Medicare Advantage Plans Minnesota 2026

Looking ahead to 2026, understanding the Medicare Advantage plans in Minnesota for 2026 options is essential. This article highlights the available plan options, along with detailed information on the possible benefits, costs, and enrollment processes for the coming year.

Key Takeaways

- Some Minnesota Medicare Advantage Plans may provide additional healthcare coverage, which may include dental, vision, and hearing care not covered by Original Medicare.

- There are various types of Medicare Advantage plans in Minnesota, including HMOs, PPOs, and Special Needs Plans (SNPs), each offering unique benefits tailored to different healthcare needs.

- Understanding the enrollment process, including the Initial Enrollment Period (IEP) and the Annual Enrollment Period (AEP), is crucial for beneficiaries to secure appropriate coverage and avoid missing out on options.

Compare Plans in One Step!

Enter Zip Code

Understanding Minnesota Medicare Advantage Plans

Minnesota Medicare Advantage Plans are provided by private companies that contract with Medicare to deliver Part A and B benefits. These plans could offer an alternative to Original Medicare, possibly reducing out-of-pocket costs and occasionally offering additional benefits. Enrolling in a Medicare Advantage Plan could lead to significant savings and access to a broader range of healthcare services.

These plans typically have a network of providers, meaning participants may face different costs and coverage measures than those under Original Medicare. Additionally, some Medicare Advantage Plans may include extra benefits not covered by Parts A and B, such as dental, vision, and hearing care.

It’s worth noting that individuals with pre-existing conditions, except those with End-Stage Renal Disease, can join these plans.

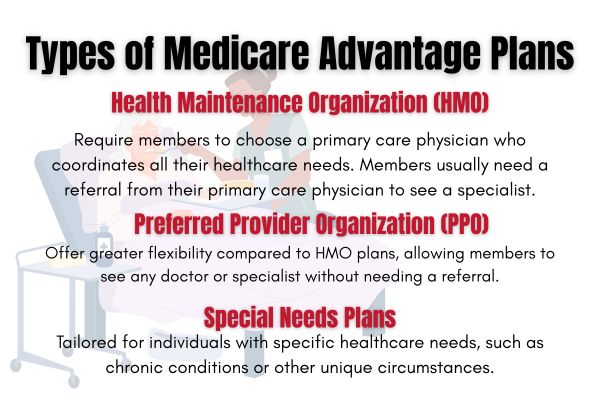

Types of Minnesota Medicare Advantage Plans Available

Minnesota will likely offer a variety of Medicare Advantage plans, including HMO, PPO, and Special Needs Plans (SNPs). Each type of plan provides unique benefits and coverage options, catering to the diverse needs of enrollees.

Knowing the differences between these plans could help in selecting the right one for your healthcare needs.

HMO Plans

Health Maintenance Organizations (HMOs) have been a popular choice in Minnesota, emphasizing preventive care and wellness services. Members typically need to use a network of doctors and facilities, and must select a primary care physician who coordinates their healthcare needs. This structure might result in lower premiums compared to other Medicare Advantage options.

However, members must receive care from providers within the plan’s network, except in emergencies. This requirement likely ensures that care is coordinated and costs are kept in check.

PPO Plans

Preferred Provider Organizations (PPOs) offer greater flexibility than HMOs, allowing members to see any healthcare provider, though costs may be lower when using a network provider. In Minnesota, PPO plans often include flexible provider options, enabling members to see specialists without a referral. This flexibility could be a significant advantage for those who need specialized care.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health needs, likely offering specialized benefits and services. These plans cater to specific populations, such as those eligible for both Medicare and Medicaid.

Enrollment in SNPs typically requires individuals to have Medicaid alongside their Medicare coverage. These plans combine Medicare Parts A and B, and sometimes Part D for prescription drug coverage, possibly providing a comprehensive healthcare solution tailored to the unique needs of the enrolled population.

Overview of Minnesota Medicare Advantage Plans

Minnesota Medicare Advantage plans could provide a comprehensive alternative to Original Medicare, combining the coverage of Parts A and B, occasionally with additional benefits. These plans will likely be designed to provide enrollees with more extensive coverage options and some might include services not available under Original Medicare, such as dental, vision, and hearing services.

Selecting a Medicare Advantage plan in Minnesota likely requires knowing the possible benefits and coverage options available. With a variety of plans to choose from, enrollees could select the one that best fits their healthcare needs and financial situation. The flexibility and potential benefits could make these plans an attractive option for many Medicare beneficiaries.

Potential Benefits of Minnesota Medicare Advantage Plans 2026

Some Minnesota Medicare Advantage Plans may offer extra benefits that could make them an appealing choice for many beneficiaries. One of the potential advantages could be the additional benefits not covered by Original Medicare, such as dental, vision, and hearing care. These potential benefits could potentially enhance the quality of life for enrollees by addressing essential health needs.

