Leave Medicare Advantage and Return to Traditional Medicare

Yes, it’s possible to leave your Medicare Advantage plan and return to Traditional Medicare. This article will show you the steps, eligibility requirements, potential costs, and timing to make the switch.

If you’re wondering, “Can I drop my Medicare Advantage plan and return to Traditional Medicare?” Understanding these details could help you plan your transition smoothly.

Key Takeaways

- Medicare Advantage will likely offer lower premiums and additional benefits, but may restrict provider flexibility compared to Traditional Medicare, which likely offers a fee-for-service structure allowing broader access.

- Switching from Medicare Advantage to Traditional Medicare is only feasible during specific enrollment periods, such as the Annual Election Period and the Medicare Advantage Open Enrollment Period.

- Potential costs associated with returning to Traditional Medicare might include Medicare Part B premiums and potential Medigap policy expenses, likely necessitating careful financial planning and consideration of prescription drug coverage.

Compare Plans In One Step!

Understanding Medicare Advantage and Traditional Medicare

Medicare Advantage plans come in various forms, such as HMOs, PPOs, PFFS, SNPs, and MSAs, each offering different benefits and network structures and offered by different insurance companies. One potential advantage of Medicare Advantage may be the potential for lower monthly premiums, additional benefits like vision and dental care, and an out-of-pocket maximum for in-network expenses.

However, if you need to change Medicare Advantage plans, these plans may require you to use a specific network of providers, which could limit your flexibility. Additionally, a new Medicare Advantage plan may also offer different options worth considering.

In contrast, Traditional Medicare, also known as Original Medicare, consists of Part A and Part B, covering hospital and outpatient care, respectively. It will likely operate on a fee-for-service basis, allowing beneficiaries to see any provider that accepts Medicare, which could be a crucial advantage.

However, unlike Medicare Advantage, Original Medicare coverage might not cover services received outside the U.S. and may also require beneficiaries to pay up to 20% of the Medicare-approved amount after meeting their deductible for covered services.

One of the critical differences between the two will likely be prescription drug coverage. Some Medicare Advantage plans might include Part D coverage, which could simplify your healthcare management.

With Traditional Medicare, however, you may need to enroll in a separate Part D plan to cover your prescription drugs. This distinction could be vital when considering a switch, as it could affect both your coverage and costs.

Knowing the nuances of each plan type will likely be crucial before making the switch. Both the potential network restrictions of Medicare Advantage and the varying out-of-pocket costs of Original Medicare will likely be important details to help you make an informed decision.

Now, we’ll discuss the eligibility criteria for switching from Medicare Advantage to Traditional Medicare.

Eligibility to Switch from Medicare Advantage to Traditional Medicare

Switching from a Medicare Advantage plan to Traditional Medicare is possible during specific enrollment periods like the Annual Election Period or the Medicare Advantage Open Enrollment Period. These windows are critical for making changes without facing penalties or lapses in coverage.

If you lose eligibility for Medicaid or other insurance, or experience significant life events like moving out of your plan’s service area, you can switch without waiting for these periods.

When switching, understanding the potential challenges is vital. For instance, missing your initial Medigap Open Enrollment Period might mean that Medigap policies, which could help cover out-of-pocket costs not covered by Original Medicare, might require medical underwriting. This could significantly affect your coverage options and costs.

Understanding the eligibility criteria and potential pitfalls will likely help you switch smoothly. Now, let’s move on to the practical steps involved in dropping your Medicare Advantage plan.

How to Drop Your Medicare Advantage Plan

To drop your Medicare Advantage plan:

- Ensure you are within an allowed disenrollment period like the Medicare Advantage Open Enrollment Period.

- Confirm your decision to drop the plan.

- Notify your Medicare Advantage plan.

- Inform your insurer as well.

- Use various methods to notify, including online, by phone, or via a written request.

Confirming that your disenrollment request and enrollment request have been processed is essential to help avoid unexpected coverage issues. Documenting your request and the date it was submitted may also help resolve any discrepancies that might arise during the transition.

Once your disenrollment request is in place, you’re ready to navigate the enrollment periods for switching back to Traditional Medicare. We’ll explore these important timeframes next.

Key Enrollment Periods for Switching

Switching from Medicare Advantage to Original Medicare will likely be contingent on specific enrollment periods.

The Medicare Advantage Open Enrollment Period and the Annual Election Period (AEP) are two important windows for making this transition. Understanding these periods could help ensure that your switch is timely and your coverage remains uninterrupted.

During these enrollment periods, you may either switch from Medicare Advantage to Original Medicare or change to a different Medicare Advantage plan. Knowing the details of these periods could help you plan your transition effectively.

We’ll start by delving into the details of these enrollment periods, beginning with the Annual Election Period.

Compare plans and enroll online

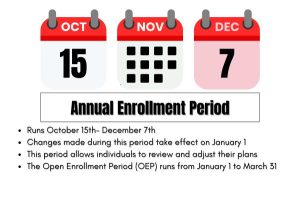

Annual Election Period (AEP)

The Annual Election Period (AEP) runs from October 15 to December 7 each year. During this period, beneficiaries can make changes to their Medicare coverage, such as switching from a Medicare Advantage plan to Original Medicare.

Any changes made during the AEP will take effect on January 1 of the following year, marking the effective date for those changes.

A thorough understanding of the AEP allows you to evaluate your current plan and make necessary adjustments for the upcoming year.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period occurs from January 1 through March 31 each year. During this period, those already enrolled in a Medicare Advantage plan can switch to a different Medicare Advantage plan or revert to Original Medicare.

