The Basics of Dental Insurance Coverage

Dental insurance coverage forms a critical aspect of comprehensive healthcare for seniors. It’s designed to partly or wholly cover the costs of dental treatments, helping reduce the often hefty out-of-pocket expenses that can arise. Basic dental insurance typically includes coverage for preventive services, such as regular check-ups, cleanings, and X-rays.

These routine visits are essential in maintaining oral health and catching potential issues early, which could lead to more extensive and costly treatments if left unchecked.

Moreover, insurance companies offer plans that extend beyond preventive care, covering a portion of costs for services like fillings, crowns, dentures, and even dental implants.

Understanding these benefits allows seniors to select plans that match their dental care needs, providing peace of mind knowing that critical treatments won’t lead to unexpected financial burdens.

Dental coverage varies significantly between insurance providers. Some plans include a network of preferred dentists, which means that costs are lower if you visit providers within this network. Working with in-network dentists usually results in better cost control, as insurance companies have pre-negotiated rates for services. However, out-of-network care might still be available, albeit at a higher cost. Seniors should carefully evaluate the network size and location of participating dentists in any insurance plan they consider.

Another aspect to keep in mind is the insurance policy’s annual maximum limit. This is the maximum amount an insurance company will pay for dental services in a given year.

After reaching this limit, any additional treatment costs will be out-of-pocket. Choosing a plan with a higher annual maximum can be beneficial for seniors expecting significant dental work. It’s also crucial to consider the waiting period, a set time after enrolling in an insurance plan before certain benefits take effect.

Waiting periods vary by plan and can range from a few months to over a year for more complex procedures like root canals or orthodontics.

Dental insurance is not just about coverage but also about understanding your benefits. Older adults are encouraged to ask detailed questions about what their plans cover, including specific treatment exclusions.

By staying informed, seniors can effectively manage their dental expenses and maintain both their oral health and financial well-being.

Why Seniors Need Dental Insurance

For many seniors, dental insurance is not just a convenience but a necessity. As we age, maintaining oral health becomes more challenging due to natural wear and tear, potential health conditions, and the side effects of medications that might affect gum health. Dental insurance provides a safety net that can alleviate some of these challenges by ensuring access to necessary dental care, which is critical for overall health and quality of life.

Coverage from dental insurance helps seniors afford preventive services that can catch issues early. Regular cleanings and exams are vital for preventing gum disease and tooth decay, both of which are common in older adults.

By detecting problems early, seniors can avoid more invasive, uncomfortable, and costly treatments down the line. Dental insurance also plays a significant role in decreasing the financial impact of more extensive treatments such as fillings, crowns, or even emergency dental care.

These procedures can quickly add up, so having insurance helps manage costs and fosters better treatment outcomes.

Additionally, dental health is closely linked to a senior’s overall well-being. Poor oral health can lead to nutrition challenges, as problematic teeth and gums may limit the types of foods an older adult can comfortably eat.

This can lead to dietary deficiencies, impacting overall health and vitality. Having consistent dental care supported by insurance ensures seniors maintain a diverse and balanced diet, contributing to their general health and happiness.

The importance of dental insurance also extends to its role in enhancing seniors’ confidence and social interactions. Dental issues can affect speech and self-esteem, potentially leading to social isolation.

With insurance, treatments that improve dental aesthetics, such as dentures or dental implants, become more accessible. These treatments are not merely cosmetic but also address practical issues, helping seniors enjoy life more fully without worrying about dental discomfort or embarrassment in social settings.

In conclusion, having dental insurance isn’t just an aspect of eldercare; it’s a vital part of safeguarding one’s health and well-being.

Seniors and caregivers looking at the varied dental insurance plans should aim for a balance of comprehensive coverage, manageable costs, and access to a reliable dental network. These factors, paired with an understanding of the role insurance plays in long-term health, enable seniors to approach their golden years with confidence and security in their dental care needs.

Types of Dental Insurance Plans Available

Understanding the various dental insurance plans available can empower seniors to make informed choices about their dental care.

Various plans cater to different needs, providing coverage for preventive services, basic and major treatments, or more comprehensive packages. By reviewing the distinct types of plans, older adults can select the level of coverage that aligns with their oral health needs, budget, and preferred network of dentists.

