UnitedHealthcare Medicare Advantage Plans Alabama 2026

Looking into the potential UnitedHealthcare Medicare Advantage plans in Alabama? This guide will walk you through the types of plans available, their potential benefits, and essential tips for choosing the right one for your healthcare needs.

Key Takeaways

- UnitedHealthcare will likely offer a range of Medicare Advantage plans in Alabama, including HMO, PPO, and Special Needs Plans, to cater to diverse healthcare needs.

- Some plans may provide comprehensive coverage with additional benefits such as dental, vision, hearing care, and sometimes integrate prescription drug coverage.

- Enrollment periods, eligibility requirements, and plan ratings could be crucial factors to consider when selecting a UnitedHealthcare Medicare Advantage plan.

Compare Plans in One Step!

Enter Zip Code

Overview of UnitedHealthcare Medicare Advantage Plans in Alabama

UnitedHealthcare has been a well-known provider of Medicare Advantage plans in Alabama, likely offering a variety of options that could cater to different healthcare needs and preferences. These plans have been designed to provide comprehensive coverage while sometimes offering additional benefits that could go beyond what Original Medicare provides.

Whether you are looking for a plan that might offer low out-of-pocket costs or extra services, those insured through UnitedHealthcare insurance company will likely have options that can meet your needs.

The flexibility of UnitedHealthcare’s Medicare Advantage plans might make them an attractive choice for many seniors. With different types of plans such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNP), you can find a plan that fits your lifestyle and healthcare requirements. Each plan type offers varying levels of flexibility and coverage, allowing you to choose the one that best suits your situation.

Types of Plans Available

UnitedHealthcare will likely offer several types of Medicare Advantage plans in Alabama, each designed to meet different needs. The Health Maintenance Organization (HMO) plans require members to use a specified network of local healthcare providers for benefits, ensuring coordinated care but with less flexibility.

For those who prefer some out-of-network coverage, the HMO Point of Service (HMO-POS) plans allow members to access services outside the network, typically at a higher cost. Preferred Provider Organization (PPO) plans may offer the greatest flexibility, enabling members to seek care from both in-network and out-of-network providers, though at different cost levels.

Additionally, Special Needs Plans (SNP) cater to specific groups of people with particular needs, such as those with chronic conditions or dual eligibility for Medicare and Medicaid. The availability and details of these plans may vary by plan area, so it’s important to contact the plan for specific information.

Eligibility Requirements

To qualify for UnitedHealthcare’s Dual Complete Plans (D-SNPs), individuals must be eligible for both Medicare and Medicaid. These plans are specifically designed to provide comprehensive benefits to those with dual eligibility, ensuring they receive the necessary coverage and support.

Other plans may have different eligibility criteria, and it’s crucial to review the evidence of coverage to understand the possible limitations, exclusions, and restrictions that may apply.

Enrollment Periods

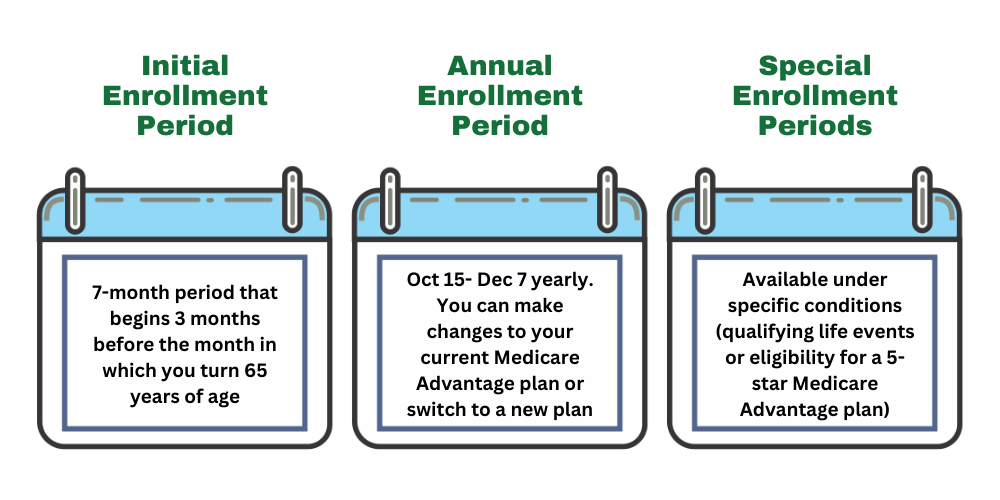

Understanding the enrollment periods for Medicare Advantage plans is vital for ensuring you get the coverage you need when you need it. The Initial Enrollment Period (IEP) is the first opportunity for new Medicare beneficiaries to sign up for a Medicare Advantage plan. This period starts three months before you turn 65, includes your birthday month, and continues for three months after. During this time, you can choose a plan that best fits your needs without any late enrollment penalties.

