Original Medicare Explained

Original Medicare consists of two main parts: Part A, which covers hospital insurance, and Part B, which deals with outpatient medical services. Understanding these components is crucial for beneficiaries to make informed decisions about their healthcare coverage.

While Part A generally includes coverage for:

- inpatient hospital stays

- skilled nursing facility care

- Hospice care Part B covers:

- outpatient care

- preventive services

- some necessary medical equipment.

Parts of Original Medicare

Part A of Original Medicare generally covers:

- Inpatient hospital stays

- Skilled nursing facilities

- Hospice care

- Some home health care services

Most beneficiaries do not pay a monthly premium for Part A if they have paid Medicare taxes while working. However, there are deductibles and coinsurance costs associated with the services covered under Part A.

Part B of Original Medicare typically includes coverage for physician services, outpatient hospital care, durable medical equipment, and preventive services like vaccinations and screenings. Unlike Part A, Part B requires a monthly premium, which can vary based on the beneficiary’s income. Understanding these parts helps beneficiaries navigate their healthcare options and make informed choices.

Medicare Coverage and Costs

Beneficiaries of Original Medicare usually pay a monthly premium for Part B, as well as deductibles and coinsurance for services received. In 2026, the Part A deductible is set to be $1,676, while the Part B deductible will be $257. These costs are essential for beneficiaries to consider when planning their healthcare expenses.

The average monthly premium for Medicare Advantage plans is expected to decrease from $16.40 in 2025 to $14.00 in 2026. Additionally, the average total premium for standalone Part D plans is projected to drop from $38.31 in 2025 to $34.50 in 2026. These changes reflect CMS’s efforts to control Medicare prescription drug coverage costs and provide affordable options for beneficiaries.

Original Medicare and Medigap

Medigap plans are designed to fill the gaps in coverage by Original Medicare, helping cover costs such as copayments, coinsurance, and deductibles. These plans are purchased from private insurance companies and offer varying levels of coverage. Medigap policies do not include coverage for prescription drugs; separate Medicare Part D plans are needed for that.

There are ten standardized Medigap plans available, with Plan F and Plan G being the most popular options for beneficiaries. Medigap insurance policies can help cover out-of-pocket costs not fully paid by Original Medicare, providing financial relief and predictability for beneficiaries.

Comparing Medigap plans is crucial because premiums can vary significantly between insurance companies for the same coverage.

Original Medicare or Medicare Advantage in 2026?

Deciding between Original Medicare and Medicare Advantage in 2026 involves considering various factors such as healthcare needs, preferred providers, and additional benefits. Original Medicare provides extensive coverage for necessary medical services, but does not include many routine care services.

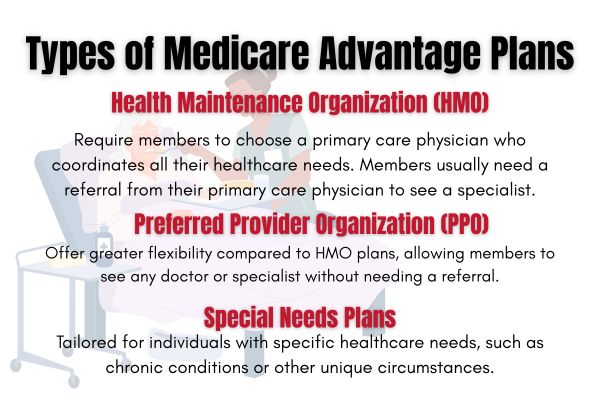

On the other hand, Medicare Advantage plans must cover all services offered by Original Medicare and often include additional benefits such as dental, vision, and hearing care. Cost is another crucial factor. While Original Medicare has no cap on out-of-pocket expenses unless supplemented by additional coverage, Medicare Advantage plans often include prescription drug coverage and have an out-of-pocket maximum, providing financial predictability.

Beneficiaries who prefer flexibility in choosing healthcare providers may opt for Original Medicare, which allows them to see any doctor or hospital that accepts Medicare. In contrast, Medicare Advantage plans typically require the use of a network of providers.

How to enroll in Original Medicare

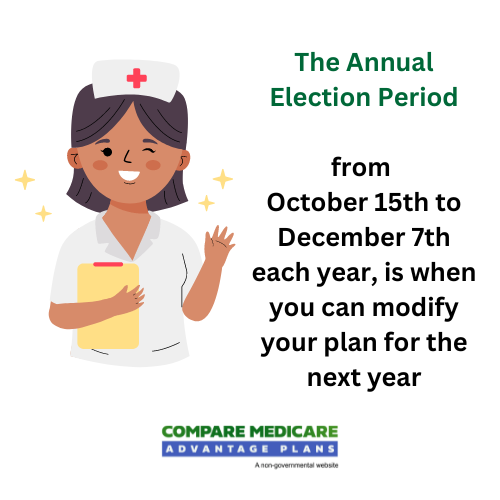

Enrollment in Original Medicare typically begins during the Initial Enrollment Period, which lasts seven months around an individual’s 65th birthday. This period starts three months before the 65th birthday and ends three months after.

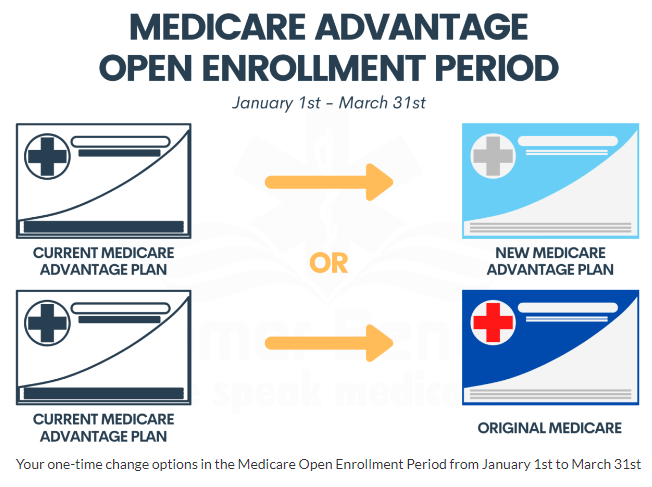

Individuals can also enroll during the General Enrollment Period from January 1 to March 31 each year, with coverage starting on July 1. To enroll, individuals need both Medicare Part A and Part B and must reside in the plan’s service area.

Verifying that the chosen plan choices cover necessary prescriptions and include approved preferred healthcare providers is crucial, as you expect to have the right mail coverage to request.