Blue Cross Blue Shield Medicare Advantage Plans for 2025

Navigating the world of Medicare might be challenging, especially when faced with numerous options and coverage choices.

Blue Cross Blue Shield (BCBS) Medicare Advantage Plans might stand out as a popular and reliable choice among seniors, potentially offering comprehensive coverage and some cost-saving benefits.

This article will guide you through the ins and outs of the potential Blue Cross Blue Shield Medicare Advantage Plans for 2025, helping you make an informed decision about your healthcare needs.

Key Takeaways

- Some of the Blue Cross Blue Shield Medicare Advantage Plans may provide comprehensive coverage that could go beyond Original Medicare, which may include dental, vision, and prescription drug benefits.

- Potential cost savings might be available through lower monthly premiums and limited out-of-pocket expenses.

- A majority of the Blue Cross Blue Shield plans have achieved a 4.17 out of 5 rating from the CMS Star Rating system, which is endorsed by experts for their quality and potentially offer cost-saving benefits.

Compare Plans in One Step!

Enter Zip Code

Understanding the Potential Blue Cross Blue Shield Medicare Advantage Plans

Some of the Blue Cross Blue Shield Medicare Advantage Plans, offered by Blue Cross and Blue Shield, might provide additional benefits beyond Original Medicare, such as dental, vision, and prescription drug coverage. Some of these plans may even combine Medicare Part A and Part B coverage with Medicare prescription drug coverage (Part D).

With the possibility of having comprehensive dental services and vision services that may include eye exams and eyeglasses, Blue Cross Blue Shield Medicare Advantage Plans will likely aim to deliver a well-rounded healthcare experience for beneficiaries.

Comprehensive Coverage

When you choose a Blue Cross Blue Shield Medicare Advantage Plan, you may expect comprehensive Medicare coverage, including all Medicare Part A and Part B services, and some plans might include additional benefits such as hearing aids, dental, vision, and prescription drug coverage.

Some of these plans might go beyond Original Medicare benefits, possibly making them an attractive option for those seeking a complete healthcare package.

Prescription Drug Coverage

Some of the Blue Cross Blue Shield Medicare Advantage Plans might provide comprehensive coverage that could include prescription drug coverage and Part D. Part D will likely provide enrollees with access to certain prescription drugs. The drug tier system in these plans could categorize prescription drugs into different tiers based on their potential cost and coverage.

This might allow you to understand which drugs may be covered and at what cost, possibly ensuring you could have access to the medications you need at an affordable price.

Comparing Blue Cross Blue Shield Medicare Advantage Plan Types

Some of the Blue Cross Blue Shield plans could offer various types of Medicare Advantage plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Special Needs Plans (SNPs), to cater to different needs and preferences.

Understanding the distinctions between these plan types might help you choose the best option for your healthcare needs.

HMO Plans

BCBS Medicare Advantage HMO plans require members to select a primary care physician (PCP) and obtain referrals for specialist visits.

These plans generally come with lower monthly premiums and are more cost-effective than PPO plans. However, they may have a more restricted network of providers, which could be a deciding factor when choosing the right plan for you.

PPO Plans

On the other hand, BCBS Medicare Advantage PPO plans provide more flexibility in selecting healthcare providers, and do not necessitate referrals for specialist visits. While offering a wider choice of providers, PPO plans may have higher out-of-pocket costs when compared to HMO plans.

Weighing the benefits of both plan types will help you determine the one that suits your healthcare requirements and budget.

Special Needs Plans (SNPs)

BCBS’s Special Needs Plans (SNPs) are designed for individuals with specific health conditions, disabilities, or those who qualify for both Medicare and Medicaid.

BCBS’s Special Needs Plans (SNPs) are designed for individuals with specific health conditions, disabilities, or those who qualify for both Medicare and Medicaid.

These plans offer distinct features such as:

- Care coordination services

- Tailored benefits

- Provider choices

- A formulary of covered drugs designed to meet the specific needs of the plan members.

