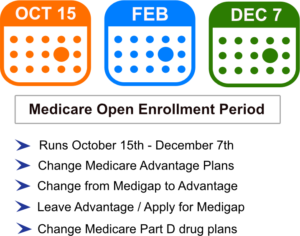

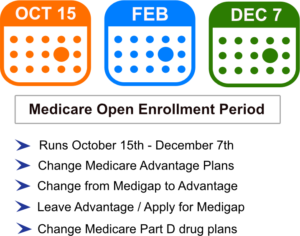

The Medicare Advantage Enrollment Period is a pivotal time for beneficiaries to ensure they are enrolled in the right health plans during the initial enrollment period. Key details include:

- Runs from October 15 December 7, lasting nearly eight weeks

- Allows individuals to enroll, switch plans, or make changes to their existing coverage

- Affects approximately 69 million people receiving Medicare benefits

- Choices made during this period can significantly impact healthcare for the following year, especially if a special enrollment period is needed.

Medicare Advantage plans, also known as Medicare Part C, are an alternative to traditional Medicare. These plans include:

- Services covered under Medicare Parts A and part b

- Additional benefits like prescription drug coverage (Part D)

- Vision coverage

- Dental coverage

- Wellness programs

This comprehensive additional coverage makes Medicare Advantage plans an attractive option for many eligible beneficiaries.

Understanding the differences between the Medicare Advantage Enrollment Period and other enrollment periods is crucial.

While the Medicare Open Enrollment Period allows for broader changes, the Medicare Advantage Enrollment Period is specifically focused on those already enrolled in or looking to join a Medicare Advantage plan. This distinction is vital for making informed decisions about your healthcare coverage.

Key Differences Between Medicare Open Enrollment and Medicare Advantage Open Enrollment

The Medicare Open Enrollment Period, running from October 15 to December 7, allows beneficiaries to make a wide range of changes to their Medicare plans. During this annual enrollment period, individuals can switch from Original Medicare to a Medicare Advantage plan, change Medicare Advantage plans, or change prescription drug plans.

This flexibility is essential for those who want to explore different coverage options during Medicare’s open enrollment period.

In contrast, the Medicare Advantage Open Enrollment Period, which occurs from January 1 to March 31, is more limited in scope. During this period:

- Beneficiaries already enrolled in a Medicare Advantage plan can switch to another Medicare Advantage plan.

- Beneficiaries can revert to Original Medicare.

- Beneficiaries cannot switch from Original Medicare to a Medicare Advantage plan.

- Beneficiaries cannot join a separate Medicare drug plan during this time.

The changes made during the Medicare Advantage Open Enrollment Period become effective on the first day of the month following the submission of the application. This timing ensures that beneficiaries experience minimal disruption in their healthcare coverage as they transition between plans.

What Changes Can You Make During the Medicare Advantage Enrollment Period?

During the Medicare Advantage Enrollment Period, beneficiaries have several options to tailor their healthcare coverage to better meet their needs. One of the primary changes that can be made is switching from one Medicare Advantage plan to another. This flexibility allows beneficiaries to find a plan that better suits their medical needs or financial situation.

Another significant change is the ability to revert to Original Medicare. For some, this option might be more appealing if they find that Medicare Advantage plans no longer align with their healthcare needs. Additionally, those who revert to Original Medicare can also choose to enroll in a separate Medicare drug plan to ensure they have prescription drug coverage.

Any changes made during the Medicare Advantage Open Enrollment Period take effect on the first day of the following month after the application is submitted. This swift transition ensures that beneficiaries do not experience any gaps in their healthcare coverage.