If you disenroll from a Medicare Advantage plan in February, for instance, the changes will take effect on March 1.

This period could offer an extra opportunity to ensure your healthcare coverage meets your needs.

Potential Costs Associated with Returning to Traditional Medicare

Switching from a Medicare Advantage Plan back to Traditional Medicare will likely involve various costs, such as:

- Medicare Part B premiums, which may vary and will likely be higher for high-income earners.

- The standard Medicare Part B premium, projected to be $202.90 in 2026.

- The annual deductible for Medicare Part B, set to rise to $283 in 2026.

Medigap policies, which could help cover certain out-of-pocket costs not covered by Original Medicare and other coverage, may add another layer of expense. The potential costs for these policies may vary based on the plan chosen.

If you do not enroll in a Medigap policy during your open enrollment period, you may face medical underwriting requirements, which could potentially increase your costs. Additionally, considering a Medicare supplement could be beneficial during this process.

Lastly, if you do not have creditable drug coverage when switching, you might incur a late enrollment penalty for Medicare Part D, which may increase your monthly premiums. Understanding these costs could help you plan your transition more effectively while paying attention to your coverage options.

Possible Impact on Prescription Drug Coverage

When switching to Traditional Medicare, be sure to consider the following:

- Enrolling in a separate stand-alone prescription drug plan (Part D) may help to avoid penalties later.

- This enrollment could be crucial to ensure you continue to have coverage for your medications.

- During the Medicare Advantage Open Enrollment Period, individuals can enroll in a Medicare drug plan if they return to Original Medicare.

Part D premiums, co-pays, and coverage phases will likely apply when switching back to Traditional Medicare. The average premium for a standalone Medicare Part D plan is approximately $34.50 in 2026. However, the maximum deductible for Part D plans might increase to about $615 in 2026.

Understanding these details could help maintain your prescription drug coverage seamlessly. Now, we’ll explore Medicare drug coverage, Medigap policies, and their role in your healthcare coverage.

Exploring Medigap Policies

Medigap policies will likely be designed to assist with out-of-pocket expenses not covered by Original Medicare, such as copayments and deductibles. Key points about the Medigap Open Enrollment Period might include:

- It is a one-time opportunity.

- It begins when you turn 65 or enroll in Medicare Part B.

- It allows you to buy any policy without health-related denials.

- This period could be crucial for securing a policy without undergoing medical underwriting.

All Medigap plans will likely be standardized across states, meaning that policies with the same letter could provide the same essential benefits regardless of the insurer.

In certain states, you might have the option to choose a Medicare SELECT policy, which may require using a specific network of healthcare providers and may also include Medigap coverage.

Grasping Medigap policies and their enrollment periods could be vital for ensuring comprehensive healthcare coverage. We’ll now discuss special circumstances for certain situations.

Special Enrollment Periods for Unique Situations

Special Enrollment Periods (SEPs) are designated time frames that allow beneficiaries to switch Medicare plans due to specific circumstances. For example, individuals returning to the U.S. after living abroad may enroll in Medicare plans within a two-month window.

Similarly, incarcerated individuals can enroll in a Medicare plan within two months of their release if they maintained their Part A or B coverage.

Persons who believe they faced enrollment errors are allowed to change their Medicare coverage within two months of notification, but they should be aware that next month is a critical time for making these changes. Knowing SEPs is vital for beneficiaries to take advantage of switching plans when facing unique circumstances.

Summary

Switching from Medicare Advantage to Traditional Medicare will likely involve understanding the differences between the two plans, eligibility criteria, and the steps for disenrollment. Knowing the key enrollment periods and associated costs could help you make an informed decision. Medigap policies and prescription drug coverage may also be crucial considerations in this transition.

By understanding these various aspects, you could potentially ensure a smooth switch and maintain comprehensive healthcare coverage. Remember, making informed decisions about your health coverage is key to securing your well-being.

Frequently Asked Questions

→ When can I switch from a Medicare Advantage plan to Traditional Medicare?

You may switch from a Medicare Advantage plan to Traditional Medicare during the Annual Election Period from October 15 to December 7 or during the Medicare Advantage Open Enrollment Period from January 1 to March 31. These designated times allow for a smooth transition to Traditional Medicare.

→ What costs could I expect when switching back to Traditional Medicare?

When switching back to Traditional Medicare, you should anticipate premiums for Medicare Part B, which is projected to be $202.90 in 2026, along with potential penalties for Part D and additional costs that might be associated with Medigap policies. These costs could significantly impact your overall budget, so plan accordingly.

→ Do I need a separate prescription drug plan if I switch to Traditional Medicare?

Yes, enrolling in a standalone Part D plan might be necessary when switching to Traditional Medicare to maintain prescription drug coverage and avoid penalties.

→ What are Medigap policies, and how do they help?

Medigap policies will likely be designed to cover certain out-of-pocket costs that Original Medicare does not pay, such as copayments and deductibles. By filling these gaps, they could potentially provide financial relief and help ensure access to necessary healthcare services.

→ What are Special Enrollment Periods (SEPs)?

Special Enrollment Periods (SEPs) provide beneficiaries the opportunity to change their Medicare plans under certain circumstances, such as relocating from one service area to another or losing other insurance coverage. These periods could help ensure that beneficiaries maintain appropriate healthcare coverage when their situations change.

Have Questions?

Speak with a licensed insurance agent

1-833-641-4938

TTY users 711

Mon-Fri: 8am-9pm ET

Find & Compare Plans Online

ZRN Health & Financial Services, LLC, a Texas limited liability company