- long-term care including nursing home care

Together, MSPs and Medicaid could potentially offer a safety net of healthcare coverage for low-income individuals.

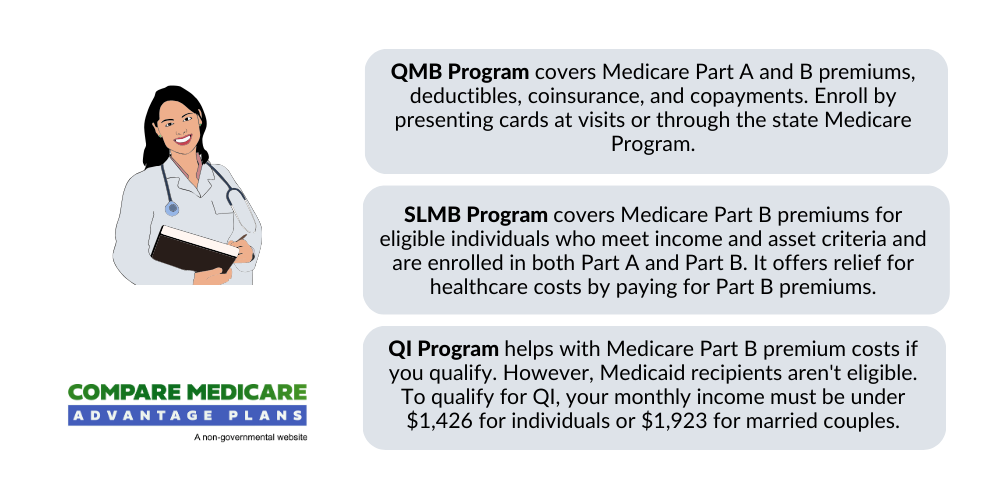

Types of Medicare Savings Programs

There are three distinct Medicare Savings Programs that could be designed to aid low-income individuals in managing their Medicare expenses: the Qualified Medicare Beneficiary (QMB) Program, the Specified Low-Income Medicare Beneficiary (SLMB) Program, and the Qualifying Individual (QI) Program.

Qualified Medicare Beneficiary (QMB) Program

The QMB Program may provide coverage for some of the following:

- Medicare Part A premiums

- Medicare Part B premiums

- Deductibles

- Coinsurance

- Copayments

To avail of the possible services under the QMB Program, individuals must present their Medicare and Medicaid card (or QMB card) at each care visit. To apply to this program, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Specified Low-Income Medicare Beneficiary (SLMB) Program

The SLMB Program may help in covering Part B premiums exclusively. To be eligible, individuals must already be enrolled in both Medicare Part A and Part B, and their income and assets must fall below specific thresholds.

The SLMB Program could be advantageous as will likely provide coverage for certain monthly Medicare Part B premiums, possibly ensuring that eligible enrollees could have their Part B costs paid for. This might provide significant relief for those who may be struggling to manage their healthcare costs.

Qualifying Individual (QI) Program

The QI Program will likely be structured to aid in covering certain Medicare Part B premium costs. Unfortunately, individuals who already qualify for Medicaid cannot receive QI benefits.

How Medicaid Complements Medicare Savings Programs

Medicaid and MSPs may work together to provide healthcare coverage. Some of the MSPs could assist with expenses that might be associated with Medicare, such as premiums, deductibles, and coinsurance, while Medicaid could function as health insurance for individuals with low income, possibly encompassing these supports through MSPs.

Dual enrollment in both Medicaid and a Medicare Savings Program could potentially offer increased assistance with healthcare expenses, which may alleviate some of the financial strain for individuals with low income by providing them with certain Medicaid benefits.