SNPs provide targeted care and restrict enrollment to particular types of beneficiaries with certain health conditions, ensuring personalized healthcare management.

Possible Costs and Savings with Blue Cross Blue Shield Medicare Advantage Plans

One of the potential advantages of some of the Blue Cross Blue Shield Medicare Advantage Plans might be their affordability. By potentially offering lower monthly premiums and limited out-of-pocket expenses, some of these plans might be a cost-effective choice for those seeking comprehensive healthcare coverage.

Monthly Premiums

The monthly premiums for certain Blue Cross Blue Shield Medicare Advantage Plans may depend on the plan you choose and your location.

Comparing the potential premiums of different plans is necessary to find a plan that aligns with your budget.

Out-of-Pocket Expenses

Some Blue Cross Blue Shield Medicare Advantage Plans may have a cap on out-of-pocket expenses, which could ensure members may be protected from excessive costs. Some of these expenses could include deductibles, coinsurance, and copayments for Part A and Part B covered services.

Knowing your out-of-pocket expenses might assist you in managing your healthcare budget effectively.

Saving Money

Some of the Blue Cross Blue Shield Medicare Advantage Plans could be designed with certain cost-saving measures in mind. By potentially offering additional benefits and lower cost-sharing options, some of these plans might help you save money on healthcare expenses.

For instance, the expansion of the Low-Income Subsidy (LIS) program could potentially help eligible enrollees afford certain medications. In addition, some plans may also offer additional preventive services that could lead to cost savings.

Enrollment Periods and Eligibility

Enrollment in a Blue Cross Blue Shield Medicare Advantage Plan is available during specific periods, such as the Initial Enrollment Period, Open Enrollment Period, and Special Enrollment Period.

Knowing the enrollment timings and process is key to not missing out on securing your preferred healthcare coverage.

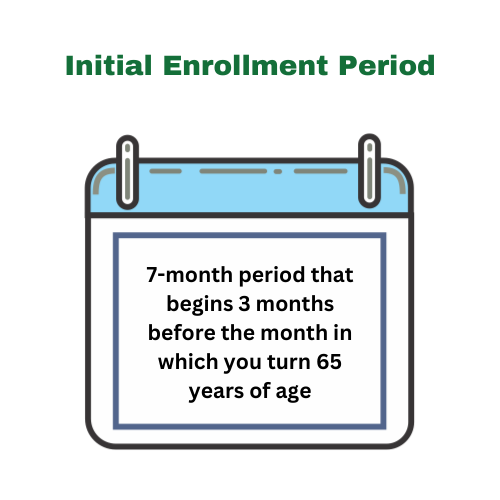

Initial Enrollment Period

The Initial Enrollment Period happens when an individual first becomes eligible for Medicare.

The Initial Enrollment Period happens when an individual first becomes eligible for Medicare.

It lasts for three months before, during, and after the eligibility month.

This seven-month window gives sufficient time to assess and choose an appropriate Blue Cross Blue Shield Medicare Advantage Plan, guaranteeing a seamless transition to your new healthcare coverage.

Open Enrollment Period

The Open Enrollment Period takes place annually from October 15 to December 7. During this time, individuals may enroll in or make changes to their Medicare Advantage plan for the following year.

Missing this period may result in having to wait until the next annual Medicare open enrollment period to request coverage.

Being cognizant of this timeline is necessary to prevent any gaps in coverage or delays in accessing the required healthcare services.

Special Enrollment Periods

Special Enrollment Periods are available for those who experience certain life events or changes in eligibility. These events include relocation to a new region, loss of other health coverage, or qualification for Extra Help.

Awareness of these special periods can aid you in making timely changes to your Medicare Advantage Plan, ensuring uninterrupted access to the necessary healthcare services.

To enroll in any of these plans, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. One of our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Blue Cross Blue Shield Network and Provider Accessibility

Blue Cross Blue Shield will likely have an extensive network of providers, but members may need referrals for specialist visits and may face limitations with out-of-network providers.

