Medicare Advantage Plans Hawaii 2026

Curious about the potential Medicare Advantage plans in Hawaii

Key Takeaways

- Hawaii Medicare Advantage Plans could provide a comprehensive alternative to Original Medicare, sometimes featuring additional benefits such as dental, vision, and hearing coverage.

- Various types of Medicare Advantage Plans are available in Hawaii, including HMO, PPO, and Special Needs Plans (SNPs), each offering distinct coverage options and requirements for care coordination.

- Enrollment in Hawaii Medicare Advantage Plans requires participants to meet specific criteria, including having Medicare Part A and B, with important enrollment periods occurring annually and during special circumstances.

Compare Plans in One Step!

Enter Zip Code

Understanding Hawaii Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, could act as an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and might include additional benefits such as dental, vision, and hearing services, which are not typically covered by Original Medicare. To be eligible for these plans, you must be enrolled in both Medicare Part A and Part B.

Types of Hawaii Medicare Advantage Plans Available

Several Medicare Advantage plans will likely be available for Hawaii residents and could cater to different healthcare needs and preferences. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each plan type offers unique features and benefits.

HMO Plans

HMO plans require members to choose a primary care physician (PCP) and obtain referrals to see specialists. This structure helps coordinate care and may result in lower monthly premiums compared to other plan types. However, coverage under HMO plans is generally limited to a specific network of doctors and hospitals. Patients enrolled in HMO plans may be required to receive care from in-network providers to maximize benefits.

PPO Plans

PPO plans provide more flexibility in choosing healthcare providers and do not require referrals for specialists. These plans typically include coverage for both in-network and out-of-network services, allowing members to visit any doctor or hospital. However, members may pay higher premiums for the increased flexibility and broader provider access offered by PPO plans.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health conditions, providing specialized care and services to meet their unique needs. In Hawaii, Dual Eligible Special Needs Plans (D-SNPs) will likely be designed for individuals who qualify for both Medicare and Medicaid, ensuring coordinated care across both programs.

Hawaii offers two main types of D-SNPs: Highly Integrated Dual Eligible Special Needs Plans (HIDE SNPs) and Fully Integrated Dual Eligible Special Needs Plans (FIDE SNPs). Enrollment in HIDE SNPs allows individuals to receive Medicare and Medicaid benefits from different organizations, while FIDE SNPs require both benefits to be managed under the same organization.

These plans provide a model of care that addresses the unique needs of their dual eligible members, including coverage for hospital and medical services.

Overview of Hawaii Medicare Advantage

Some Medicare Advantage plans in Hawaii may offer additional benefits that could go beyond Original Medicare. Certain plans may include coverage for routine dental, hearing, and vision services, which are not typically covered by Original Medicare.

Availability of Medicare Advantage plans may vary by island, with some regions having more options than others. Understanding these potential offerings could help you make a more informed decision about your healthcare coverage.

Covered Services and Potential Benefits

Medicare Advantage plans will likely encompass a wide range of medical services through various plan types, such as HMO and PPO, and some might integrate additional benefits like vision and dental coverage. These plans typically cover emergency services, inpatient hospital care, outpatient care, and sometimes prescription drugs.

Possible Benefits of Hawaii Medicare Advantage Plans

Certain Medicare Advantage plans in Hawaii may offer lower monthly premium, likely making them financially accessible. Some plans may also incorporate comprehensive dental, vision, and hearing benefits, possibly exceeding what Original Medicare offers.

Enrollment Process for Hawaii Medicare Advantage Plans 2026

Beneficiaries must follow the guidelines set by the Social Security Administration to enroll in California Hawaii Medicare Advantage plans. Enrollment requires individuals to have Medicare Part A and Part B, and they must reside in the plan’s service area.

To enroll, use this website or call our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Understanding these requirements is the first step towards securing the healthcare coverage you need.