Exploring supplemental options and understanding the role they play can also be vital for covering gaps and enhancing existing dental insurance coverage.

Exploring Different Plan Options

Diving into the myriad of dental insurance plans can seem overwhelming, but grasping the basics helps simplify the process. Senior dental plans differ primarily by the type of coverage they offer and the costs associated with them.

Common options include indemnity plans, which offer the flexibility to visit any dentist, and the widely chosen PPO (Preferred Provider Organization) plans, which are popular for their balance of network flexibility and cost management.

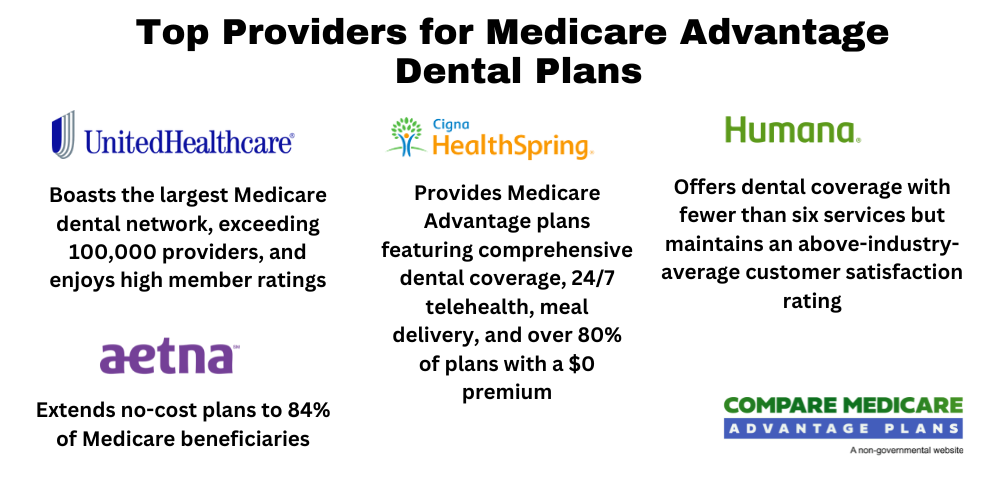

PPO plans, such as those offered by Aetna Dental and Humana Dental, allow seniors to select their dentists and often cover a substantial portion of preventive and basic services while remaining affordable.

Conversely, Health Maintenance Organizations (HMOs) require policyholders to choose dentists within a specific network, potentially limiting choices but offering lower premiums and minimal out-of-pocket expenses.

These plans are beneficial for seniors seeking cost-effective, predictable options. Aflac Dental stands as an example of how some insurance companies tailor their plans to meet diverse dental care needs while maintaining affordability.

It’s crucial for seniors to evaluate whether the dentists they prefer are within the plan’s network, as staying within the network typically leads to significant savings on dental care costs.

Indemnity plans provide the widest range of options, covering care from any dentist and typically reimbursing a percentage of costs. However, these plans often come with higher premiums and out-of-pocket expenses, which may not be ideal for seniors on a fixed income.

Additionally, many seniors opt for dental discount plans, which are not insurance per se, but provide reduced rates from participating dentists.

These plans can be a budget-friendly choice for those looking to pay for services outright but still save some costs.

When exploring different options, seniors should assess their specific dental care needs and financial limitations.

This assessment will guide them in selecting a plan that balances coverage and costs, meeting their oral health requirements without over-stretching their budget. Comparing insurance companies’ plan offerings can help pinpoint which one provides the best network, coverage, and cost benefits for their unique situation.

By doing so, seniors can ensure they maintain their dental health with confidence and financial foresight.

Here are key considerations for seniors evaluating dental plan options:

- Assess coverage for preventive services like cleanings and check-ups, as these are crucial for maintaining oral health.

- Examine if the plan includes major procedures, such as dentures or crowns, which might be necessary in the future.

- Review the network of dentists involved with the plan to ensure easy access to preferred dental care providers.

- Compare monthly premiums and out-of-pocket costs to budget effectively and avoid unexpected financial strain.

- Check if the plan offers flexibility to add additional services as oral healthcare needs evolve over time.