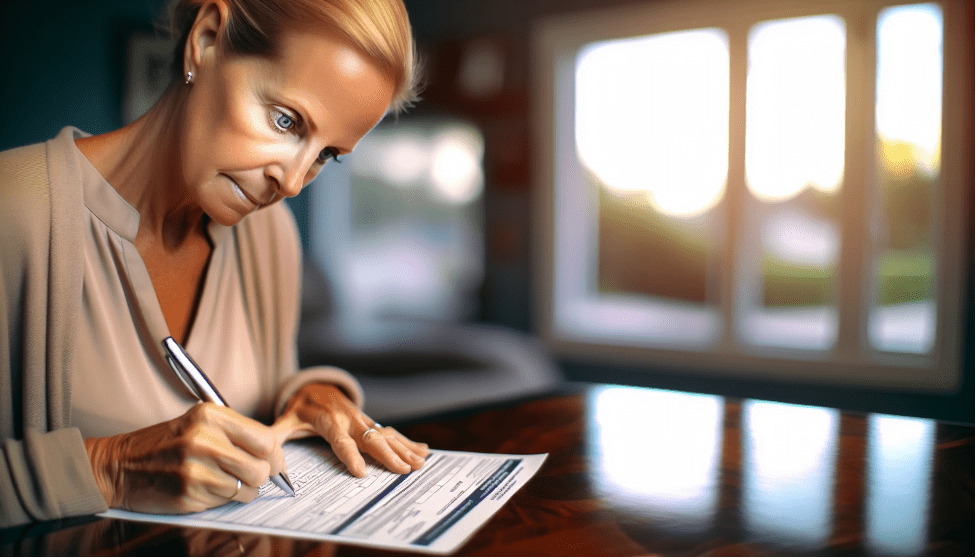

Application Process: Enrolling in MSPs and Medicaid

Applying for MSPs and Medicaid may involve contacting the state’s Medicaid office and providing the necessary documentation to prove eligibility. This may include:

- Your Social Security card

- Medicare card

- Birth certificate

- Passport or green card

- Proof of address

- Proof of residence

The application process for MSPs and Medicaid usually lasts around 45 days. It might be advantageous to apply for both programs at the same time as they could provide different medical coverage, which could potentially optimize the benefits for eligible individuals.

Additional Support for Prescription Drugs

Low-income individuals may also qualify for additional prescription drug support through programs like the Low-Income Subsidy (LIS). The LIS program will likely provide coverage for certain expenses that may be related to Medicare prescription drug plans, such as premiums, deductibles, and copayments.

The LIS program, also known as Extra Help, is managed by the Social Security Administration and could help low-income individuals afford certain Medicare Part D prescription drug premiums and share costs. To apply for the LIS program, individuals can access the Social Security Administration website at www.ssa.gov.

Summary

Understanding Medicare Savings Programs and Medicaid is critical in managing healthcare costs for low-income individuals. Each of these programs could provide substantial assistance in covering a wide array of healthcare services, possibly easing the financial burden on eligible beneficiaries.

By understanding the eligibility criteria and application process, individuals may be able to take full advantage of these programs to obtain the healthcare coverage they need.

Frequently Asked Questions

→ What is the Medicare savings program?

The Medicare Savings Program (MSP) is a Medicaid-run program that could assist low-income individuals by covering certain Medicare premiums and other out-of-pocket costs. Eligibility is based on income and may vary by state. Contact your state’s Medicaid agency for specific information.

→ Is MSP the same as Medicaid?

No, MSP and Medicaid are different programs. MSP is a Medicaid-administered program that could help cover certain Medicare premiums and other cost-sharing expenses for individuals with low income. However, it is possible to have both MSP and Medicaid at the same time.

→ What is the difference between Medicare and Medicaid?

The main difference between Medicare and Medicaid is that Medicare is a federal program providing health coverage for those 65+ or with a disability, regardless of income, while Medicaid is a state and federal program that may offer health coverage for individuals with very low income.

→ What is the difference between full Medicaid and QMB?

The main difference between full Medicaid and QMB is that Medicaid might cover services that may not be normally covered by Medicare, while QMB could help pay for services only if they are covered by Medicare. Therefore, QMB is a partial Medicaid program that could be designed to complement Medicare coverage.

→ How is eligibility for MSPs and Medicaid determined?

Eligibility for MSPs and Medicaid will likely be determined based on income and financial resources, where some of these criteria may differ by state and program type.

ZRN Health & Financial Services, LLC, a Texas limited liability company