In-Network vs Out-of-Network Providers

Understanding the network of providers in a Medicare Advantage plan is crucial, as it significantly affects your access to care and associated costs. Key points include:

- In-network providers have agreements with the insurance company to offer services at negotiated rates, which generally means lower costs for you.

- Seeking care from out-of-network providers typically results in higher costs.

- In some instances, services from out-of-network providers may not be covered at all.

In HMO plans, you must obtain referrals to see specialists and use in-network doctors to ensure coverage. This can be a significant limitation if your preferred doctors or specialists are not within the network.

Before choosing a Medicare Advantage plan, verify whether your chosen doctor participates in the plan and consider the doctor’s participation in the plan. Not all doctors accept Medicare Advantage plans, and confirming this beforehand can save you from unexpected expenses and disruptions in your medical care.

Types of Medicare Advantage Plans and Doctor Flexibility

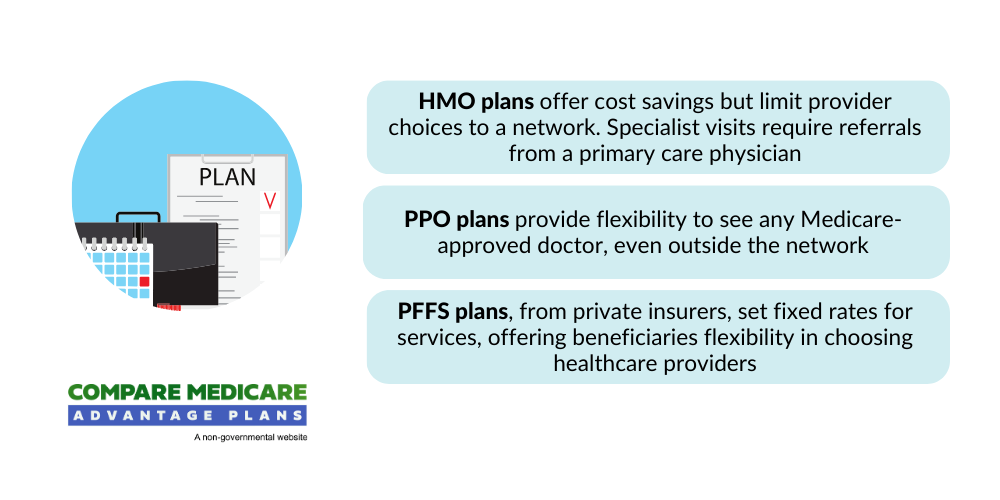

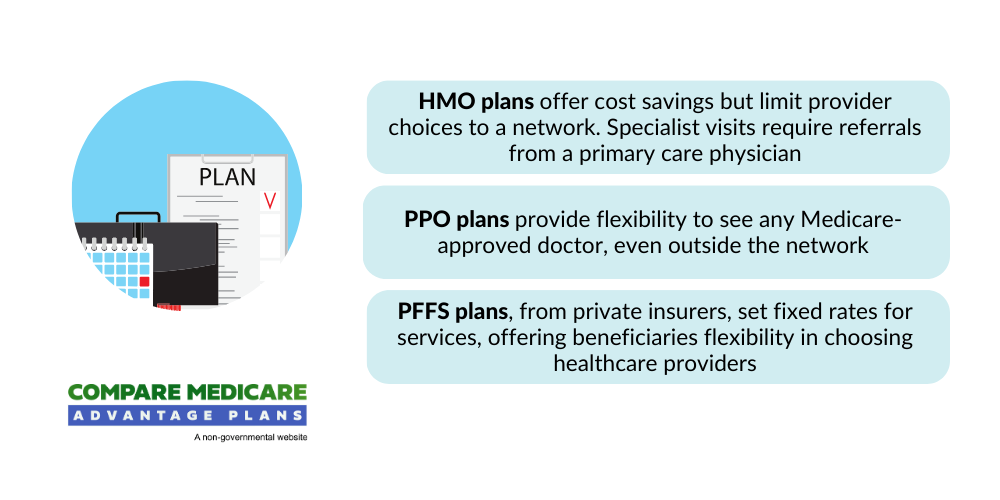

The type of Medicare Advantage plan you choose greatly impacts your flexibility in doctor choice, with plans like HMO, PPO, and PFFS offering different levels of freedom in selecting healthcare providers, including a medicare plan, a medigap plan, a medigap policy, and part c.

Recognizing the distinctions between these plans and plan g helps in comparing plans and making an informed decision that balances your need for flexibility with your budget constraints on a case by case basis.

HMO (Health Maintenance Organization) Plans

HMO plans are known for their strict network restrictions. Key characteristics include:

- You must use doctors and specialists within the plan’s network, except in emergencies.

- If your current doctor is not part of the network, you will need to switch to a network provider.

- Members typically must select a primary care doctor to manage all their healthcare needs.

- The primary care physician provides referrals to specialists.

While this may seem limiting, HMO plans often come with lower out-of-pocket costs compared to other Medicare Advantage plans. Lower premiums and fixed copayments make HMOs an attractive option for many beneficiaries. However, the trade-off is less flexibility in choosing healthcare providers. Seeing a specialist usually requires referrals from the primary care physician.

The structured nature of HMO plans means you have a clear path for receiving care, which can simplify your healthcare management. However, staying within the network is crucial to keep costs low and ensure services are covered.

PPO (Preferred Provider Organization) Plans

PPO plans provide more flexibility than HMOs, allowing you to see both in-network and out-of-network doctors, though the latter generally costs more. This is particularly beneficial if your preferred specialist is not within the plan’s network or if you travel often and need access to a broader range of providers.

PPO plans have the following characteristics:

- Do not require referrals to see specialists, streamlining access to needed care.

- Come with higher premiums and cost-sharing.

- Usually have structured networks with predictable costs, providing peace of mind when managing healthcare expenses.

The main differences between PPO plans and other Medicare Advantage plans like PFFS are:

- PPO plans have a structured network with more predictable costs.

- Out-of-network services in PPO plans cost more.

- PPO plans offer the option to use out-of-network services, which can be worth the additional expense for those prioritizing flexibility.

PFFS (Private Fee-for-Service) Plans

PFFS plans offer the most flexibility in terms of doctor choice. With a PFFS plan, you can see any doctor who accepts Medicare assignment and agrees to the plan’s payment terms, allowing you to maintain relationships with current healthcare providers if they accept the plan’s terms.

One of the challenges with PFFS plans is that not all providers, including other providers, may agree to treat PFFS members, even if they accept Medicare assignment. This variability can lead to unpredictability in accessing care and potentially higher costs if you need to see a non-participating provider.

Despite these challenges, PFFS plans can be a good option for those who prioritize flexibility and are willing to navigate the potential complexities of provider acceptance. Confirming your providers’ willingness to treat you under the plan’s terms is crucial to avoid unexpected out-of-pocket costs.