Some plans may also offer lower costs compared to Original Medicare, such as premiums and copays, likely making healthcare more affordable. The flexibility to choose from different types of plans, such as HMO, PPO, and SNP, allows enrollees to find a plan that best fits their healthcare needs and financial situation.

Enrollment Process for Minnesota Medicare Advantage Plans 2026

Enrolling in a Minnesota Medicare Advantage plan involves selecting the type of plan that best suits your needs, such as a Medicare Advantage or Medicare Cost plan. To be eligible, individuals must be enrolled in Medicare Part A and Part B.

The enrollment process is straightforward, but it’s essential to understand the different periods when you can enroll to ensure you don’t miss out on coverage opportunities.

When to Enroll

The Initial Enrollment Period (IEP) is the first opportunity to enroll in a Medicare Advantage plan. This period starts three months before you turn 65 and lasts until three months after your birthday month. Individuals under 65 who qualify for Medicare due to a disability can enroll in Medicare Advantage plans 24 months after receiving Social Security Disability benefits.

Another crucial enrollment period is the General Enrollment Period (GEP), which occurs every year from January 1 to March 31. During this time, individuals who missed other enrollment opportunities can sign up for Medicare Advantage plans.

The Annual Enrollment Period (AEP) from October 15 to December 7 allows beneficiaries to make changes to their Medicare coverage for the upcoming year.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Different Enrollment Periods

Several key enrollment periods exist for Medicare plans. The Initial Enrollment Period lasts seven months around the age of 65, including three months before, the month of, and three months after your birthday. The Annual Enrollment Period (AEP) occurs from October 15 to December 7 each year, allowing beneficiaries to change their Medicare coverage.

The Medicare Advantage Open Enrollment Period (OEP) runs from January 1 to March 31, providing an opportunity for those enrolled in a Medicare Advantage plan to make one-time changes. Additionally, a Special Enrollment Period (SEP) is available for individuals who experience specific life events, such as moving or losing existing health coverage, enabling them to switch or enroll in a new plan outside regular periods.

OEP, AEP, Special Enrollment

During the Open Enrollment Period (OEP) from January 1 to March 31, individuals can change their Medicare Advantage plan under certain circumstances. This period is crucial for making adjustments to ensure your plan meets your healthcare needs. The Annual Enrollment Period (AEP) from October 15 to December 7 is another critical time for making changes to your Medicare coverage.

A Special Enrollment Period (SEP) may be available under specific circumstances, such as losing employer coverage or moving to a new area. This flexibility ensures that beneficiaries can maintain appropriate coverage regardless of life changes.

Possible Costs Associated with Minnesota Medicare Advantage Plans

Understanding the potential costs associated with Minnesota Medicare Advantage plans will likely be essential for making informed decisions. These costs may include various premiums, copays, and out-of-pocket maximums, which might vary depending on the specific plan and coverage options chosen.

Premiums and Co-Pays

Some Medicare Advantage plans in Minnesota may offer lower monthly premiums, possibly making them more affordable for enrollees. In-network primary care visits under certain plans may also have a lower copay, potentially reducing out-of-pocket costs for routine healthcare.

Lower premiums and copays could make Medicare Advantage plans appealing for those looking to manage healthcare expenses effectively. It’s important to review the specific costs associated with each plan to determine the best fit for your budget and healthcare needs.

Out-of-Pocket Maximums

Out-of-pocket maximums will likely be a critical aspect of Medicare Advantage plans, possibly capping the total amount members must pay for covered services in a year. These potential maximums could provide financial protection against high medical costs, possibly ensuring that once you’ve reached the limit, the plan covers up to 100% of additional costs.

The range of coverage might vary depending on the specific plan and the network of providers. Knowing these limits could help beneficiaries plan for potential healthcare expenses and avoid unexpected financial burdens.

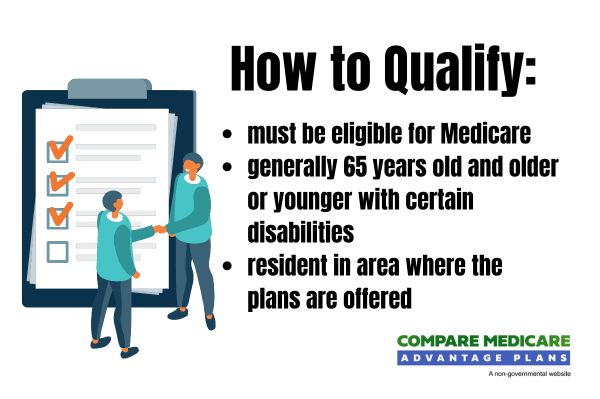

How to Qualify for Minnesota Medicare Advantage Plans

To qualify for Minnesota Medicare Advantage Plans, individuals must first be enrolled in Original Medicare Parts A and B. Eligibility typically requires individuals to be 65 years or older, or under 65 with certain disabilities. Additionally, residency in the state of Minnesota is a key requirement for qualifying for local Medicare Advantage Plans.