When to Enroll

Individuals are encouraged to start the enrollment process for Medicare Part B three months before reaching age 65 to avoid coverage gaps. The initial enrollment period for Medicare begins three months before you turn 65 and lasts until three months after your birthday month, providing a total of seven months to enroll.

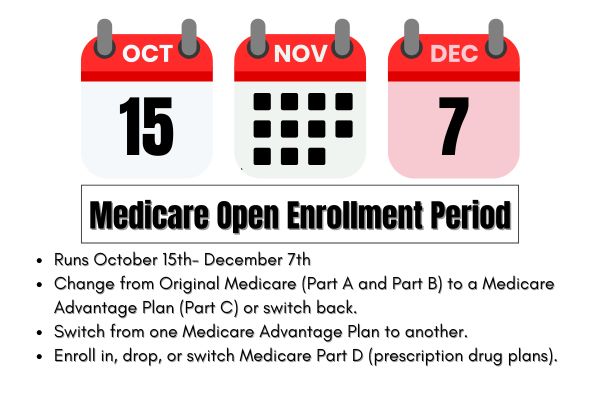

The annual enrollment period for Medicare Advantage plans runs from October 15 to December 7 each year, during which you can make changes to your Medicare plan. Additionally, the Medicare Advantage Open Enrollment Period from January 1 to March 31 allows members to switch plans or revert to Original Medicare.

Special Enrollment Periods are available for those who experience qualifying life events, allowing them to adjust their plans outside the standard enrollment windows.

Different Enrollment Periods

The Initial Enrollment Period (IEP) lasts seven months, covering three months before and after the month of turning 65. New Medicare beneficiaries can enroll outside the regular enrollment period during a special enrollment period if they meet specific criteria.

The annual enrollment window for Medicare Advantage is from October 15 to December 7, allowing new plan selections to start on January 1 the following year. Individuals qualifying for special enrollment can apply outside the standard enrollment dates based on specific life events. Eligible applicants must provide their Medicare number and may require their primary care provider’s information during the enrollment process.

OEP, AEP, Special Enrollment

The Special Enrollment Period allows for an eight-month window to enroll in Medicare after a group health plan ends. The Open Enrollment Period (OEP) allows changes to coverage from January 1 to March 31 each year.

Special Enrollment Periods occur when significant life events, such as moving or losing other coverage, enable beneficiaries to make changes to their Medicare plans.

Potential Costs Associated with Hawaii Medicare Advantage Plans

Certain Medicare Advantage plans might offer competitive costs compared to Original Medicare, potentially lowering overall expenses for beneficiaries. These plans might cover more services than Original Medicare, which could potentially lead to lower overall costs for beneficiaries.

Premiums and Co-Pays

The premiums for Medicare Advantage plans could vary widely, and members will likely be required to pay a copayment for each healthcare service they use.

Out-of-Pocket Maximums

Certain Medicare Advantage plans may incorporate an out-of-pocket maximum, which may limit the total amount members may spend on covered services each year. This limit might include deductibles, co-pays, and coinsurance, but does not cover premium payments.

Each Medicare Advantage plan will likely have a specific out-of-pocket maximum that might vary by plan, ensuring members know their maximum potential spending. These out-of-pocket maximums could help seniors manage their healthcare costs effectively.

Covered Services and Potential Benefits

Medicare Advantage plans will likely provide a variety of medical benefits, including access to both HMO and PPO options. Some plans may also cover dental, vision, and hearing care, in addition to standard medical coverage. Certain Medicare Advantage plans might include prescription drug coverage as part of many of their plans.

How to Qualify for Hawaii Medicare Advantage Plans

Individuals qualify for Medicare in Hawaii if they are at least 65 years old or meet specific health conditions such as having end-stage renal disease or receiving disability benefits. Residents must also be U.S. citizens or legal residents for a minimum of five years. Individuals under 65 may qualify if they have amyotrophic lateral sclerosis (ALS) or have received a kidney transplant.

