Medicare Advantage Plans 2024

As the year 2024 unfolds, the Medicare Advantage landscape continues to evolve, offering beneficiaries more coverage options and benefits than ever before.

With expanded coverage areas, new benefits, and improved services, it’s essential to stay informed and make the most of your Medicare Advantage plans in 2024.

In this comprehensive overview, we’ll guide you through the latest updates and offerings from top providers and help you navigate Medicare Advantage plans in 2024.

Key Takeaways

- Medicare Advantage Plans 2024 offers expanded coverage areas, new benefits, and improved services from major payers such as UnitedHealthcare, Humana, Cigna, and Aetna.

- Consumers should understand premiums & cost sharing, star ratings, and enrollment periods to make informed decisions about healthcare coverage.

- Maximizing Medicare Advantage plan benefits requires confirming benefit eligibility. Utilizing extra benefits & understanding coverage limitations.

Compare plans & rates for 2024!

Enter Zip Code

Overview of 2024 Medicare Advantage Plans

The 2024 Medicare Advantage plans emphasize the extension of coverage areas, the introduction of novel benefits, and the enhancements in services for beneficiaries.

These are offered by private companies approved by the federal government through a medicare contract to provide benefits equal to Medicare Part A and Medicare Part B. Some plans may offer additional benefits such as dental, vision, and hearing coverage, often at no extra cost.

Major insurance companies, such as UnitedHealthcare, Humana, Cigna, and Aetna, represent 60% of the Medicare Advantage market and offer a range of benefits for 2024, sometimes including $0 monthly premiums, low-cost prescription drug coverage, and benefits addressing social determinants of health.

While traditional Medicare covers a wide array of services, Medicare Advantage plans offer even more options to suit your healthcare needs.

From expanded coverage areas to new benefits and improved services, the 2024 Medicare Advantage plans are designed to provide better coverage and cater to the diverse needs of Medicare beneficiaries.

So, what changes can you anticipate in the 2024 Medicare Advantage plans and what are the offerings from the top providers? Here’s what you need to know.

Expanded Coverage Areas

In 2024, Medicare Advantage plans are expanding into new counties and states, offering more choices for beneficiaries, including those who may be eligible for both Medicare and their state Medicaid program. Aetna is providing plans in 46 states and Washington, DC. This will add 255 new county options and result in an increase of 2.2 million beneficiaries.

Thus, there will be a total of 2,269 counties with Aetna plans available. Some of these plans may even have a $0 Medicare Part B premium.

UnitedHealthcare’s Medicare Advantage plans are extending their coverage area to 110 extra counties in 2024, encompassing 96% of the overall coverage area.

Humana will offer Medicare Advantage plans in 39 counties, while Cigna’s plans have expanded to 29 states.

Wellcare’s 2024 Medicare Advantage plans expansion is anticipated to reach a total of 48 million Medicare-eligible adults nationwide, potentially including coverage for behavioral healthcare services.

With these expansions, beneficiaries have a wider range of options to choose from, ensuring they can find a plan that suits their healthcare needs and preferences.

New Benefits

Beyond the expanded coverage areas, 2024 Medicare Advantage plans are also rolling out new benefits to better cater to their members.

These include mental health coverage, telehealth services, and support for cultural and language diversity. Alignment Health is a Medicare provider that has partnered with Instacart to co-brand four plans spanning 13 counties in California and Nevada.

This contract with the federal government allows them to provide these services to their clients.

Aetna has added several new benefits for 2024, including:

- Fitness benefits

- $0 Part D drugs

- Dental, vision, and hearing services

- Allowances for everyday living costs

These additional offerings cater to the diverse needs of Medicare Advantage members and ensure that beneficiaries receive comprehensive and tailored healthcare services.

Improved Services

In line with their dedication to serving their members better, Medicare Advantage providers have notably enhanced their services in 2024. These enhancements include:

- Dental coverage

- Vision coverage

- Hearing coverage

- Improved coverage for mental healthcare

Some plans may also offer additional benefits not covered by Original Medicare, such as certain vision, hearing, and dental services.