Those with end-stage renal disease are eligible for Medicare Advantage Plans, but specific rules may apply. Knowing these qualification criteria ensures you meet the requirements to enroll in a Medicare Advantage plan.

Contracted Network and Access to Care

Some Medicare Advantage plans may require members to utilize a predetermined network of healthcare providers to receive full benefits. HMO plans in Minnesota might restrict access to services outside the contracted network, except in emergency situations. This network ensures coordinated care and helps manage costs effectively.

PPO plans offer more flexibility, allowing members to seek care from non-network providers, usually at a higher cost. Special Needs Plans (SNPs) may integrate Medicare hospital and doctor coverage tailored for specific groups. Access to a wide network of healthcare providers, including major hospitals and clinics, likely enhances the quality of care for members.

Comparing Minnesota Medicare Advantage Plans to Original Medicare

Comparing Minnesota Medicare Advantage Plans to Original Medicare might reveal several possible differences. Some Medicare Advantage plans may provide additional benefits not found in Original Medicare, such as dental, vision, and hearing programs. These plans also combine the coverage of Parts A and B, offering a more comprehensive healthcare solution.

Knowing these differences could help beneficiaries choose the plan that best meets their healthcare needs.

Coverage Differences

Certain Medicare Advantage plans in Minnesota may include additional benefits not found in Original Medicare, such as vision and dental care. Original Medicare primarily covers hospital and outpatient care, while some Medicare Advantage plans may incorporate extra services. This potential coverage could potentially enhance the quality of care and support overall health and well-being.

Medicare Supplement policies, also known as Medigap plans, will likely be designed to fill in the gaps left by Original Medicare coverage, possibly providing additional benefits and financial protection.

Cost Comparisons

Minnesota Medicare Advantage plans might have varying premiums, possibly allowing beneficiaries to choose a plan that fits their budget and healthcare needs.

Original Medicare will likely cover up to 80% of hospital and outpatient costs, whereas certain Medicare Advantage plans may offer additional benefits at a different cost structure. Knowing these potential cost differences could be crucial for making informed decisions about your healthcare coverage.

Emergencies and Referrals

Medicare Advantage plans typically cover emergency services anywhere in the United States, even if the provider is outside the plan’s network. This nationwide coverage likely ensures that beneficiaries could have access to necessary care in emergencies, providing peace of mind when traveling. However, referrals may be required for non-emergency specialist visits, depending on the type of Medicare Advantage plan one is enrolled in.

Familiarizing yourself with your specific plan’s referral policies may help you avoid unexpected costs. When traveling outside the U.S., only emergency services are covered under Medicare Advantage plans. Knowing these coverage details helps beneficiaries plan for potential healthcare needs and ensures they receive appropriate care when needed.

Summary

Minnesota Medicare Advantage Plans for 2026 will likely offer a range of options and potential benefits that could cater to diverse healthcare needs. From HMO, PPO, and SNP plans to possible benefits like dental, vision, and hearing services, these plans could provide comprehensive coverage and financial protection. Understanding the enrollment process, possible costs, and coverage differences between Medicare Advantage and Original Medicare is crucial for making informed decisions. As you navigate your healthcare options, consider the unique benefits and flexibility that Minnesota Medicare Advantage Plans could offer to ensure you receive the best possible care.

Frequently Asked Questions

→ What are the differences between Minnesota Medicare Advantage Plans and Original Medicare?

The differences between Minnesota Medicare Advantage Plans and Original Medicare will likely be the additional benefits that might be offered in certain Medicare Advantage plans. These potential benefits might include dental, vision, and hearing services, and sometimes prescription drug coverage. These additional benefits could make Medicare Advantage Plans a potentially more robust option for those seeking extra coverage.

→ When is the best time to enroll in a Minnesota Medicare Advantage Plan?

The best time to enroll in a Minnesota Medicare Advantage Plan is during your Initial Enrollment Period, which spans three months before and after you turn 65. Additionally, consider the Annual Enrollment Period from October 15 to December 7 for potential changes to your plan.

→ What additional health services could Minnesota Medicare Advantage Plans offer?

Some Minnesota Medicare Advantage Plans may offer additional health services such as dental, vision, and hearing coverage.

→ Can I see any doctor with a Minnesota Medicare Advantage Plan?

You will likely be able to see any doctor with a Minnesota Medicare Advantage Plan depending on your specific plan type. HMO plans require network providers, while PPO plans offer more flexibility to see non-network doctors, albeit at a higher cost.

ZRN Health & Financial Services, LLC, a Texas limited liability company