Enrollment Process for Devoted Medicare Advantage Plans

To enroll in a Devoted Medicare Advantage Plan, individuals must have Medicare Part A and Part B, reside within the plan’s service area, and be U.S. citizens or legally present. Members can enroll by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Knowing the enrollment process and timing ensures continuous and comprehensive coverage.

When to Enroll

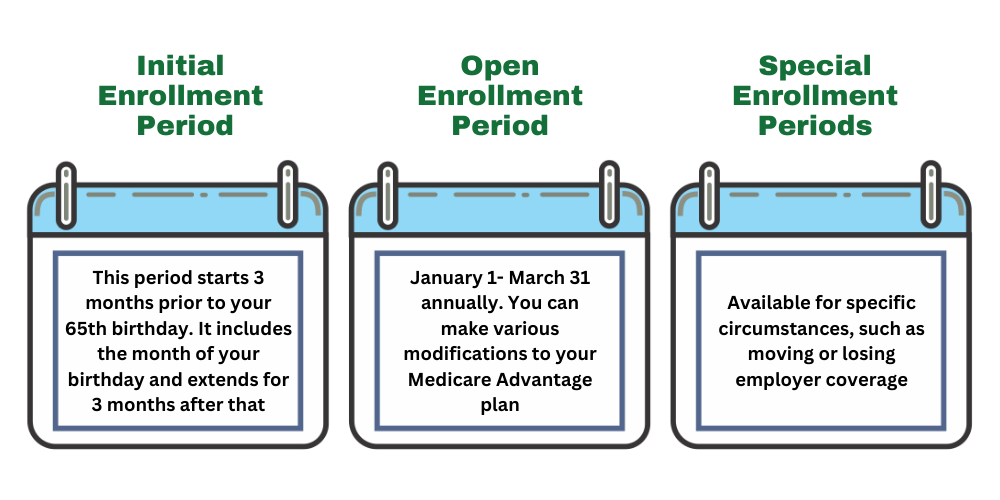

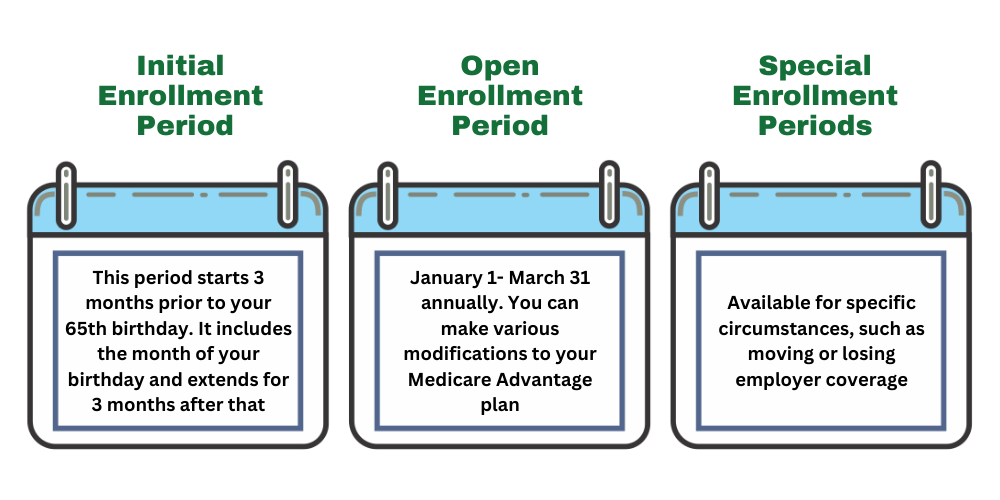

The Initial Enrollment Period for Medicare Advantage Plans starts three months before the individual becomes eligible for Medicare and ends three months after. New Medicare beneficiaries can enroll in a plan that suits their needs during this period.

The Open Enrollment Period from October 15 to December 7 allows individuals to switch or drop their Medicare Advantage plans. Beneficiaries already enrolled in a Medicare Advantage plan can make changes from January 1 to March 31 each year.

Certain life events can trigger a Special Enrollment Period, allowing enrollment or plan changes outside regular periods.

Different Enrollment Periods

There are specific enrollment periods, including the Open Enrollment Period from October 15 to December 7, during which individuals can join, switch, or drop plans. The Initial Enrollment Period lasts seven months, beginning three months before turning 65 and ending three months after.

During the Annual Enrollment Period from October 15 to December 7, individuals can make changes to their Medicare coverage. The Medicare Advantage Open Enrollment Period from January 1 to March 31 allows switching between Medicare Advantage plans or Original Medicare.

A Special Enrollment Period can be triggered by life events, such as moving out of a service area or losing existing coverage.

OEP, AEP, Special Enrollment

The Special Enrollment Period allows individuals to enroll or switch plans due to life events, such as moving or losing other insurance coverage. The Annual Election Period (AEP) allows Medicare beneficiaries to enroll in or switch their Medicare Advantage plans each year.