To further streamline the member experience, Medicare Advantage providers have implemented digital improvements, such as:

- Providing digital health education to enrollees to enhance access to telehealth services and augment digital health literacy

- Introducing online hubs, furnishing a more straightforward member experience with augmented benefits and easier access to information about Medicare Advantage plans

- Allowing beneficiaries to compare and select from a broader array of plans offered by various firms

- Offering virtual visits, reduced cost-sharing, and additional supplemental benefits, such as dental, vision, and hearing exams

These digital improvements aim to enhance the overall experience and accessibility of Medicare Advantage plans.

View plans & rates

Enter Zip Code

Comparing Top Medicare Advantage Providers in 2024

To aid your decision-making process about your Medicare Advantage plan, we’ll analyze the offerings of the top providers in 2024:

- UnitedHealthcare

- Anthem

- Banner

- Humana

- Cigna

- Aetna

- Florida Blue

- Wellcare

- Blue Cross Blue Shield

- Healthfirst

These providers have expanded their coverage areas, providing comprehensive benefits and services to cater to the diverse needs of Medicare consumers.

By comparing the top Medicare Advantage providers, you can ensure that you select a plan that offers the right balance of coverage, benefits, and services to suit your individual healthcare needs.

Let’s analyze the offerings of each provider and compare them in terms of coverage areas, benefits, and services.

UnitedHealthcare Medicare Advantage Plans 2024

UnitedHealthcare, a major player in the Medicare Advantage market, has expanded its coverage area for 2024, providing access to 96% of all Medicare consumers. The company’s Medicare Advantage plans offer:

- Enhanced benefits

- A more streamlined member experience

- Renew Active®, a fitness program with a $0 copay

- Integrated features in the UnitedHealthcare UCard®

- $0 copays for most covered dental services

- Dental, vision, and hearing benefits

- Key preventive dental care is available at no cost

These new benefits, along with UnitedHealthcare’s expanded coverage, position the company as a strong contender for those seeking comprehensive and affordable Medicare Advantage plans.

Gaining a clear understanding of the company’s offerings and coverage areas will assist you in making a choice that fits your healthcare needs and preferences.

Humana Medicare Advantage Plans 2024

Humana is another top Medicare Advantage provider for 2024, known for its comprehensive dental, vision, and hearing benefits.

In 2024, Humana’s Medicare Advantage plans are set to be available across 49 states, Washington, DC, and Puerto Rico. Estimates suggest that more than 50% of the projected Medicare beneficiaries will not have to pay any monthly premiums for these plans.

Humana’s dual-eligible special needs plans have several features to make sure their members are taken care of.

No copays on Part D prescriptions make it much easier to afford medication for those members who need it, helping to reduce prescription drug costs. The monthly Healthy Options Allowance provides money to put towards healthy food, or essential expenses such as rent and utility bills.

Evaluating Humana’s offerings and coverage areas, including their prescription drug plans, will help you find a plan that aligns with your healthcare needs while being economical.

Cigna Medicare Advantage Plans 2024

Cigna Healthcare is another major provider of Medicare Advantage plans, offering:

- $0 premium plans (varies by plan and area)

- a wide range of benefits in 2024

- dental, vision, and hearing services

- meal delivery

- fitness benefits

These features make it an attractive option for those seeking a comprehensive and cost-effective Medicare Advantage plan.

In addition, Cigna’s Medicare Advantage plans are expanding in 2024, with coverage available across 29 states and 25 new counties, for a total of 603 counties.

Understanding Cigna’s coverage areas and their offered benefits will help you determine whether their plans fit your healthcare needs and preferences.

Aetna Medicare Advantage Plans 2024

Aetna, another leading Medicare Advantage provider, has expanded its coverage in 2024, offering plans in 46 states and Washington, DC, and adding 255 new counties, increasing the number of counties with plans available to 2,269. Aetna has also introduced several new benefits for 2024, including:

- Fitness benefits

- $0 Part D drugs

- Dental, vision, and hearing services

- Allowances for everyday living costs

In addition to these new benefits, Aetna has introduced the Aetna Medicare payment card, a preloaded debit card that Aetna Medicare members receive for the purpose of paying for in-network copayments when visiting a primary care physician.

This card is loaded with $100 every quarter and can be utilized for approved expenses, making Aetna an attractive option for those seeking a comprehensive Medicare Advantage plan with added perks.

Wellcare Medicare Advantage Plans 2024

Wellcare is a health insurance company that focuses on providing affordable and comprehensive Medicare Advantage plans.