The initial enrollment period for Medicare starts three months before an individual turns 65 and ends three months after their birthday month. Hawaii will likely offer numerous Medicare Advantage plans, and all residents with Medicare can purchase coverage. Ensuring you meet these criteria is the first step towards enrolling in a Medicare Advantage plan.

Contracted Network and Access to Care

Medicare Advantage plans offer a variety of networks, including PPO and HMO, which dictate how members access care and providers. Members in PPO plans can choose providers both inside and outside the network, with lower costs associated with network providers. HMO plans typically require members to select a primary care physician (PCP) who coordinates all care and refers them to specialists.

Emergency services are covered by plans regardless of whether the provider is in-network or out-of-network.

Comparing Hawaii Medicare Advantage Plans to Original Medicare

Medicare Advantage plans could potentially provide broader benefits compared to Original Medicare, which might include additional services like dental and vision care.

Understanding the differences in coverage and costs could help you make an informed decision about which plan best suits your needs.

Coverage Differences

Unlike Original Medicare, some Medicare Advantage plans might offer extra coverage for preventative services, and sometimes incorporate prescription drug coverage. Possible benefits like dental, vision, and hearing care may be included in some plans, while Original Medicare typically does not cover these services. Medicare Advantage plans will likely have different rules and costs associated with obtaining care compared to Original Medicare.

Cost Comparisons

Medicare Advantage plans could be more cost-effective since they could bundle services that may require separate payments under Original Medicare. Certain Medicare Advantage plans may offer lower monthly premiums.

Medical deductibles for Medicare Advantage plans may differ based on whether the services are received in-network or out-of-network.

By entering your zip code into the Plan Finder Tool on this website, prospective members can evaluate costs and possible benefits of Medicare Advantage plans against Original Medicare.

Emergencies and Referrals

In Medicare Advantage plans, referrals may be needed for specialist care, differing by plan type. Health Maintenance Organization (HMO) plans typically require a primary care doctor to provide a referral for specialist services.

In Preferred Provider Organization (PPO) plans, a member does not need referrals to see specialists. Private Fee-for-Service (PFFS) plans allow members to see any doctor who accepts the plan’s payment terms without needing referrals.

Special Needs Plans (SNPs) require members to get a referral from their primary care doctor to access specialist services. Medicare Advantage plans often allow direct access to emergency services without a referral.

Summary

Choosing the right Medicare Advantage plan in Hawaii can significantly impact your healthcare experience. From understanding the different types of plans available to knowing the enrollment process and potential costs, being informed is key. Some Medicare Advantage plans may offer numerous benefits that Original Medicare does not, such as additional coverage for dental, vision, and hearing services. As you navigate your options

Frequently Asked Questions

→ What are the eligibility criteria for Hawaii Medicare Advantage plans in 2026 ?

You must be enrolled in Medicare Part A and Part B and reside in the plan’s service area to qualify for Hawaii Medicare Advantage plans.

→ How do I know which type of Medicare Advantage plan is right for me?

To determine the right Medicare Advantage plan for you, evaluate your healthcare needs and preferences, such as whether you value the flexibility of a PPO or the coordinated care of an HMO. Consider any specific health conditions that might necessitate a Special Needs Plan (SNP). This targeted approach could help you choose the plan that best fits your situation.

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the annual enrollment period from October 15 to December 7. Additionally, there are initial and special enrollment periods based on specific circumstances.

→ Are there additional benefits with Medicare Advantage plans compared to Original Medicare?

Some Medicare Advantage plans may provide additional benefits like dental, vision, hearing services, and sometimes prescription drug coverage, that are not included in Original Medicare. Choosing a Medicare Advantage plan could potentially enhance your healthcare coverage.

→ What costs should I consider when choosing a Medicare Advantage plan?

When choosing a Medicare Advantage plan, it’s important to consider the potential premiums, co-pays, and out-of-pocket maximums. These costs could significantly impact your overall healthcare expenses.

ZRN Health & Financial Services, LLC, a Texas limited liability company