The Open Enrollment Period (OEP) allows beneficiaries to make changes to their Medicare Advantage plans outside the AEP. Special Enrollment Periods (SEPs) allow beneficiaries to enroll in a Medicare Advantage plan outside of the typical enrollment periods due to qualifying events.

Costs Associated with Devoted Medicare Advantage Plans

Devoted Medicare Advantage plans offer comprehensive medical coverage similar to Original Medicare, which may also offer additional benefits that could potentially lower overall healthcare costs. Knowing the possible costs associated with these plans, including premiums and out-of-pocket expenses, will likely be crucial for making an informed decision.

Premiums and Co-Pays

Some of the Devoted Health Medicare Advantage plans may offer low premiums and co-pays for primary care visits. This financial accessibility might make it easier for Medicare beneficiaries to manage their healthcare costs. However, certain Medicare Advantage Plan costs, including premiums and out-of-pocket expenses, might differ significantly from one plan to another.

Medicare Advantage Plans typically require enrollees to continue paying the Part B premium to maintain coverage.

The out-of-pocket limit for Medicare Advantage Plans will likely vary by plan. Once reached, the plan covers all eligible services for the rest of the year. Some Medicare Advantage Plans might involve co-pays, which are a fixed fee per service or visit.

Out-of-Pocket Maximums

Certain Devoted Medicare Advantage plans might set an annual out-of-pocket maximum, possibly protecting members from excessive healthcare costs within a given year. This potential feature could have a significant advantage over Original Medicare, which lacks out-of-pocket spending limits. By potentially capping the total costs members pay for covered services, some plans could provide a safety net beneficial for those with high healthcare needs.

The out-of-pocket maximum for Devoted Medicare Advantage plans will likely vary by plan. This cap could provide peace of mind, knowing that financial exposure is limited.

How to Qualify for Devoted Medicare Advantage Plans

To qualify for Devoted Medicare Advantage plans, individuals must generally be enrolled in Medicare Part A and Part B. Eligibility for these plans may also be restricted to specific times of the year, unless you qualify for a Special Enrollment Period or are within your Initial Election Period. Check specific enrollment periods to ensure you can join or switch plans when needed.

Devoted Medicare Advantage plans will likely be available in certain counties across 13 states, affecting eligibility based on location. Those eligible for Special Needs Plans must often have specific health conditions or qualify for both Medicare and Medicaid.

Check eligibility for Devoted Medicare Advantage plans through this website or by contacting one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Contracted Network and Access to Care

Medicare Advantage plans must have a sufficient network of providers to ensure enrollees can access covered services effectively. This network must align with typical care patterns in the area, ensuring beneficiaries have access to healthcare services without significant barriers. Devoted Health will likely ensure its network of providers is comprehensive and accessible, providing members with the care they need when they need it.

In areas with multiple network-based plans, specific network requirements may be established for Private Fee-for-Service (PFFS) plans. CMS releases the list of network areas for Medicare Advantage plans two contract years in advance. This advance notice could allow beneficiaries to make informed decisions about their healthcare coverage, ensuring access to a sufficient network of providers.

Comparing Devoted Medicare Advantage Plans to Original Medicare

Medicare Advantage plans, including Devoted Medicare, could provide coverage through private insurers and might include additional benefits not found in Original Medicare. These potential benefits, such as dental and vision care, could make certain Medicare Advantage plans attractive for many beneficiaries.

The following subsections detail the coverage differences and possible cost comparisons between Devoted Medicare Advantage plans and Original Medicare.

Coverage Differences

Some Medicare Advantage plans might cover services like dental, vision, and hearing, which are not included in Original Medicare. Traditional Medicare does not impose network restrictions, allowing beneficiaries to choose any doctor or hospital that accepts Medicare, while certain Medicare Advantage plans may have specific network limitations. This flexibility in provider choice could be a significant factor for many beneficiaries when deciding between the two options.

Cost Comparisons

Certain Medicare Advantage plans may have low or even zero monthly premiums, but beneficiaries still need to pay the Medicare Part B premium. Out-of-pocket costs under Traditional Medicare might be significant due to potential caps on spending, whereas Medicare Advantage plans include an annual out-of-pocket maximum. This cap could provide financial protection for beneficiaries, ensuring their healthcare costs do not become unmanageable.

Emergencies and Referrals

In the event of an emergency, Devoted Medicare Advantage plans typically cover services even if they are received outside the network. This ensures that members have access to necessary care when they need it most.

Referrals for specialist services are often required in HMO plans, ensuring that all care is coordinated through the primary care physician. This coordination helps streamline patient care and likely ensures that all providers involved are aware of the patient’s medical history and needs.

Summary

Devoted Medicare Advantage Plans could offer a comprehensive and integrated approach to healthcare, possibly providing benefits that could go beyond what is available under Original Medicare. With options tailored to meet diverse healthcare needs, these plans will likely ensure that Medicare beneficiaries receive the care and support they need to manage their health effectively. From potential benefits like dental and vision care to financial protections like out-of-pocket maximums, Devoted Health will likely offer a robust solution for those seeking comprehensive healthcare coverage. Consider exploring Devoted Medicare Advantage Plans to find a plan that meets your healthcare needs and provides peace of mind.