While specific plan details are not specified, Wellcare’s 2024 Medicare Advantage plans offer numerous unique benefits, including savings with $0 or low monthly premiums, additional benefits for qualifying members at no extra cost, and a focus on affordability.

Wellcare’s Medicare Advantage plans in 2024 are accessible in all 50 states, ensuring that beneficiaries have a wide range of options to choose from when selecting a plan that best suits their healthcare needs and preferences.

By understanding Wellcare’s offerings and coverage areas, you can make an informed decision about which plan is the right fit for you.

Navigating the Medicare Advantage Market in 2024

To fully benefit from your 2024 Medicare Advantage plan, understanding various aspects of the market, such as premiums and cost-sharing, star ratings, and enrollment periods, is key.

By comprehending these factors, you can make informed decisions about your healthcare coverage and ensure you receive the best possible benefits and services.

The upcoming sections will guide you through:

- Understanding premiums and cost-sharing

- Emphasizing the importance of considering a plan’s star rating

- Explaining the various enrollment periods for Medicare Advantage plans in 2024.

Premiums and Cost-Sharing

The estimated average monthly premium for Medicare Advantage plans in 2024 is $18.50, which is an increase of 64 cents from 2023. It is important to note, however, that premium costs may vary depending on the insurer and level of coverage. Cost-sharing in 2024 Medicare Advantage plans includes:

- Premiums

- Deductibles

- Copayments

- Coinsurance

The cost-sharing structure is determined by the plan chosen by the beneficiary. By reviewing the details of each plan, beneficiaries can better understand the cost-sharing requirements and select a plan that best suits their financial and healthcare needs.

It’s also important to be aware that not all enrollees will experience an increase even though Medicare Advantage premiums might rise in 2024. Understanding the factors that determine the cost of premiums, such as projected increases in healthcare spending and the Part B standard premium and deductible, can help you make an informed decision about your Medicare Advantage coverage and anticipate potential changes in premium costs.

Star Ratings

It’s important to take into account the star rating of a Medicare Advantage plan when making a selection. The Centers for Medicare and Medicaid Services (CMS) evaluates several factors, such as the quality of care, customer service, and member experience with the health plan, to determine the overall star rating for each plan.

It’s important to take into account the star rating of a Medicare Advantage plan when making a selection. The Centers for Medicare and Medicaid Services (CMS) evaluates several factors, such as the quality of care, customer service, and member experience with the health plan, to determine the overall star rating for each plan.

The ratings range from one to five stars, with five stars indicating outstanding performance.

By comparing the star ratings of various Medicare Advantage plans, you can select a plan that delivers high-quality services and benefits.

Keep in mind that star ratings are updated annually, with finalized ratings released in October of each year. By staying informed about the latest star ratings, you can make informed decisions about your healthcare coverage and choose a plan that meets your needs and expectations.

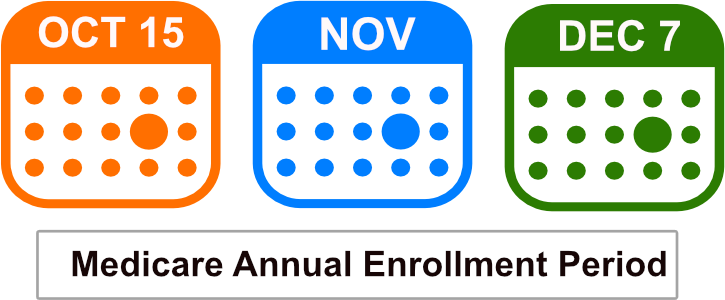

Enrollment Periods

There are two main enrollment periods to be aware of when enrolling in a Medicare Advantage plan. The Initial Enrollment Period is a seven-month period that includes the three months before, the month of, and the three months after you first become eligible for Medicare. This is the time when you can enroll in a Medicare Advantage plan for the first time.

The Annual Enrollment Period for Medicare Advantage is from October 15th to December 7th annually. During this period, you can make modifications to your Medicare Advantage plan, such as transitioning to a different plan or joining a plan for the first time.

Understanding these enrollment periods and the eligibility criteria associated with them is essential to ensure that you can enroll in a Medicare Advantage plan that suits your healthcare needs and preferences.

By staying informed about enrollment periods and eligibility requirements, you can make the most of your Medicare Advantage coverage and maximize your benefits.

