Key Dates for 2026 Medicare Advantage Plans

The timing of enrollment or modifications to your Medicare Advantage plan is crucial. The Centers for Medicare & Medicaid Services (CMS) will announce the 2026 Medicare Advantage plans on April 1, 2025. This initial announcement will be followed by more detailed information released in stages, likely ensuring that beneficiaries have ample time to review and understand their options before making any decisions.

The open enrollment period for the 2026 Medicare Advantage plans begins on October 15, 2025, and ends on December 7, 2025. During this critical window, beneficiaries can join, switch, or drop plans as needed. Mark these dates on your calendar and begin preparations early to make the most of this opportunity.

Initial Release Date

The preliminary details about the 2026 Medicare Advantage plans and MA plans may be released by CMS around March 1, 2025. Additional information will likely follow on April 1, 2025, with final preliminary details on April 6, 2025.

This staggered approach could help ensure that beneficiaries receive comprehensive information to help them make informed decisions about their healthcare coverage.

Enrollment Periods

The open enrollment period for Medicare Advantage plans in 2026 is set to commence on October 15, 2025, and will run through December 7, 2025. During this period, beneficiaries should review current plans, compare new options, and make necessary changes to secure the best coverage for the upcoming year.

Deadline Reminders

Beneficiaries must finalize their Medicare Advantage plan choices by December 7, 2025, to ensure coverage for 2026. Missing the deadline could lead to coverage gaps or higher costs, so prompt action and informed decisions are necessary.

Possible Changes in 2026 Medicare Advantage Plans

The 2026 Medicare Advantage plans might come with some changes that will likely be designed to improve the overall healthcare experience for beneficiaries. One of the possible changes might be the average increase of about 5.06% for the costs of certain plans. Given this potential increase, carefully review your plan options to find the most cost-effective solution.

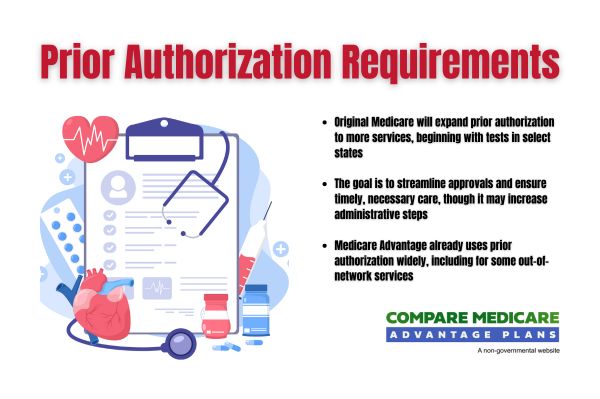

Additionally, some changes will likely aim to enhance accountability and efficiency in the utilization of the prior authorization process and management. Beneficiaries could potentially receive more streamlined processes and quicker responses for necessary healthcare services.

Regularly assessing your Medicare plan could help avoid unexpected costs and possibly ensure a reasonable expectation of access to necessary services.

Prescription Drug Coverage

The Inflation Reduction Act could potentially lower certain prescription drug prices, which could significantly impact costs for Medicare beneficiaries. These potential provisions could improve access to essential medications and possibly ensure the affordability of prescribed treatments.

The Medicare Part D programs might incorporate redesign features to help enhance the accessibility and affordability of prescription drugs, as outlined in the Part D final rule.