Accessing Care Through Narrow Network Plans

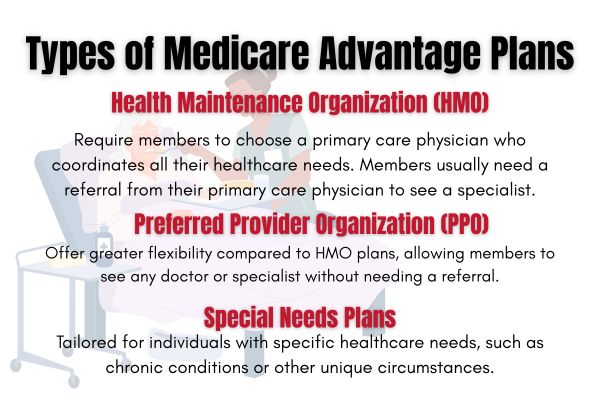

Narrow network plans, while offering cost savings, can pose challenges in accessing care. These cost plans are categorized into:

- Broad networks: covering a larger percentage of enrollees.

- Medium networks.

- Narrow networks: beneficiaries may face limited access to certain specialists, impacting their overall care options within the plan’s network. These plans can be beneficial for specific groups of enrollees.

Higher-risk individuals often seek out more comprehensive network options to accommodate their healthcare needs. Plans with varying range sizes can significantly affect the availability of specialists and services for members, influencing their healthcare experience to some extent. While narrow networks may offer lower out-of-pocket expenses, they can limit access to preferred providers and necessary services, making broader networks an appealing choice.

Medicare beneficiaries must balance the cost savings of narrow network plans with potential concerns about limitations in access to care, which policymakers should consider. Understanding these trade-offs can help enrollees make more informed decisions about their health care coverage that is covered, including medicare cost plans and plan based options.

Changing Doctors Within Medicare Advantage Plans

Changing doctors within Medicare Advantage plans is a straightforward process, but it requires careful consideration. Patients are encouraged to communicate their choice to switch doctors to their current provider, although it is not mandatory. This step ensures a smoother transition and helps maintain continuity of care.

Additionally, Medicare Advantage enrollees often utilize out-of-network care when they perceive their in-network options as inadequate, particularly among those with higher health risks.

Impact of Provider Networks on Healthcare Quality

Provider networks in Medicare Advantage plans significantly influence healthcare quality. Narrow networks can restrict access to essential services, such as psychiatric care, where more than half of plans include less than 10 percent of psychiatrists. This limitation can reduce the quality of care received by enrollees.

Star ratings, commonly used to assess plan quality, are not always reliable indicators of network size or quality. Broad-network PPOs received an average rating of 4.0 stars, while narrow-network PPOs only received 3.9 stars, reflecting a potential quality gap. Closed-panel HMOs, which typically have narrow networks, employ a majority of physicians, dictating the quality of care experienced by enrollees.

Building a new relationship with a doctor in a narrow network requires patience, as the provider will need time to understand the patient’s medical history while receiving care. This process can impact the perceived quality of care, emphasizing the ability to make careful consideration when choosing a Medicare Advantage plan to receive care.

Geographic Variations in Network Availability

Geographic variations significantly impact the availability and utilization of Medicare Advantage networks. Regional characteristics and demographics influence the composition of provider networks, affecting patient outcomes within different areas. The Medicare Advantage Geographic Variation dataset provides insights into these differences, helping beneficiaries understand how regional factors may affect their access to care.

Data regarding geographic disparities in Medicare Advantage networks is typically updated annually by the Centers for Medicare and Medicaid services, offering valuable information for making informed enrollment decisions. Limited provider networks in certain regions may deter individuals with complex health conditions from enrolling, leading them to prefer traditional Medicare for its broader access to providers.

The Importance of Reviewing Provider Networks Before Enrollment

Reviewing provider networks before enrolling in a Medicare Advantage plan ensures satisfaction with your healthcare coverage. Beneficiaries should evaluate both their healthcare needs and the potential costs associated with network providers. Ensuring that preferred doctors and hospitals are included in the plan’s network is crucial for continuity of care.

Many beneficiaries overlook the importance of Medicare Advantage provider networks, which can result in dissatisfaction with their plan. Those with complex health needs often value access to a broad network of providers and may choose traditional Medicare over Medicare Advantage plans when faced with limited provider options.

Reviewing provider networks thoroughly ensures that your healthcare preferences and needs align and are met.