What Is Medicare Advantage?

Medicare Advantage plans are a popular option for seniors looking to expand their Medicare coverage. These plans are offered by private insurance companies that contract with Medicare to provide all your Part A and Part B benefits.

One of the key features of Medicare Advantage plans is their ability to offer additional services beyond what traditional Medicare covers. While Original Medicare will cover care only within the United States, Advantage plans can provide access to other benefits like vision, dental, and hearing services.

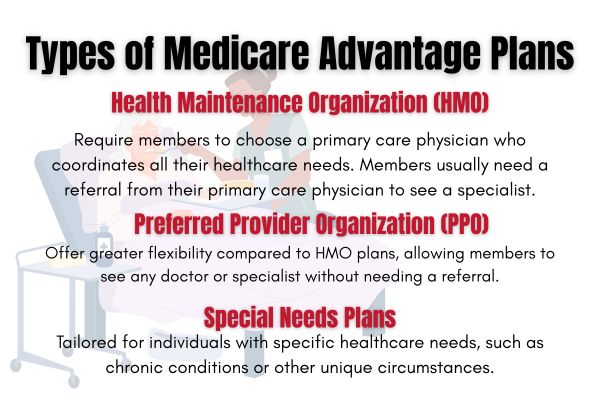

These plans come in various types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and others, each with its own network rules regarding in-network and out-of-network coverage.

When selecting Medicare Advantage, it’s essential to understand that while they often provide comprehensive health coverage, each plan is different. Specifically, when it comes to international travel, you’ll want to check with your provider about what kinds of coverage are included for medical services overseas.

Interestingly, not every Advantage plan offers coverage for foreign travel, so it’s vital to delve into the specifics of your plan. For instance, some plans provide emergency health insurance while traveling abroad, which can be invaluable in cases where domestic precautions aren’t enough.

This means if you’re traveling abroad, you might still have access to emergency care or urgent services, helping you stay safe in foreign countries.

It’s also good to note that having a plan that does cover international travel doesn’t exempt you from out-of-pocket costs. Foreign travel can come with unexpected expenses, and understanding your plan’s limitations helps mitigate surprises.

Thus, it’s crucial to ask questions about what services are covered and under what conditions your Medicare Advantage plan offers such benefits, whether it’s emergency care in overseas travel or if there are any reimbursements options for care received outside the country.

How Can Medicare Advantage Help With Travel?

For seniors who love traveling internationally, Medicare Advantage plans can be a valuable asset. One of the significant advantages is the potential for emergency care coverage when traveling abroad.

While not universal among all plans, some Medicare Advantage plans do include provisions for emergency health events in a foreign country. This feature can provide peace of mind by ensuring access to necessary medical services when out of the United States.

Traveling overseas presents unique health challenges that can be mitigated with the right insurance coverage. Medicare Advantage plans with international travel benefits can cover unexpected hospital visits or urgent care if you’re traveling abroad and encounter an emergency.

It’s crucial to understand what your specific advantage plan covers before embarking on your journey. Some plans might even have arrangements with hospitals in foreign countries, further smoothing any emergency care needs overseas.

Aside from this, evaluating the various Advantage plans available, focusing on travel benefits, can help you choose one that aligns with your needs. Consider whether the plan includes travel-related services such as emergency evacuation or support for prescription medication while you’re away from your home country.

Check if your insurance plan offers guidance or resources for finding healthcare providers abroad.

When considering travel, it’s also wise to carry contact information for your insurance company, and understand the process for filing claims when you return, as each plan’s approach may differ. Knowing these details can ease navigation through any potential hurdles you might encounter while dealing with health affairs in a foreign country.

Importantly, Medicare Advantage plans can expand your safety net beyond domestic borders, but always confirm the particulars of coverage as they can differ significantly between plans.

By assessing your needs and the plan’s features, you can travel internationally with greater assurance, supported by a plan that cushions against unforeseen health issues abroad.

