Aetna Medicare Advantage Plans Maine 2026

Looking at the Aetna Medicare Advantage Plans in Maine

Key Takeaways

- Aetna will likely offer a variety of Medicare Advantage plans in Maine

for 2026 , including HMO, PPO, and specialized plans to meet diverse healthcare needs.

- Comprehensive coverage options may include additional benefits such as prescription drugs, dental, vision, and hearing services.

- The potential inclusion of prescription drug coverage

in 2026 might include an out-of-pocket spending cap and possible reduction of the coverage gap, potentially making medication more affordable for members.

Compare Plans in One Step!

Enter Zip Code

Overview of Aetna Medicare Advantage Plans in Maine 2026

Aetna will likely offer a diverse range of Medicare Advantage plans in Maine

HMO plans have been particularly popular among those who prefer a more managed approach to their healthcare. Members of Aetna’s HMO plans are required to choose an in-network primary care provider who will coordinate all their healthcare needs. This ensures that all treatments are streamlined and managed efficiently, potentially leading to lower out-of-pocket costs for the member.

On the other hand, PPO plans could offer greater flexibility, allowing members to see any provider who accepts Medicare without needing referrals. This could an excellent option for those who want more freedom in choosing their healthcare providers.

Using Aetna’s network providers could reduce costs compared to out-of-network options. Additionally, Aetna may offer HMO-POS plans that provide the flexibility of PPO plans and could potentially include the added benefit of network dental care options. These varied options likely ensure that there is a plan tailored to meet the specific needs and preferences of every individual.

Detailed Coverage Options

Some Aetna Medicare Advantage plans might include comprehensive prescription drug coverage. This could be a vital component for many, as managing medication costs will likely be a significant concern.

Some of Aetna’s Medicare Advantage plans may offer a range of additional benefits that could go beyond prescription drug coverage:

- Dental coverage, which includes checkups, cleanings, and X-rays

- Vision benefits offer annual eye exams and assistance with purchasing eyewear benefits or contact lenses

- Hearing benefits that could cover the costs of hearing aids, fittings, and annual exams

These potential benefits likely ensure that members have access to essential health services beyond just medical and prescription needs.

Overall, the detailed coverage options that will likely be provided by Aetna could ensure that all aspects of a member’s health are well taken care of.

Specialized Plans for Diverse Needs

Aetna understands that not all Medicare beneficiaries have the same healthcare needs. Therefore, they will likely offer specialized plans designed to cater to individuals with specific health requirements. These specialized plans include Dual Eligible Special Needs Plans (D-SNPs), Chronic Condition Special Needs Plans (C-SNPs), and Institutional Special Needs Plans (I-SNPs). Each of these plans is tailored to provide enhanced benefits and support to members, ensuring they receive the necessary care to manage their health effectively.

D-SNPs are designed for individuals who qualify for both Medicare and Medicaid, providing comprehensive care and integrated benefits. C-SNPs focus on individuals with chronic conditions, offering specialized services and care management.

Lastly, I-SNPs are intended for those residing in nursing homes or similar facilities, addressing their unique health needs. These specialized plans could play a crucial role in ensuring that all members receive the appropriate level of care and support they need to thrive.

Dual Eligible Special Needs Plans (D-SNPs)

Dual Eligible Special Needs Plans (D-SNPs) are specifically designed for individuals who are eligible for both Medicare and Medicaid. These plans offer an integrated approach to healthcare, combining the benefits of both programs to provide comprehensive coverage. This could mean that members may be able to receive medical, prescription drugs, and other possible benefits all under one plan, simplifying their healthcare management.

Aetna’s D-SNPs likely ensure that members could have access to a wide range of services, which might include prescription drug coverage, durable medical equipment, and Aetna Part D for other essential healthcare needs. This holistic approach could potentially ensure that dual-eligible individuals could receive the necessary care and support to manage their health effectively.

Chronic Condition Special Needs Plans (C-SNPs)

Chronic Condition Special Needs Plans (C-SNPs) are designed for individuals with specific chronic or disabling conditions. These plans focus on providing specialized care and support to help members manage their health more effectively. To qualify for a C-SNP, individuals must have Medicare and a diagnosed chronic condition that meets the plan’s criteria.

Aetna’s C-SNPs offer tailored services and care management, possibly ensuring that members receive personalized attention and support. This might include access to specialized healthcare providers, care coordination, and additional resources to manage their conditions.

By focusing on the unique needs of individuals with chronic conditions, C-SNPs help improve health outcomes and possibly enhance the quality of life for their members.

