Understanding Molina Medicare Advantage Plans in Utah

Molina Medicare Advantage plans provide comprehensive health coverage that extends beyond the basics of standard Medicare. These HMO plans are designed to incorporate a variety of healthcare services, aiming to enhance patient outcomes and ensure better access to care. This holistic approach means that beneficiaries can expect a more integrated and streamlined healthcare experience.

In Utah, these plans are available across multiple counties, catering to a diverse population of eligible seniors. Whether you live in a bustling city or a quieter rural area, there’s a good chance a Molina Medicare Advantage snp plan can meet your needs. This extensive availability allows more residents to take advantage of Molina’s comprehensive services.

Additionally, Molina provides different Medicare Advantage plan options in Utah, each tailored to meet varying needs and preferences. Plans range from basic to extensive medical services to fit different needs. Such flexibility lets individuals choose plans that match their health requirements and financial situations.

Key Features of Molina Medicare Complete Care

Molina Medicare Complete Care stands out for its comprehensive coverage options. These plans often include prescription drugs coverage alongside medical services, ensuring that members have access to the medications they need without additional hassles. This integration of drug coverage with medical care is a significant advantage for those managing chronic conditions or requiring multiple medications.

Preventative services are a major focus for Molina Healthcare. They encourage:

- Regular screenings

- Vaccinations

- Wellness visits These services help members maintain their health and avoid more serious medical issues. Emphasizing prevention can improve health outcomes and reduce healthcare costs over time. Molina Healthcare has various centers dedicated to these preventative services.

Additionally, some specialized Molina plans have specific eligibility requirements based on special health needs. For example, there are plans tailored for individuals with chronic conditions or those who are pregnant. These specialized plans provide targeted care, enhancing the effectiveness of Molina Medicare Complete Care.

Eligibility for Molina Medicare Advantage Plans

To qualify for Molina’s Medicare Advantage plans, individuals typically need to be 65 years or older or under 65 with specific disabilities. This criterion ensures access for those who need these plans the most. Additionally, applicants must reside in the state where the plan is offered, which for our focus is Utah. The residency requirement ensures effective access to local providers and services.

Another key eligibility criterion is citizenship or eligible immigration status. Most Molina Medicare plans require applicants to be U.S. citizens, although those with eligible immigration status can also qualify. Inclusivity allows a broader range of individuals to benefit from Molina’s healthcare services.

Molina also offers specialized plans for dual-eligible individuals, meaning those who qualify for both Medicare and Medicaid. These dual-eligible plans are designed to provide extensive coverage and support, particularly beneficial for individuals with limited financial resources. Dual eligibility can greatly reduce out-of-pocket costs and improve access to necessary healthcare services.

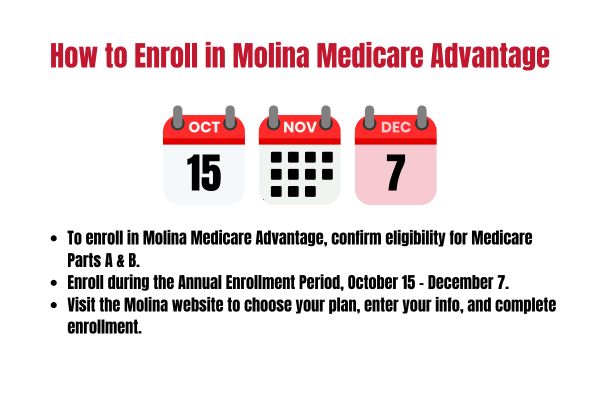

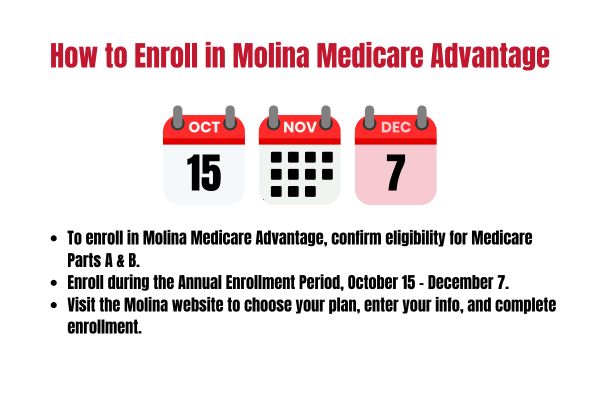

Enrollment Process for Molina Medicare Advantage Plans

Enrolling in a Molina Medicare Advantage plan involves several steps:

- Understand the enroll periods.

- Note that Medicaid allows for year-round enrollment.

- Be aware that other plans have specific open enrollment times.

- Ensure awareness of these periods for timely application and uninterrupted coverage.

When apply, individuals must provide documentation to verify:

- Identity

- Residency

- Income

- Citizenship or immigration status

Verification ensures applicants meet eligibility criteria and access needed benefits with permission. Preparing these documents in advance can streamline enrollment and provide a tier reference to prevent delays in the request process.

It’s also advisable to seek assistance if needed. Molina Healthcare offers support to potential enrollees by:

- Helping them navigate the complex application process

- Offering guidance on understanding plans

- Assisting with completing paperwork to help make informed decisions.

Costs Associated with Molina Medicare Advantage Plans

Grasping the costs of Molina Medicare Advantage plans is crucial for informed decision-making. Many Medicare Advantage plans, including Molina’s, charge a premium in addition to the standard Part B premium. This additional premium can vary depending on the specific plan and coverage options selected.

However, many Molina Medicare Advantage plans feature no monthly premium, making them an attractive option for those looking to minimize their healthcare expenses. This financial accessibility is particularly beneficial for individuals on a fixed income, ensuring they can access necessary healthcare services without financial strain.

Income thresholds are important, particularly for Medicaid or subsidized Marketplace plans. Meeting these income criteria can qualify applicants for reduced premiums and lower out-of-pocket costs, making comprehensive healthcare more affordable. Grasping these financial aspects helps individuals choose the most cost-effective plan for their healthcare needs, including a low income subsidy.

Comparing Molina Medicare Advantage Plans to Other Options

When comparing Molina Medicare Advantage plans to other options, several distinct advantages stand out:

- These plans often include benefits like dental, vision, and hearing services, which are not typically covered by Original Medicare.

- This additional coverage can significantly improve the quality of life for members.

- It ensures members receive comprehensive care.

Molina’s plans also include wellness programs and care coordination, enhancing patient care beyond traditional Medicare. These programs focus on preventative care and chronic disease management, helping members maintain their health and potentially reduce healthcare costs.

Molina Medicare Advantage plans often feature lower monthly premiums than some private plans while offering similar benefits. Additionally, these plans can result in lower out-of-pocket costs, particularly for those who qualify for Medicaid or low-income assistance. Comprehensive coverage combined with cost-effectiveness makes Molina a strong contender in the Medicare Advantage market.