Aetna Medicare Advantage Plans Georgia 2025

Choosing Aetna Medicare Advantage plans in Georgia in 2025 means understanding your coverage options.

This informative guide tackles the HMO and PPO Aetna Medicare Advantage plans in Georgia for 2025 offer to residents, breaking down the costs and potential benefits without overwhelming you with jargon.

Get equipped with the facts to select the plan that’s right for your health.

Key Takeaways

- Aetna offers a range of Medicare Advantage plans in Georgia, including HMO, PPO, and PFFS options, which provide more benefits and potentially lower costs than Original Medicare.

- Various monthly premiums are available for Aetna Medicare Advantage plans, with costs varying based on services, plan types, and whether providers are in-network or out-of-network.

- Aetna’s Medicare Advantage Plans may include prescription drug coverage, dental, vision, and hearing services, and rely on members using an online directory to find in-network providers to reduce out-of-pocket expenses.

Compare Plans in One Step!

Enter Zip Code

Understanding Aetna Medicare Advantage Plans in Georgia

Aetna offers a variety of Medicare Advantage plans in Georgia, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS) options.

These Medicare Advantage plans from Aetna, also known as a medicare plan, may provide more plan benefits and potentially lower costs compared to Original Medicare.

HMO Plans

In Georgia, Aetna’s HMO plans mandate the usage of network providers for healthcare services, except in emergency cases. Numerous HMO plans mandate a primary care provider to oversee the patient’s care. Referrals for specialist appointments are also a requirement in some HMO plans.

PPO Plans

Aetna’s PPO plans in Georgia provide the flexibility to choose any healthcare provider, including specialists and hospitals, that accepts Medicare and agrees to the plan’s terms without requiring a referral. While out-of-network coverage is available with Aetna PPO plans, using in-network providers is generally more cost-effective.

The cost-sharing measures, such as copays and deductibles, are typically lower when using in-network providers compared to out-of-network providers within Aetna’s PPO plans, making it essential to consider medical coverage options.

Comparing Aetna Medicare Advantage Plans in Georgia

Aetna’s Medicare Advantage plans in Georgia offer various monthly premium options, ranging from low to higher premium plans that may provide additional benefits. Copays for these plans can vary greatly depending on the specific plan and service provided.

The deductibles also vary, with some plans offering lower annual medical deductibles. Out-of-pocket costs, including copays and deductibles, are affected by whether you choose an HMO or PPO plan, the service tier, and whether the provider is in-network.

Premiums

The premiums for Aetna Medicare Advantage plans in Georgia can vary based on the plan and location. These monthly premiums are not fixed and should be checked based on the individual’s ZIP code for accurate details.

Upon enrollment in an Aetna Medicare Advantage plan, individuals are obliged to maintain payment of their Medicare Part B premium, along with any premium specific to their plan.

Copays and Deductibles

Copay amounts and medical deductibles vary across Aetna Medicare Advantage plans in Georgia.

These medical deductibles are specific to the plan and can be determined by entering the individual’s ZIP code.

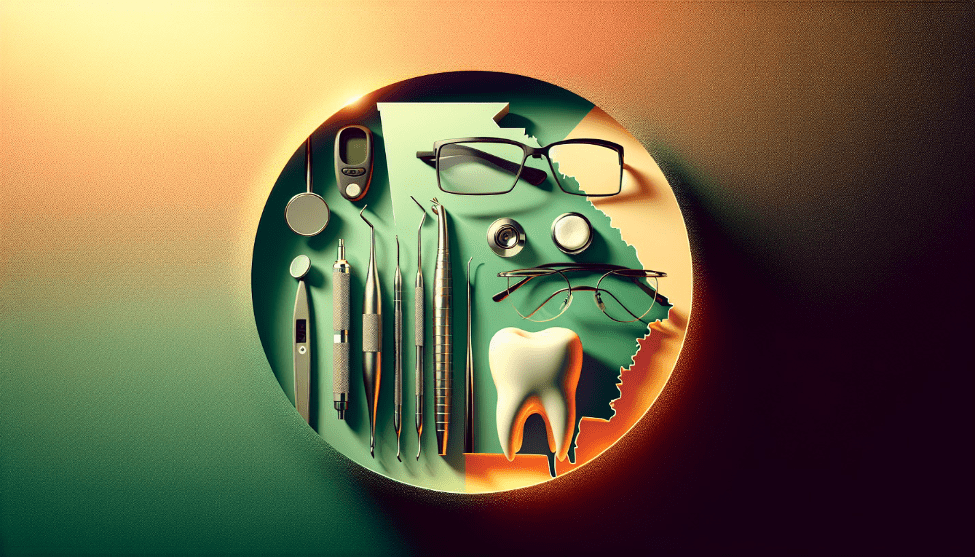

Additional Benefits

Aetna Medicare Advantage plans in Georgia may provide the following benefits:

- Dental coverage

- Hearing coverage

- Vision coverage

- Prescription drug coverage

Telehealth services are offered to members for remote healthcare access, and a meals-at-home program is available for recovery after hospital or skilled nursing facility stays. These are just a few examples of the services provided.