When planning a trip abroad with a Medicare Advantage plan, it is important to keep the following considerations in mind:

- Contact your plan provider to clarify international coverage options before departure.

- Understand the differences between emergency and non-emergency care coverage overseas.

- Carry all necessary documents, like your Medicare Advantage card and contact details, while traveling.

- Check if additional travel insurance is advisable for broader coverage.

- Note the procedure for filing international claims and reimbursement processing times.

- Explore possible network restrictions that might affect care access internationally.

- Keep emergency contacts for medical assistance readily available during the trip.

By considering these factors, you can travel with confidence and preparedness under your Medicare Advantage plan.

Does Medicare Cover Healthcare While Traveling?

Traveling domestically or internationally can be a thrilling experience, but concerns about healthcare coverage may arise for seniors on Medicare. Understanding how Medicare Advantage plans handle such situations is crucial, especially as these plans can differ widely in the services they offer.

While Original Medicare does not typically cover healthcare outside the U.S., some Medicare Advantage plans may provide coverage for emergency care abroad. It’s important to explore the specifics of your healthcare plan to ensure you’re adequately protected.

This section delves into Medicare’s domestic and international travel coverages, highlighting what plans may offer when traveling overseas.

Coverage for Domestic and International Travel

Whether you’re visiting family across state lines or embarking on an international adventure, your healthcare coverage needs are a crucial consideration. Medicare Advantage plans sometimes extend their offerings beyond what Original Medicare can provide, especially when it comes to emergencies.

Domestically, these plans generally follow the nationwide network of providers, ensuring you can access emergency care across the United States. However, always verify your plan’s network limitations to avoid surprises when seeking medical services away from home.

For international travel, however, Medicare Advantage plans shed light on a different landscape.

Traditional Medicare does not include health coverage in foreign countries, barring a few specific circumstances, like emergencies occurring during travel to the nearest hospital outside the U.S. But here’s where Medicare Advantage might step in, some plans do cover healthcare while abroad, albeit typically for emergency situations.

It’s critical to check if your plan includes such travel benefits and under what conditions they’re applicable.

Moreover, it’s good practice for seniors planning overseas travel to carry detailed information about their insurance plan’s emergency contact numbers and procedure for handling claims while abroad. This preparation can make an enormous difference, reducing stress during emergencies.

Coverage specifics can vary, which services are deemed necessary, which hospitals are included, and any co-pays involved should be transparent before you leave. In essence, understanding the extent of your domestic and international travel coverage in advance helps avoid both healthcare and financial headaches.

What Plans Cover When Traveling Overseas?

When planning to travel abroad, understanding which Medicare Advantage plans might cover you overseas becomes essential. Unlike Original Medicare, which only covers a limited range of services in foreign countries, some Medicare Advantage plans provide more comprehensive international travel benefits.

These benefits can include emergency care, crucial when far from home. However, these offerings are not uniform across all Advantage plans, with variations depending largely on the insurance provider and the specific plan you choose.

Some Medicare Advantage plans include benefits intended for overseas travel. These might encompass hospital emergency room visits and urgent care, which can be vital in a foreign country where healthcare systems and costs differ from those in the United States.

Certain plans extend these benefits by establishing agreements with international hospitals to ease the process of receiving care. Thus, verifying the details of your Medicare Advantage plan before traveling is indispensable to ensure you’re covered.

It’s important to be proactive: contacting your insurer to confirm the scope of your coverage will bring peace of mind. Check if the plan supports coverage for emergency evacuations or even routine medical needs like prescription medications.

Don’t forget to inquire about the claims process, as documentation and reimbursement for services obtained abroad can often be complex. By knowing these procedures ahead of time, you can avoid potential complications upon returning home.

For seniors who love traveling abroad, having a Medicare Advantage plan that provides international healthcare services is a valuable safety net. It’s all about finding a plan that aligns well with your travel habits and provides reassurance that medical needs will be met, no matter where your journey takes you.

As you evaluate these plans, consider how your travel schedule might influence your choice, and remember, being well-prepared is your best asset.