Understanding the accessibility of providers within the Blue Cross Blue Shield network could aid you in making educated choices about your healthcare coverage.

In-Network Providers

In-network providers might offer lower costs and better coverage for Blue Cross Blue Shield Medicare Advantage Plan members. Some of these providers will likely have agreed to offer services at negotiated rates, which could reduce out-of-pocket costs for members.

By utilizing the plan provider directory or the Blue Cross Medicare Advantage Provider Finder, members may be able to locate in-network providers and might ensure they receive quality care at a reduced cost.

Out-of-Network Providers

Out-of-network providers may not be obligated to accept Blue Cross Blue Shield Medicare Advantage Plans, which could result in increased out-of-pocket expenses.

Reviewing the potential plan details or contacting Blue Cross Blue Shield directly to understand how out-of-network care could be covered and what expenses may be incurred is imperative.

Referrals and Specialist Visits

Depending on the plan type, referrals may be required for specialist visits. For instance, under certain Blue Cross Blue Shield HMO plans, a referral from your primary care provider (PCP) is required for specialist visits within the medical group.

Being aware of the referral process for your specific plan will likely be necessary to ensure seamless access to specialist care when needed.

Expert Opinions and Ratings

A majority of the Blue Cross Blue Shield Medicare Advantage Plans have received high ratings from the Centers for Medicare & Medicaid Services (CMS) and will likely be recommended by experts for seniors seeking comprehensive coverage.

CMS Star Ratings

Most of the Blue Cross Blue Shield have a 4.17 out of 5 rating from CMS for their Medicare Advantage Plans.

The CMS Star Rating system evaluates the performance and quality of Medicare health and drug plans, with five stars representing excellent performance.

A 4.17 rating indicates that Blue Cross Blue Shield Medicare Advantage Plans might possess a high level of quality and performance, making them a reliable choice for your healthcare needs.

Expert Recommendations

Experts might recommend Blue Cross Blue Shield Medicare Advantage Plans for their comprehensive coverage and potential cost-saving benefits.

Forbes Health experts have conducted a review of Blue Cross Shield Medicare Advantage plans, providing information on possible costs, coverage options, and features. Their endorsement of Blue Cross Blue Shield Medicare Advantage Plans might highlight the reliability and value these plans could offer to Medicare beneficiaries.

Summary

Some of the Blue Cross Blue Shield Medicare Advantage Plans may offer comprehensive coverage, potential cost-saving benefits, and an extensive network of providers that could cater to various healthcare needs.

With high CMS ratings and expert recommendations, some of these plans could be an excellent choice for seniors looking to enhance their Medicare coverage.

It’s essential to understand the differences between plan types, enrollment periods, and provider accessibility to make an informed decision and secure the best healthcare coverage for your needs.

Frequently Asked Questions

→ What is the biggest advantage of Medicare Advantage?

One of the biggest advantages of Medicare Advantage might be its broad range of choices for healthcare providers and abundant coverage. Additionally, members could secure prior authorization for various services.

→ Why are people choosing Medicare Advantage plans?

Some people might choose Medicare Advantage plans due to the quick payments from insurers.

→ What are 4 types of Medicare Advantage plans?

The main types of Medicare Advantage Plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, and Special Needs plans (SNPs).

→ Do you still pay for Medicare Advantage Plan Part B?

Yes, you will likely still have to pay for Medicare Advantage Plan Part B. You must pay the monthly Part B premium as well as the plan’s premium and may also be charged a deductible. In some cases, the plan might help pay part of your Part B premium.

→ What additional benefits could Blue Cross Blue Shield Medicare Advantage Plans provide?

Some of the Blue Cross Blue Shield Medicare Advantage Plans may offer additional benefits such as dental, vision, and prescription drug coverage that could go beyond those provided by Original Medicare.

BCBS Medicare Advantage Plans by State:

ZRN Health & Financial Services, LLC, a Texas limited liability company