The Annual Election Period (AEP) occurs each fall, from October 15 to December 7, allowing existing Medicare beneficiaries to make changes to their current plans. This is an important time to review your coverage and make adjustments based on any changes in your health or personal circumstances.

Additionally, Special Enrollment Periods (SEPs) are available for those who experience certain life events, such as moving to a new area or losing other health coverage, allowing them to enroll in or switch plans outside the regular enrollment times.

Possible Benefits and Features

Some UnitedHealthcare Medicare Advantage plans in Alabama may come with a host of potential benefits and features that could enhance the healthcare experience for seniors. Certain plans may combine medical benefits with additional services that are not typically covered by Original Medicare, such as dental, vision, and hearing care. This comprehensive approach could potentially ensure that members have access to the care they need, all under one plan.

Potential Benefits

One of the potential advantages of UnitedHealthcare Medicare Advantage plans could be the range of potential benefits they offer. Some plans may include dental, vision, and hearing coverage as part of their coverage. These services could potentially enhance the overall health and well-being of members, possibly providing access to preventive care and wellness programs that are not covered by Original Medicare.

For example, dental care may include routine exams, cleanings, and even more complex procedures like fillings and extractions. Vision benefits might cover annual eye exams and discounts on glasses or contact lenses, while hearing benefits may include coverage for hearing aids.

Prescription Drug Coverage

Prescription drug coverage could be a crucial component in certain UnitedHealthcare Medicare Advantage plans. Some plans may include an integrated Medicare Part D prescription drug benefit, possibly covering a wide range of medications. This potential integration could simplify the process of managing prescriptions, as members do not need to enroll in a separate Medicare prescription drug plan.

The prescription drug coverage under these plans may also feature a tiered formulary, which categorizes medications into different cost levels. This structure helps manage medication costs more effectively, possibly ensuring that members can afford the prescriptions they need.

The potential inclusion of prescription drug coverage in a UnitedHealthcare Medicare Advantage plan could make it easier for members to access and afford their medications.

Comparing UnitedHealthcare Medicare Advantage Plans vs. Original Medicare

When comparing UnitedHealthcare Medicare Advantage plans to Original Medicare, several differences might stand out. Some UnitedHealthcare Medicare Advantage plans may offer a range of features that could go beyond what is provided by Original Medicare. These plans may provide comprehensive coverage, which might include additional benefits like dental, vision, and hearing coverage, which are not typically included in Original Medicare.

Cost Comparison

Cost will likely be a crucial factor when comparing Medicare Advantage plans to Original Medicare. Certain UnitedHealthcare Medicare Advantage plans might offer low premiums, potentially making them an affordable option for beneficiaries.

However, it’s important to note that these plans may also come with additional costs, such as copayments for services, which might vary significantly from the flat fees associated with Original Medicare.

Understanding these cost structures is essential for making an informed decision.

Network of Providers

One of the main differences between Medicare Advantage plans and Original Medicare will likely be the network of providers. UnitedHealthcare Medicare Advantage plans generally operate with a specific network of providers, which may require members to use in-network doctors for the lowest costs. This network-based approach could help coordinate care more effectively but may limit the choice of healthcare providers compared to Original Medicare, which allows beneficiaries to see any doctor who accepts Medicare.

However, some UnitedHealthcare plans, such as Preferred Provider Organization (PPO) plans, might offer more flexibility by allowing members to seek care outside their network, typically at a higher cost. This flexibility could be beneficial for those who want more freedom in choosing their healthcare providers.

It’s important to consider these potential network restrictions when selecting a plan, as they could impact your access to care.

How to Choose the Right Plan

Choosing the right Medicare Advantage plan likely requires careful consideration of your healthcare needs, personal preferences, and budget. UnitedHealthcare will likely offer a variety of plans, each with different benefits and features, making it essential to evaluate what is most important to you.

Whether you prioritize low out-of-pocket costs, access to specific healthcare providers, or potential benefits like dental and vision care, there may be a plan that fits your needs.

Reviewing the plan’s contract renewal with Medicare and any annual changes may also affect your coverage and costs. Taking the time to assess your options and understand the details of each plan could help you make an informed decision that aligns with your healthcare goals.

Assessing Your Health Needs

Evaluating your health needs is a critical step in choosing the right Medicare Advantage plan. Members should consider their current health status, any ongoing medical conditions, and the frequency of doctor visits and treatments they may require. By understanding their healthcare needs, members can choose a plan that provides the necessary coverage and benefits to support their health and well-being.