Maximizing Your Medicare Advantage Plan Benefits in 2024

To maximize your 2024 Medicare Advantage plan benefits, it’s important to confirm your benefit eligibility, make use of the extra benefits offered by your plan, and comprehend any applicable coverage limitations.

By following these steps, you can ensure that you receive the best possible healthcare services and benefits from your Medicare Advantage plan.

The following sections will provide tips on confirming benefit eligibility, making use of extra benefits, and understanding coverage limitations. This will help you optimize your Medicare Advantage plan in 2024.

Confirming Benefit Eligibility

Verifying your eligibility for Medicare Advantage plans during enrollment periods is vital to ensure that you meet the plan criteria and can utilize the provided benefits.

To confirm benefit eligibility, you can refer to resources provided by the Centers for Medicare & Medicaid Services (CMS), such as their official website and fact sheets, or consult the Medicare and You publication for information on eligibility criteria.

Insurance providers like UnitedHealthcare, Humana, and Blue Cross Blue Shield also offer resources and plan options for Medicare Advantage in 2024.

By confirming your eligibility and understanding the available coverage options, you can make a decision about your Medicare Advantage plan that ensures you receive optimal benefits and services.

Utilizing Extra Benefits

Many Medicare Advantage plans in 2024 provide extra benefits, such as:

- Vision coverage

- Fitness programs

- Hearing coverage

- Dental coverage

To fully utilize these additional offerings, be sure to make use of the supplementary coverage provided by your plan, including prescription drugs, vision, hearing, dental, or wellness services.

By understanding the extra benefits offered by your plan and utilizing them effectively, you can maximize your healthcare coverage and receive the best possible care.

In addition to understanding the extra benefits offered by your plan, it’s important to stay informed about any updates or changes to your Medicare Advantage plan in 2024 that may affect your benefits.

By staying informed and actively utilizing your plan’s extra benefits, you can ensure that you receive comprehensive and tailored healthcare services.

Understanding Coverage Limitations

While Medicare Advantage plans present a broad array of benefits and services, it’s important to understand any potential constraints and restrictions tied to your plan, including provider networks and service limitations.

For example, provider networks in Medicare Advantage plans to determine which healthcare providers are included in the plan’s network, and coverage may be limited or not covered at all for out-of-network providers.

Additionally, be aware that Medicare Advantage premiums could rise in 2024, although not all enrollees will experience an increase.

Understanding the factors that determine the cost of premiums and the potential limitations of your plan will help you make informed decisions about your healthcare coverage and ensure that you receive the best possible benefits and services.

Summary

In conclusion, the 2024 Medicare Advantage landscape offers beneficiaries expanded coverage areas, new benefits, and improved services to suit their healthcare needs.

By comparing top providers, understanding the market, and maximizing your plan benefits, you can make informed decisions about your healthcare coverage and ensure that you receive the best possible care. Stay informed, explore your options, and make the most of your Medicare Advantage plan in 2024.

Frequently Asked Questions

![]() What will the Medicare premium be for 2024?

What will the Medicare premium be for 2024?

The standard monthly premium for Medicare Part B enrollees in 2024 will be $174.70, an increase of $9.80 from 2023. Additionally, the average monthly plan premium among all Medicare Advantage enrollees in 2024 is expected to be $18.50.

![]()

![]()

![]()

![]()

![]()

![]()

Medicare Advantage plans in 2024 will see an average increase in monthly premiums of $0.64, but 73% of enrollees won’t experience any premium increase if they stay on their plan. Additionally, the plans will provide better coverage for mental healthcare. 19% of the plans will offer some reduction in the Part B premium.

![]()

![]()

![]()

![]()

![]()

![]()

The biggest disadvantage of Medicare Advantage is that you may be limited to fewer choices of doctors and hospitals due to the smaller plan network than Original Medicare.

![]()

![]()

![]()

![]()

![]()

![]()

In 2024, Medicare Advantage plans will include enhanced coverage for mental health services, telehealth visits, cultural and language support, plus increased dental, vision, and hearing benefits.

![]()

![]()

![]()

![]()

![]()

![]()

To confirm your eligibility for a Medicare Advantage plan, you can refer to resources provided by the Centers for Medicare & Medicaid Services (CMS), consult the Medicare and You publication, or contact insurance providers directly.

Medicare Advantage Plans by State

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.