Prescription Drug Coverage with Aetna Medicare Advantage Plans

Aetna Medicare Advantage plans in Georgia may provide prescription drug coverage as a key benefit for enrollees, ensuring that various prescriptions covered are available to members.

Each plan has a formulary, listing covered drugs that are organized into tiers; the tier level determines the cost-share for members, with lower tiers usually offering lower costs. Prescription drugs under these plans may have coverage rules such as prior authorization, step therapy, and quantity limits that members need to consider.

Members have the facility to scrutinize the plan formulary and any drug limitations on a secure website and utilize a mail-order service to potentially reduce medication expenses.

How to Find In-Network Providers for Aetna Medicare Advantage Plans

Aetna offers an online provider directory specifically for its Medicare Advantage plans, enabling members to search for in-network doctors, dentists, and hospitals. This provider directory serves as an essential tool for members to locate participating healthcare professionals and facilities.

Members have the ability to verify online whether their current doctors and prescribed drugs are included under their specific Aetna Medicare Advantage plan.

It’s paramount for members to check the provider directory to avail care from in-network providers, as choosing out-of-network services might result in increased out-of-pocket costs.

Aetna’s website also offers features for members to compare Medicare plans, and review potential benefits and costs, including confirming the in-network status of primary care physicians. For additional support and to find in-network providers, members can contact Aetna directly or visit the Aetna Medicare website at AetnaMedicare.com.

Aetna's Star Ratings for Medicare Advantage Plans in Georgia

The CMS Medicare Star Ratings rank Medicare Advantage and Medicare Advantage Prescription Drug plans across several categories, including:

- Staying healthy

- Managing chronic conditions

- Member experience

- Member complaints

- Health plan performance changes

- Customer service

These star ratings assess the quality and member satisfaction of the plans, and we encourage users to provide new tab feedback as well as general tab feedback for further improvement.

In 2024, Aetna’s top-rated Medicare Advantage plans in Georgia secured a 4.5-star rating, underscoring their dedicated commitment to delivering excellent healthcare services.

Enrollment Process for Aetna Medicare Advantage Plans in Georgia

To be eligible for Aetna Medicare Advantage plans in Georgia, individuals must be entitled to Medicare Part A, enrolled in Medicare Part B, and live within the plan’s service area. Prior to enrolling, it’s important for beneficiaries to prepare their medication list, doctor information, and current plan details like out-of-pocket maximum and premium costs.

During enrollment, beneficiaries must furnish their Medicare number, and effective dates for Parts A and B, and choose their preferred payment method for monthly premiums.

They can enroll online via Aetna’s plan recommendation tool, the CMS Medicare Online Enrollment Center, or by requesting an enrollment kit in digital or paper format.

Licensed agents and Aetna representatives provide phone support, especially during the Annual Election Period, to aid beneficiaries through the enrollment process. Special Enrollment Periods may be granted for events such as moving, losing employer coverage, or certain qualifying disabilities before age 65.

Support and Resources for Aetna Medicare Advantage Members

Aetna Medicare Advantage members benefit from:

- the support of compassionate consultants who assist with healthcare-related queries and promote overall health management

- access to an array of online resources, classes, and workshops

- the ability to subscribe to email updates to stay abreast of their plan details

- telehealth benefits, allowing members to have virtual visits with healthcare providers from the comfort of their own homes.

The Annual Healthy Home Visit program offers an in-home or virtual visit with a licensed healthcare professional to review health, and medications, and discuss health resources at no additional cost. Customer service for Aetna Medicare Advantage members is available via a dedicated line operating 7 days a week to assist with various inquiries.

Summary

In summary, Aetna’s Medicare Advantage plans in Georgia offer a diverse range of options to fit the unique needs of individuals. They provide a variety of potential benefits, including prescription drug coverage, dental, vision, and hearing coverage, in addition to offering quality healthcare services.

It’s clear that Aetna’s commitment to its members is reflected in their high CMS star ratings and the comprehensive support and resources they provide. Remember, the right health plan is a significant factor in maintaining your health and well-being.

With Aetna, you’re not just joining a health plan, you’re joining a health partner.

Frequently Asked Questions

→ What is the difference between Aetna Medicare and Aetna Medicare Advantage?

The main difference between Aetna Medicare and Aetna Medicare Advantage is that Aetna Medicare Advantage plans, also known as Part C plans, are provided by private insurance companies and may offer extra benefits not included in Original Medicare.

→ What are the eligibility criteria for Aetna Medicare Advantage plans in Georgia?

To be eligible for Aetna Medicare Advantage plans in Georgia, you need to be entitled to Medicare Part A, enrolled in Medicare Part B, and reside within the plan’s service area. These are the main eligibility criteria for Aetna Medicare Advantage plans in Georgia.

→ What is the difference between HMO and PPO plans?

The main difference between HMO and PPO plans is that HMO plans require the use of network providers and a primary care provider to coordinate care, while PPO plans offer more flexibility in choosing healthcare providers without needing a referral.

→ What additional benefits do Aetna Medicare Advantage plans in Georgia offer?

Aetna Medicare Advantage plans in Georgia may offer additional benefits such as dental, vision, hearing, and prescription drug coverage, allowing for a comprehensive approach to healthcare.

ZRN Health & Financial Services, LLC, a Texas limited liability company