Checking Plan Availability

Checking the availability of specific Medicare Advantage plans in your area is crucial before making a decision. Members can enter their ZIP code to this website to figure out which plans are available in their local area.

This step ensures that you choose a plan that is accessible and meets your healthcare needs.

Understanding Plan Ratings

Medicare Star Ratings could be an important tool for evaluating the quality of Medicare Advantage plans. These ratings measure various performance metrics, including member satisfaction, health outcomes, and the quality of care provided. Higher Star Ratings indicate better plan performance and quality, possibly making them a crucial factor to consider when selecting a plan.

By understanding these ratings, you can make an informed choice that aligns with your expectations for care.

UnitedHealthcare Dual Complete Plans

UnitedHealthcare might offer Dual Complete Plans specifically designed for individuals who are eligible for both Medicare and Medicaid. These plans, classified as HMO-POS Dual Special Needs Plans (D-SNPs), may provide comprehensive coverage by potentially combining benefits from Medicare Parts A, B, and D. This potential integration could ensure that members receive the care and support they need, tailored to their specific health and financial circumstances.

Dual Complete Plans may also offer a range of potential benefits and services that cater to the unique needs of their members. Some plans might offer additional benefits like dental, vision, and hearing coverage.

The availability and details of these benefits may vary by plan area, so it’s important to review the specific benefits features of the plan you are considering.

Eligibility and Enrollment

Eligibility for UnitedHealthcare Dual Complete Plans likely requires individuals to have both Medicare Medicaid and Medicaid. Enrollment typically involves providing personal information and proof of eligibility, which may vary by plan and state. If you qualify for these plans, each plan could offer significant benefits and support, particularly for those with limited income and resources.

Potential Benefits and Services

The UnitedHealthcare Dual Complete Plans may offer a comprehensive range of benefits and services designed to meet the needs of dual-eligible individuals. Some plans may combine coverage from Medicare Parts A, B, and D, providing hospital care, outpatient care, and possibly prescription drug coverage.

Additionally, they may also include extra benefits like dental, vision, and hearing coverage, possibly enhancing the overall healthcare experience.

These potential benefits, along with possible premiums, and co-payments may change annually on January 1, so it’s crucial to review your plan’s details regularly to stay informed about any updates.

Coordination of Care

Care coordination will likely be an important feature of UnitedHealthcare Dual Complete Plans, helping members manage their complex health needs. Network providers work closely with members to coordinate access to specialists and other healthcare services through their primary care physician. This coordinated approach could potentially ensure that members receive the necessary care in a timely and efficient manner, improving health outcomes and overall satisfaction.

Member Resources and Support

UnitedHealthcare offers a range of resources and support services to help members manage their healthcare. From customer service to the Nurse Hotline, there are multiple ways for members to get the assistance they need. These resources are designed to provide guidance and support, ensuring members have access to the information and care they require.

Customer Service

Customer service is available 24/7 through the UnitedHealthcare app or by calling the number listed on your member ID card. This ensures that members can receive assistance and support at any time, whether they have questions about their benefits or need help with a specific issue.

Utilizing these contact methods ensures that members can get the help they need promptly.

Summary

UnitedHealthcare Medicare Advantage plans in Alabama will likely offer a comprehensive range of benefits and features designed to meet the diverse healthcare needs of seniors. From potential benefits like dental and vision care to the possibility of having integrated prescription drug coverage, these plans could provide a robust solution for managing your health.

By understanding the different types of plans, eligibility requirements, and potential benefits, you can make an informed decision that best suits your healthcare needs. Take advantage of the resources and support available to ensure you get the most out of your Medicare Advantage plan.

Frequently Asked Questions

→ What types of Medicare Advantage plans does UnitedHealthcare offer in Alabama?

UnitedHealthcare offers Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNP) in Alabama, providing varying levels of flexibility and coverage to suit different needs.

→ Who is eligible for UnitedHealthcare Dual Complete Plans?

To be eligible for UnitedHealthcare Dual Complete Plans, you must qualify for both Medicare and Medicaid.

→ What additional benefits could UnitedHealthcare Medicare Advantage plans offer?

Some UnitedHealthcare Medicare Advantage plans may include added benefits like dental, vision, and hearing coverage that Original Medicare does not typically cover. This could potentially enhance your overall healthcare experience.

→ How can I check the availability of Medicare Advantage plans in my area?

To check the availability of Medicare Advantage plans in your area, utilize the ZIP code tool on this website. This will provide you with specific plan options based on your location.

→ What should I do if I need urgent medical care?

If you need urgent medical care, it’s crucial to call 911 or go directly to the nearest emergency room for immediate assistance. Seeking prompt help ensures your situation is addressed swiftly and effectively.

ZRN Health & Financial Services, LLC, a Texas limited liability company