- Investigate waiting periods for specific treatments, as immediate coverage may not be available for all procedures.

- Seek feedback from peers or consult reviews to gain insights into others’ experiences with the plan under consideration.

With these points in mind, seniors can navigate their way to a suitable dental plan with assurance.

The Role of Supplemental Dental Insurance

For many seniors, simply having a primary dental insurance plan is not enough to cover every need, particularly when unexpected treatments arise.

This is where supplemental dental insurance steps in, filling the gaps left by traditional coverage. Supplemental plans are designed to work alongside existing policies, helping to cover costs that primary plans might not fully handle, such as certain treatments, higher costs, or extended waiting periods.

Supplemental plans are particularly beneficial for seniors who find their dental health requires more frequent or specialized care, such as periodontal treatment or orthodontics, which are sometimes not fully covered by standard plans.

A supplemental option can also be a strategic choice for those dealing with high-cost procedures, like dental implants and dentures, ensuring that their out-of-pocket expenses remain manageable. Spirit Dental is an example of a company offering supplemental options that bolster primary coverage, providing peace of mind to seniors looking to avoid unexpected outlays on essential dental care.

Moreover, supplemental insurance can cater to seniors’ desires for cosmetic treatments aimed at enhancing appearance and functionality, addressing both health and self-esteem concerns.

It’s essential for older adults to calculate the combined premiums of their primary and supplemental plans to ensure that they’re financially feasible. Balancing costs against the benefits of enhanced coverage allows seniors to make informed choices that align with their health priorities.

Understanding how supplemental plans integrate with existing coverage is vital for maximizing benefits.

Seniors should carefully read each policy’s terms, identifying areas where the supplemental plan can add value, such as coverage increases or reduced waiting periods.

This comprehensive approach to dental insurance helps ensure that seniors have the necessary resources to maintain their oral health robustly in their later years without unexpected financial burdens. As seniors weigh their options, entering their ZIP code on comparison websites can unveil available supplemental plans, highlighting costs and coverage variations, further aiding in making a well-informed choice.

Coverage and Costs Explained

Navigating dental insurance can seem daunting, but it’s crucial for maintaining oral health without financial worries.

Seniors must understand what dental insurance covers and how much it can cost. Generally, dental insurance covers a variety of treatments and services, providing essential benefits. However, several factors influence costs, such as plan type, location, and whether your dentist is within the insurance company’s network. Understanding these variables offers clarity, empowering seniors to make informed decisions.

We’ll discuss typical coverage and analyze factors affecting costs to help seniors grasp how dental insurance works.

What Dental Insurance Plans Typically Cover

Dental insurance plans for seniors often encompass a range of services that cater to both routine and unexpected dental care needs.

Primarily, dental coverage includes preventive services like regular check-ups, cleanings, and X-rays. These services play a crucial role in avoiding more severe dental issues down the road. Preventive dental care is an investment in maintaining healthy teeth and gums, which can save costs and prevent extensive treatment, which leads to more discomfort later on.

Beyond preventive treatments, many dental insurance plans cover a percentage of basic and major procedures.

Basic procedures might include fillings and simple extractions, while major treatments often encompass crowns, root canals, dentures, and even partial coverage for dental implants. Each insurance company outlines specific benefits under its policies, so it’s essential for seniors to read through the plan details carefully and understand exactly what is covered.

The extent of coverage can vary depending on whether the treatment is performed by a dentist within the insurer’s preferred network. Utilizing a network provider generally results in lower costs since insurance companies often have pre-agreed rates for various services.

On the contrary, choosing out-of-network dentists might lead to higher costs, making network considerations a vital part of plan selection. Effective dental coverage thus revolves around leveraging these network benefits while ensuring access to your preferred dental care provider.

Moreover, understanding coverage limits is key. Most plans come with an annual maximum, which is the upper limit the insurance company will pay within a year.

Once this limit is reached, any further treatment costs will become out-of-pocket expenses for the insured. Knowing this helps seniors plan their dental care procedures wisely, particularly those who might anticipate high-cost treatments. It’s important to align your dental care needs with your insurance plan’s offerings to maximize benefits while managing personal expenses effectively.