Institutional Special Needs Plans (I-SNPs)

Institutional Special Needs Plans (I-SNPs) are tailored for individuals residing in skilled nursing facilities for extended periods. These plans focus on providing coordinated care and services that address the unique health needs of residents in such facilities. To qualify, members must reside in a skilled nursing facility for at least 90 days.

Aetna’s I-SNPs will likely ensure that members receive comprehensive care, such as access to healthcare providers who specialize in geriatric care and other services designed to support the health and well-being of residents.

These specialized plans could potentially ensure that individuals in nursing facilities could receive the necessary care and support to maintain their health and quality of life.

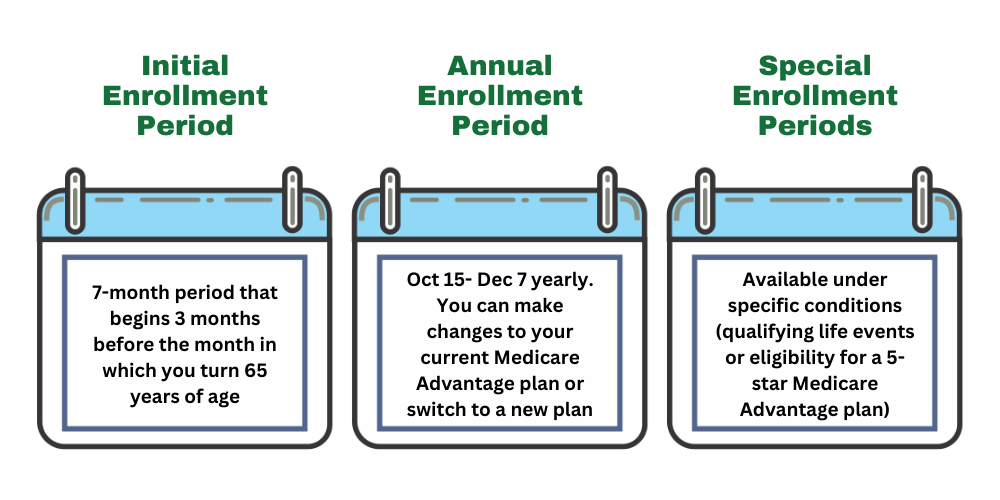

Simplified Enrollment Process

Enrolling in an Aetna Medicare Advantage plan has never been easier, thanks to the simplified enrollment process. The Annual Enrollment Period starts on October 15, 2025. It continues until December 7, 2025. For those whose plans are being discontinued, there is a Special Enrollment Period from December 8, 2025, to February 28,

Current benefits for Aetna Medicare Advantage plan members remain active until December 31, 2025. If no new plan is enrolled, members will lose coverage and revert to Original Medicare.

The enrollment process is designed to be straightforward, ensuring that members can easily transition to a new plan without any gaps in coverage. Additionally, our licensed agents can assist with the enrollment process, making it as smooth and hassle-free as possible. For assistance with enrollment, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST or enter your zip code into the zip code box on this website.

How to Choose the Right Plan

Choosing the right Medicare Advantage plan may be challenging, but members have several resources that could help. Members can enter their zip code into the zip code box on this website, which allows you to:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your personal situation.

Additionally, Aetna hosts seminars where local specialists provide information about Medicare plans and answer any questions.

When selecting a plan, it’s essential to ensure that your preferred healthcare providers are included in the plan’s network. Also, check whether the plan allows visits to out-of-network providers and understand the potential additional costs. Verifying that your regular medications are covered by the plan’s formulary could be another critical step.

Finally, analyze your budget to determine if the plan’s costs, including possible premiums and out-of-pocket expenses, are manageable. For personalized assistance, members can call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Summary

The Aetna Medicare Advantage Plans in Maine

Choosing the right plan could significantly impact your healthcare experience, but this process is made easier with a simplified enrollment process, extensive support resources, and personalized assistance. By taking advantage of the possible benefits and specialized services, you could ensure that your healthcare needs are fully met. Make an informed decision today and secure your health coverage for a better tomorrow.

Frequently Asked Questions

→ What types of Aetna Medicare Advantage plans are available in Maine for 2026 ?

Aetna Medicare Advantage plans in Maine

→ What is the out-of-pocket spending cap for prescription drugs in 2025?

The plan details

→ What are Dual Eligible Special Needs Plans (D-SNPs)?

Dual Eligible Special Needs Plans (D-SNPs) could provide integrated and comprehensive care for individuals eligible for both Medicare and Medicaid, possibly ensuring tailored healthcare services to meet their unique needs.

→ How can I get help choosing the right Aetna Medicare Advantage plan?

To choose the right Aetna Medicare Advantage plan, you can call for assistance from our licensed agents or enter your zip code into the zip code box on this website. This support ensures you make an informed decision tailored to your needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company